Market situation: What caused Bitcoin to jump yesterday?

Bitcoin was able to regain its position above the $ 37,000 level yesterday, while many Altcoins did not perform well. As it turns out, cash flow in special funds investing in digital currencies is positive after 5 weeks, and most long-term holders are still profitable.

To Report Kevin Desk The digital currency market is stabilizing after its massive fall late last week and early this week. As some indicators show, the sentiment of market traders is sharply declining; A situation that usually forms before the start of buying waves in the market. Other technical indicators, however, can be seen as likely to fluctuate between buyers and sellers in the short term.

The price of Bitcoin once again reached above $ 37,000 yesterday. Bitcoin is currently above $ 36,000 and has risen more than 3.5 percent in the last 24 hours. Solana has recently experienced a 5% jump and the Atrium market has been almost volatile.

“The time has not yet come to set a price floor,” said Marcus Sotiriou, an analyst at the GlobalBlock Institute.

I think determining the direction of the market is not as simple as the previous cycle; Because the market structure changes rapidly with the entry of large organizational investors into the field. At present, Bitcoin seems to be caught in a certain range (between $ 29,000 and $ 69,000) rather than following a certain directional trend.

“Alex Axelrod, the founder and CEO of Aximetria Digital Currency,” said:

Bitcoin price recovery is not very likely at the moment; Because investors are more inclined to stabilize prices.

Axelrad believes that breaking the $ 32,000 support and the $ 40,000 resistance could determine the direction of the market.

The chart below shows the recent growth in bitcoin trading volume in the digital currency exchange instant markets. Apparently, some short-term investors have reactivated despite the skepticism about the future of prices in the market.

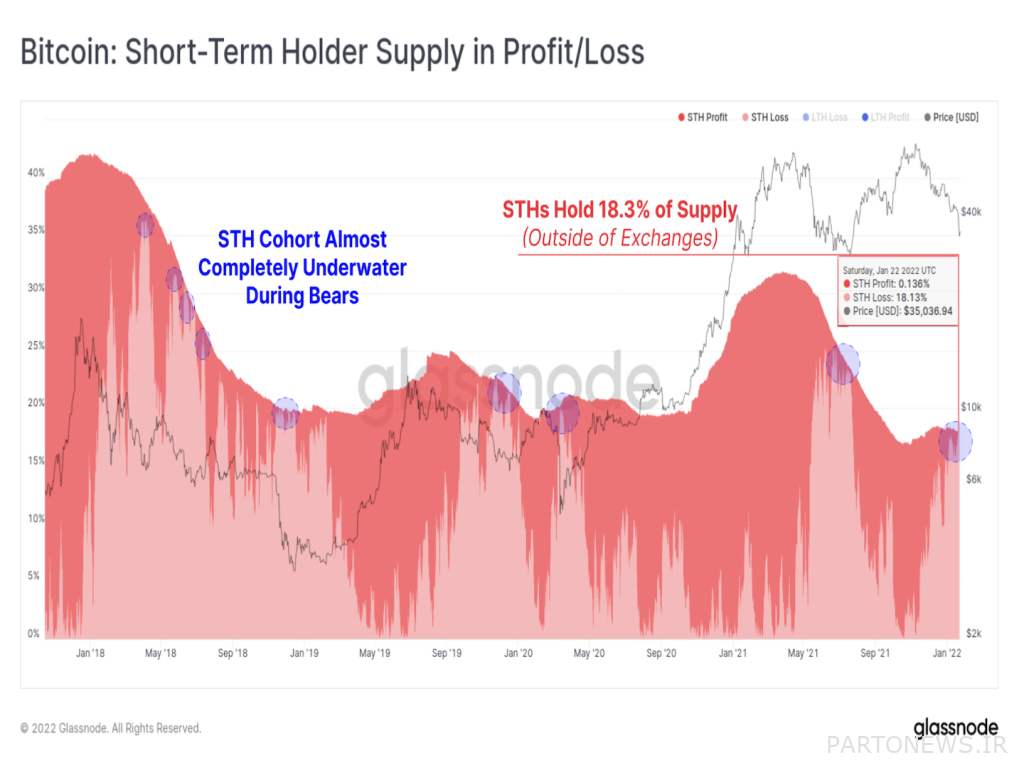

Short-term holders are still at a loss

As can be seen from the end-of-chain data, the losses of short-term bitcoin holders are increasing.

As can be seen in the chart below, 18% of the supply of Bitcoin short-term holders is currently at a loss; This means that the current price is lower than the average purchase price. This could lead to increased sales pressure among this segment of bitcoin investors. A similar scenario occurred earlier in 2018, during price correction.

Long-term holders, however, do not seem to be much worried about falling prices in recent days.

Golsnood Analytical Platform wrote in an article yesterday:

The profit-loss ratio of long-term holders has returned to its uptrend, which means that the group is reluctant to sell its assets.

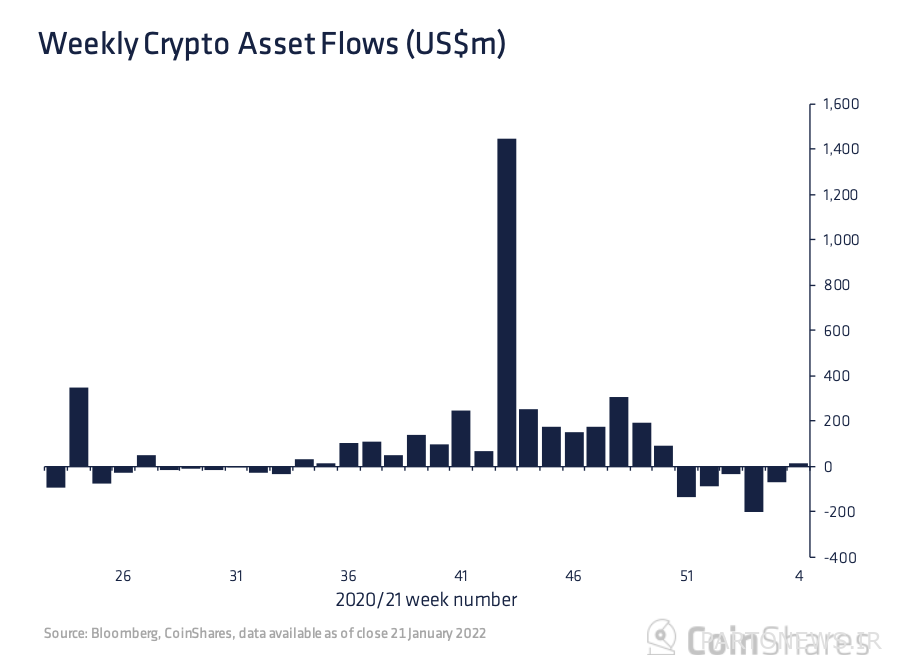

Capital inflows into digital currency funds after 5 weeks of sales

Special funds for investing in digital currencies, after five consecutive weeks of sales, finally tasted the inflow of capital; This shows that investors have taken advantage of falling prices during this period. The funds had $ 14.4 million in inflows over the past seven days, ending capital outflows after 35 days.

Of that figure, $ 13.8 million came from Bitcoin Special Investment Funds, while Atrium Funds saw sales of $ 15.6 million.