New requirements for initial public offering of companies – Tejaratnews

The stock exchange organization has been assigning initial offerings to investment funds for some time. This action has faced a wave of criticism on the basis that it is not clear which fund bought what amount of shares at what price in the initial offering. Now, the stock exchange organization has announced new requirements to create transparency.

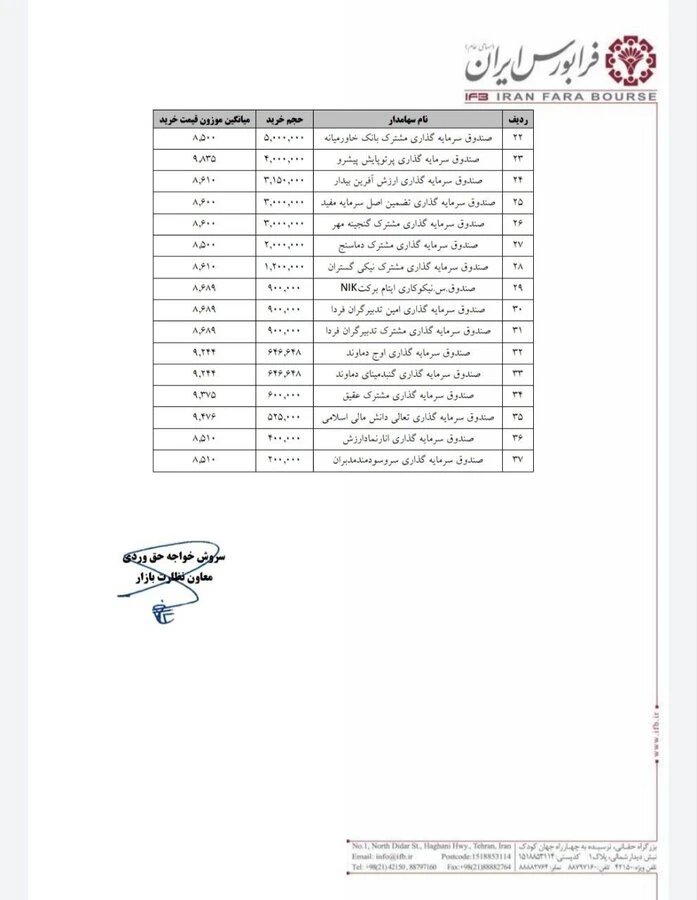

According to Tejarat News, according to the decision of the Securities and Exchange Organization, the stock exchanges were required to disclose the purchase information of the funds’ initial offering in the initial offerings that are allocated to qualified investors.

Based on the latest decision of the stock exchange organization in order to create transparency in the course of initial offerings, the stock exchanges were required to disclose the purchase information of the initial offerings of funds in the initial offerings that are allocated to qualified investors.

In this regard and after this decision, three initial offerings have been allocated to the funds, and the exchange has disclosed the names of the investment funds that participated in the initial offering, along with the number and average price, on its website. Transparency is a shield against corruption.

Source: Senate