Micro shareholders prefer fixed income funds

According to the economic correspondent of Fars News Agency, one of the problems of the capital market these days is the problem of lack of liquidity.

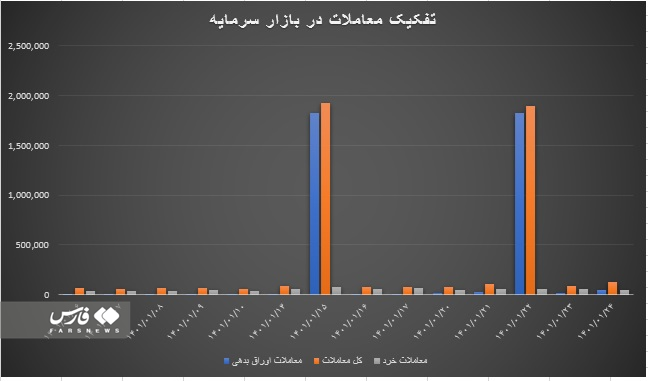

Capital outflows by real investors have exacerbated this over the past year. Stock market distrust has led shareholders to invest their money in bond markets, fixed income funds and the banking system.

A study of securities transactions in the secondary market in 1401 shows that securities transactions in the new year account for more than 84% of transactions in the capital market.

In the first working week of the year, the share of securities in the secondary market was 4%, but in the second working week in 1401 and with the start of the securities trading engine on Mondays, the share of these transactions in the capital market reached more than 85%. Is.

In other words, in the third week, the share of fixed income securities transactions in the stock market was 85%, which is a significant increase compared to the previous week. In the fourth week, the routine was the same. Last week, the share of fixed income securities in the stock market was 84%, which is a decrease of one percent compared to the previous week.

Debt trading trend in the first week of 1401

In the first week of the new year, the trading engine did not start on Mondays. This week, 589 billion tomans have been traded on Saturday and 100 billion tomans on Sunday in the debt market.

On Monday and Tuesday, 100 billion Tomans and 557 billion Tomans of securities were traded, respectively, but on Wednesday, these transactions were sharply reduced and reached 49 billion Tomans.

In total, 4% of total transactions this week were devoted to bonds, which is a normal trend.

* Review of bond transactions in the second week of April

This week, the highest number of debt transactions in the secondary market was allocated to Monday, which was more than 182 thousand billion tomans.

This week, along with the relative growth of the value of small stocks, the average daily value of securities transactions has also increased. In the second working week of the stock exchange in 1401, the average value of debt securities transactions in the secondary market increased from 279 billion tomans to 46,146 billion tomans, which shows a growth of 165 times.

Bond trading has had two different halves in the last week. It grew in the first two days, but fell to lower figures in the last two days.

On Sunday, 14% of the market transactions were allocated to debt securities, and on Monday, the value of debt securities transactions on the stock exchange was 182,927 billion tomans, which constituted 95% of the market transactions.

On Tuesday, the value of bond transactions was 135 billion tomans, which was 2% of the total market transactions, and on the last working day of the week, the value of bond transactions reached 299 billion tomans, which includes 4% of the total value of market transactions.

In the third week of April, we saw the growth of the value of small stock transactions. This week, when the stock market index climbed to a total of 31,653 units, the average value of stock exchange transactions increased to 6,664 billion tomans, which has increased by 48% compared to the figure of 4,512 billion last week.

* Trading trend in the third working week of the stock exchange in the new year

This week, the highest number of debt transactions in the secondary market was allocated to Monday, which was 182 thousand and 823 billion tomans.

Last week, along with the relative decline in the value of small stocks, the average daily value of securities transactions also decreased by one percent.

In the second week of April, the average value of bond transactions in the secondary market was 46 thousand billion tomans, which in the last week reached 38 thousand and 733 billion tomans, which shows a decrease of 16 percent.

On Saturday, the share of bonds in secondary market transactions was 17%. On Sunday, 28% of the market transactions were allocated to debt securities, and on Monday, the value of debt securities transactions on the stock exchange was 182,893 billion tomans, which constituted 96% of the market transactions.

On Tuesday, the value of bond transactions was 1,734 billion tomans, which constituted 20% of the total market transactions, and on the last working day of the week, the value of bond transactions reached 4,733 billion tomans, which is 40% of the total value of market transactions. .

Last week we also saw a decline in the value of small stocks. In this week, when the stock index fell by a total of 9 thousand 653 units, the average value of small stock transactions decreased to 5 thousand 532 billion tomans, which is a decrease of 16% compared to the figure of 6 thousand 664 billion last week.

* High share of securities in stock market transactions

One of the main reasons for the formation of such a market, along with the stock market, is the issue of government financing from the stock exchange. The Twelfth Government insisted on using this method to cover the budget deficit too much, and this issue led to the issuance of several directives on the amount of investment of banks, financial institutions, fixed income funds.

The same issue in the current situation and with the time of repayment of these bonds has caused the value of bond transactions in the secondary market to grow significantly. If we look at bonds like what is stated in the 1401 budget, we can benefit both the government and the shareholders in this regard.

End of message /