Market Status: Bitcoin whales are trading at $ 53,000

Intra-chain data show that despite falling prices seven months ago, market whales are now accumulating new units rather than selling their bitcoins. However, in the daily and weekly view of the Bitcoin market, there are signs of decline, which, if confirmed, could be accompanied by a deeper price correction.

to the Report Coin Telegraph Today, with Bitcoin Weekly Candle on the verge of closing at its lowest level in two months, prices continue to fluctuate around $ 54,000. Market data show that the Bitcoin market has been completely calm for the past 24 hours after falling $ 6,000 on Friday.

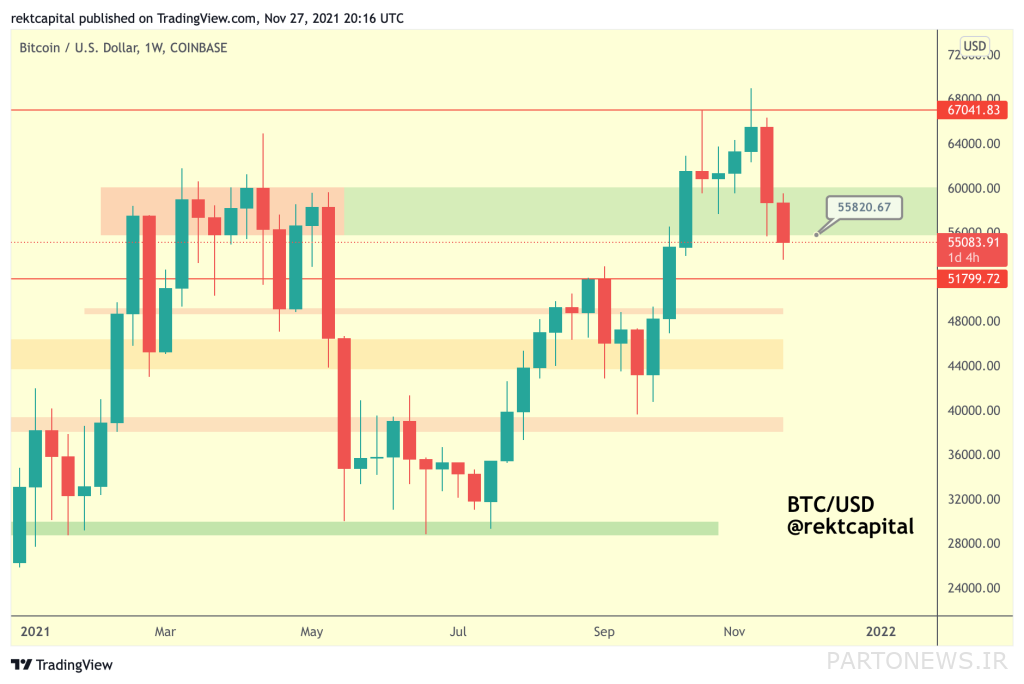

Despite the fact that prices have remained stable for the past 24 hours, in the weekly market view, the price has fallen below a key support area, and it is now possible that the weekly candle will close at the lowest level since late September.

Rekt Capital, one of the leading analysts in the digital currency market, has said that $ 55,800 support should be revived so that the market can reverse the current trend. He says it is still easy for Bitcoin to return to this level.

Capital Company wrote on its Twitter:

[در نمای ۱ روزه] Kendall has confirmed the breaking price of the declining corner pattern. Bitcoin is likely to try today to temporarily rise before the price falls further, turning the floor level of the pattern into a new resistance. The Bitcoin daily candle must close above $ 55,000 to invalidate the temporary price growth scenario before the wider market crashes.

The prominent analyst added:

In the weekly market view, the price has fallen below the green demand area. Bitcoin can still easily close its weekly candle on the floor of this green channel; The move that the bitcoin market needs to be able to return to the corner pattern structure.

Also read: Familiarity with 10 Technical Analysis Chart Patterns That Every Trader Should Know

As it turns out, the recent drop in prices has not been enough to dissuade buyers from continuing to operate in the market, as various businesses, as well as the government of El Salvador, have recently purchased a significant amount of bitcoins.

Alex Mashinsky, founder and CEO of the Celsius Lending Protocol, announced on Sunday that it has increased its bitcoin and atrium inventories as prices hit the floor.

He wrote on Twitter:

At current price levels, I bought about $ 10 million worth of Bitcoin and Atrium and added it to my trading positions. We may see bitcoin return to $ 53,000 and Atrium reach $ 4,000, but these levels are short-lived and we will then move to $ 70,000.

Machinsky added that if the price of Bitcoin continues to fall below $ 50,000, it will sell 50% of the amount of its latest purchases.

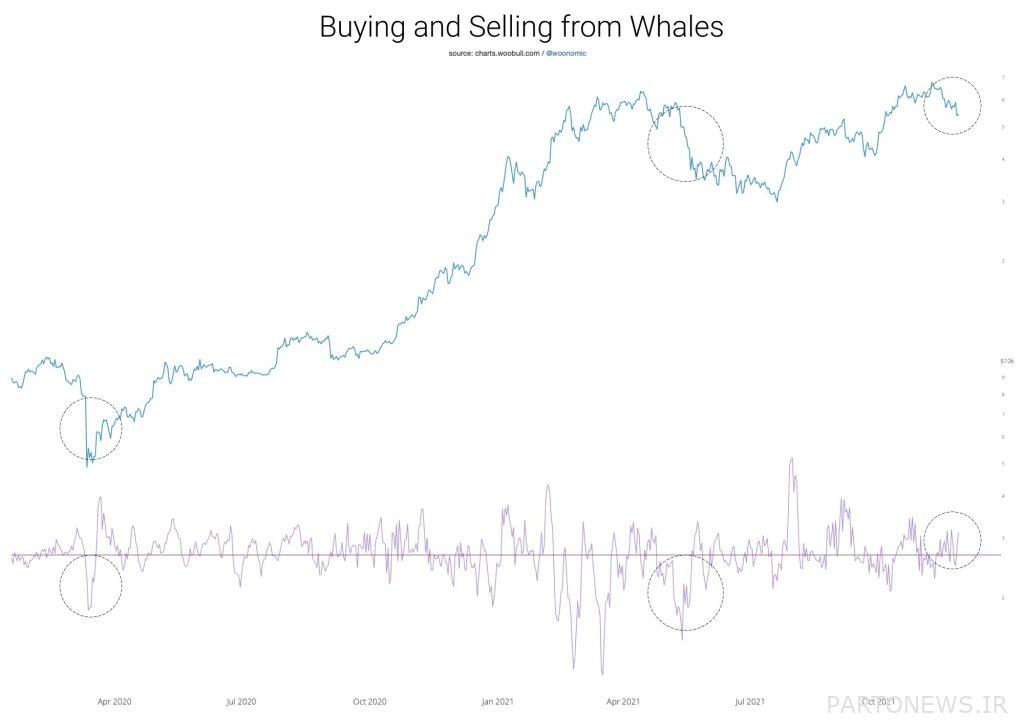

Data released by Willy Woo, another digital currency market analyst, confirms Bitcoin accumulation at current price levels.

Leaving aside exchange-traded institutions (ETFs), there is still evidence that large-scale purchases were made this week, in stark contrast to the atmosphere we saw after prices fell in May.

Shortly after the news of the discovery of a new strain of the corona virus was released, the digital currency market faced an increase in sales pressure on Friday. This fear and feeling of distrust quickly affected the traditional financial markets and the digital currency market, and the Bitcoin fear and greed index entered the “extreme fear” area.

At the same time as the weekly candle closes, there is no sign of price recovery in the stock market, and the weekly candle of the top 10 currencies in the market, except for the coin’s, is red.