Multi-million dollar selfies; Is the NFT bubble bursting?

“This species is not worth much!” A sentence that gives us the worst feelings when we hear it from the buyer and we feel anxious and distressed. If you have any experience in the financial markets, you know that this sentence can mean the loss of all of a person’s capital. This phrase is an example of a situation that is troubling these days some It has confused NFT holders. Some of them keep asking themselves whether what they have bought during this time was not more than a bubble. Do they have to say goodbye to their capital? Of course, this view may seem exaggerated and pessimistic; But the current situation has made many people pessimistic about the future.

Read more: What is a non-fungible token or NFT?

In this article, we will first take a look at the subject of million dollar selfies and the conditions governing the non-monogamous token market, and at the end, we will answer these questions: should we wait for the bursting of the NFTs bubble? Has this field of digital assets reached its end? So we invite you to stay with us until the end of this article.

Will dotcom events repeat itself for NFTs?

In general, the word “bubble” means a situation where the price of an asset suddenly skyrockets due to market inflammation and the influx of users and the false excitement of small and large investors and finds a value higher than what it should have. This price inflation reaches a point that has no justification and goes beyond the real uses of that asset.

This bubble often happens with the entry of investors who do not have enough knowledge and only pour their money into the market based on the created space, and finally, this cycle ends with a big and heavy fall; The ending will definitely not be happy. The issue of the price bubble and people losing their money due to hype and false excitement is an issue that we have witnessed many times; But one of these key events is the one known as the bubble dotcom (dot com) is mentioned.

At the end of the 1990s and with the booming of Internet businesses and companies, many investors put their assets into startups in this field in order not to be left behind. This level of acceptance and popularity had another reason, and that was the action of the American central bank to reduce the interest rate. In this situation, even the Nasdaq Index (NASDAQ) reached a peak of 5,400 points from 100 points, and in the meantime, there were few people who did not want to enter this profitable cycle. However, this fever was a guest of investors for a short time and in late 2000 and early 2001, the resulting bubble burst.

Big companies like Pets.com declared bankruptcy and some of the famous companies we know today like Oracle, Intel and Cisco lost up to 80% of their stock value. Some experts have called this important event “Internet Bubble” or “Dotcom Bomb” and believe that this happened because of the popularity of the concept called Information Superhighway.

In this situation, many start-ups started extensive marketing campaigns and spent huge amounts of money on advertising due to abandoning the rules and principles of capital control and specific planning. Finally, with the sharp fall of the stock index and other events, a period of recession was formed in the United States of America. Although less than half of the companies were able to survive the conditions of that period, this event showed how dangerous and problematic it can be to not have enough knowledge of the market and to follow the emotional atmosphere unknowingly and not to check companies and projects.

Many of us have witnessed this model of events for various goods and items and even some digital currencies; But are non-coin tokens going to follow the path of the Internet in the 1990s? Should we include these assets in the category of goods that are caught in a price bubble? To answer this question, we need to go back a little. In January 2022, Sultan Gustaf Al Ghozali, a 22-year-old computer science student from Malaysia, made a million dollars overnight by selling 1,000 of his selfies in NFT format and selling them on the OpenSea market.

All of us, seeing this model of headlines and news, unconsciously think that very well, what do we use the selfies of a teenager? What is the use of this model of images or unusual tokens? It may appear in our mind that the market of NFTs is nascent and it is impossible to predict what will happen in the future and these images with astronomical prices are also part of this uncertain future; But it is important to know the position and purpose of this technology. We have to see why this innovation came about. Is such a mechanism created simply so that everyone can make a profit from this market and in the end, the pockets of others remain empty, or is there a higher purpose?

In the CoinDesk website’s interview with the former director of the Metropolitan Museum of New York, Thomas Hoving, he points out that about 40% of the valuable and historical objects he receives are fake or fake. Of course, we should not forget that the origin of this problem is historical and has a long history. This issue has been one of the main goals of the creation of non-traditional tokens; This means that with the existence of NFTs, the records of artworks and their previous owners and creators can be checked and verified without any changes or tampering.

Symptoms

If you, like many other people, are eager to enter the glamorous world of cryptocurrencies in hopes of making huge profits, you should be aware of the potential dangers of this arena. Like any other digital asset, NFTs also have signs that indicate a price bubble bursting and a sharp decrease in their value; Therefore, it is better to familiarize yourself with some of these signs so that you can exit the market quickly when the signs appear.

Some of these symptoms include:

- Sudden price drop: This event is one of the first signs that the bubble of the non-genuine token you own and probably bought at a high price is deflating. Considering these conditions, it is better to always pay attention to the price chart of your digital assets, especially your NFTs.

- Reducing media coverage: Another important sign related to the bursting of the non-proprietary tokens bubble is the change in the media’s approach to this type of assets. As we mentioned earlier, the media plays a prominent role in guiding the price and the influx of investors towards new assets. So, whenever you see that an unusual token has a sharp decrease in media exposure, consider this as a warning sign that your asset will most likely lose its value quickly.

- Create sales queues: When users start selling their holdings, it could be another sign that the NFTs bubble is bursting and your holdings are devaluing.

Will non-coin tokens eventually lose their value?

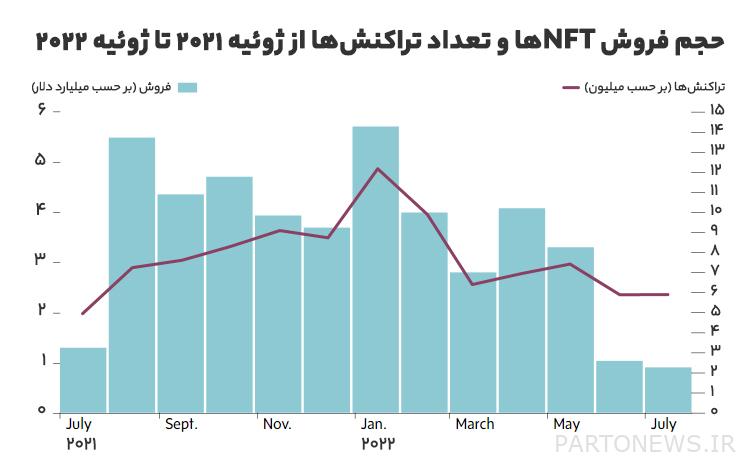

To answer this question, it is better to look at a few months ago. Around May of this year, the transactions of non-homologous tokens reached the figure of 2.7 billion dollars; But this number only lasted a little. According to the DappRadar report, after the historical peak of the sale of non-coin tokens in January 2022 and its fever subsided in the following months, the volume of exchanges faced a decrease of 99% and its figure reached 9.43 million dollars. Pedro Herrera, a senior researcher at Depredar, says in an article in the Canadian publication The Globe and Mail:

The bubble of foreign tokens has burst or is on the verge of bursting. Nearly 95% of the projects that are currently in the market will find a value equal to zero in the next two years.

Many experts believe that this decrease in value is related to the fall of the digital currency market. When the price of Bitcoin and other digital currencies drops significantly, it is natural that the value of other tokens will also decrease.

Conclusion

It seems that the growth path of NFTs has suffered many twists and turns with the entry of some contentless projects and creating false excitement; For this reason, in months In the past, we have seen a drop in prices and a decrease in the volume of transactions and users’ acceptance of this industry.

Undoubtedly, the issue of verifying the authenticity and security of works of art and preventing their forgery is a goal that will not be easily changed and ultimately will not create a disturbance in the basic principles of non-symbolic tokens. Perhaps these changes and fluctuations can be interpreted with the aim of purifying the market from worthless projects and actors and purifying this industry.

What is your opinion about the decrease in price and trading volume of NFTs in the past months? Is it too late to enter the NFT market or are these conditions temporary and we should wait for the market to peak again?