New data: Miners are accumulating bitcoins

Recent data show that bitcoin miners have not been selling for some time and are accumulating new units. Bitcoin accumulation means that its holders are not satisfied with selling at current prices.

To Report Coin Telegraph, new data shows that miners have accumulated more bitcoins than ever before in the last five months, which could be a new sign that current prices are not good for sale.

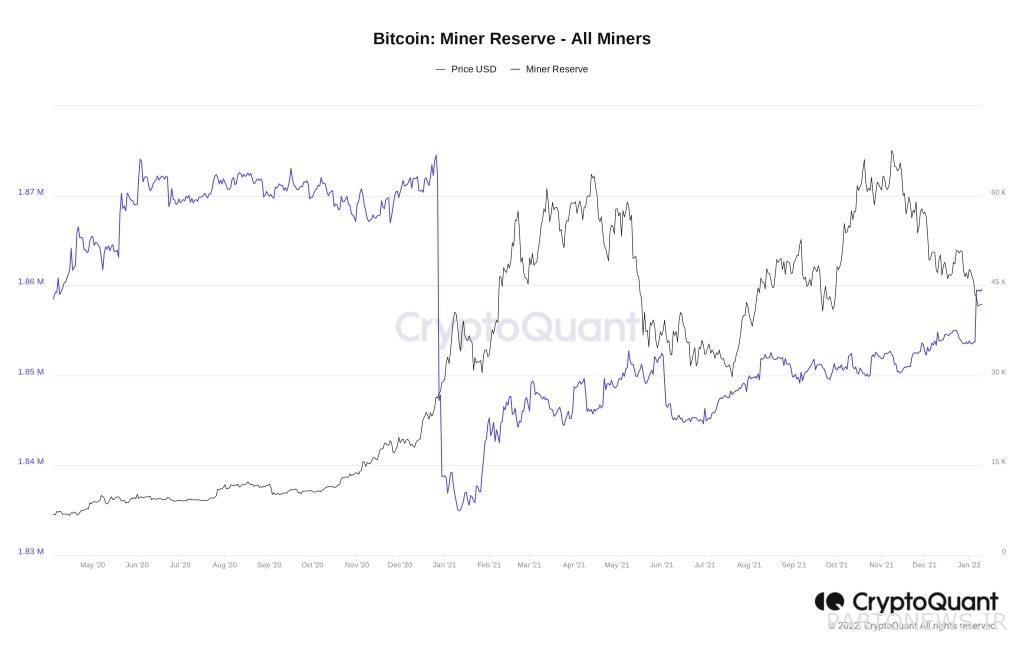

As can be seen from the index data on changes in the inventory of bitcoin miners, miners are heavily accumulating new units to extract. A popular Twitter account called Bitcoin Archive recently mentioned this index of Glassnode analytics platform and the accumulation of miners.

Bitcoin prices may disappoint instant market traders this year; But long-term market participants will not have to worry about this.

In addition to powerful traders or experienced hoodlers, miners are no exception, increasing their bitcoin holdings significantly in the first two weeks of 2022.

In the last five days, more than 5,000 bitcoins have been registered and accumulated in the Miners’ Office every day. In fact, this process is already taking place ahead of the $ 69,000 bitcoin record in November.

Further data from the CryptoQuant Internal Chain Analysis Service show the extent to which miners have reclaimed their bitcoin assets following the May developments in China.

Total miner bitcoin reserves as of Monday were 1.859 million units, the highest level since late 2020. At that time, after the price of Bitcoin broke the 2017 price record, miners began to sell and their reserves fell sharply.

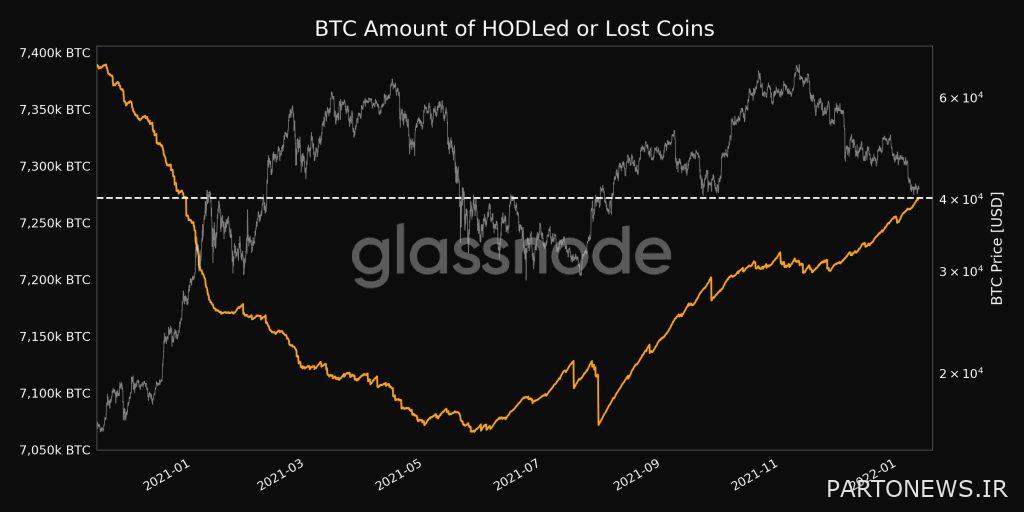

Looking at powerful traders, the share of bitcoins that are thought to have been lost or accumulated by long-term investors reached their one-year high this week.

If the holders were firm in their decision, we can now say that 7.27 million bitcoins are probably out of the market forever.

The index fell this summer due to a ban on bitcoin mining in China and falling prices.

In contrast, Golsnood data show that the accumulation process has accelerated since Bitcoin reached $ 69,000.