Note: Don’t judge all stablecoins by tera

Did the collapse of the algorithmic stablecoin Terra invalidate the concept altogether, or are these fiat digital currencies still valuable? In the following, we will try to check the answer of Cointelegraph expert and other experts to this question.

To Report Cointelegraph, not long ago, stablecoins were considered the boring old man in the world of digital currencies. Safe and reasonable but boring! The stablecoin concept probably did not meet Satoshi Nakamoto’s initial expectations; But these digital currencies were created to be a useful shelter away from the constant turbulence of the digital currency market.

We couldn’t get rich quickly with stablecoins; But they were still useful. Their role was to provide a safe place to store capital without the need for full liquidity so that assets are backed by fiat currencies instead of volatile tokens.

However, the events of May indicated that it is still not possible to be completely sure of the stability of the price of digital currencies. With the slow reaction of lawmakers and law enforcement, Terra Network’s Luna token, which has now been renamed Luna Classic, was destroyed and its value dropped to almost zero, losing $60 billion in the process. The clear result of this crash for market participants was that stablecoins did not pass their test, but perhaps Terra’s experience can be seen as the forerunner of a new era in which stablecoins will become acceptable, accepted and beneficial components of the global economic system and the current regulations They will go down in history.

Also read: What is Terra blockchain and LUNA digital currency?

Don’t beat all stablecoins with the same stick

Although this seems unlikely considering the events that have happened, the failure of several stablecoins will not destroy this whole concept. There are many other stablecoins that have a solid foundation and perform as expected.

What is currently in decline are algorithmic stablecoins to be more precise. These digital currencies never served the purpose for which they were developed; Because they were based on unsafe pillars. Many critics were against this type of digital currency from the beginning. A group called Terra and other algorithmic stablecoins a Ponzi scheme, arguing that its value only depends on more people buying it.

Algorithmic stablecoins are not fixed and they are not supported by equivalent amounts of fiat currencies or other things, but smart contracts control the amount of supply and demand and thus the price with the mechanism of creating or burning existing tokens. This system is supported by an artificial interest payment mechanism called Anchor. Many people believed in the working mechanism of this protocol, but it was at the beginning of May that this belief was lost and the devastating flood of shedding began.

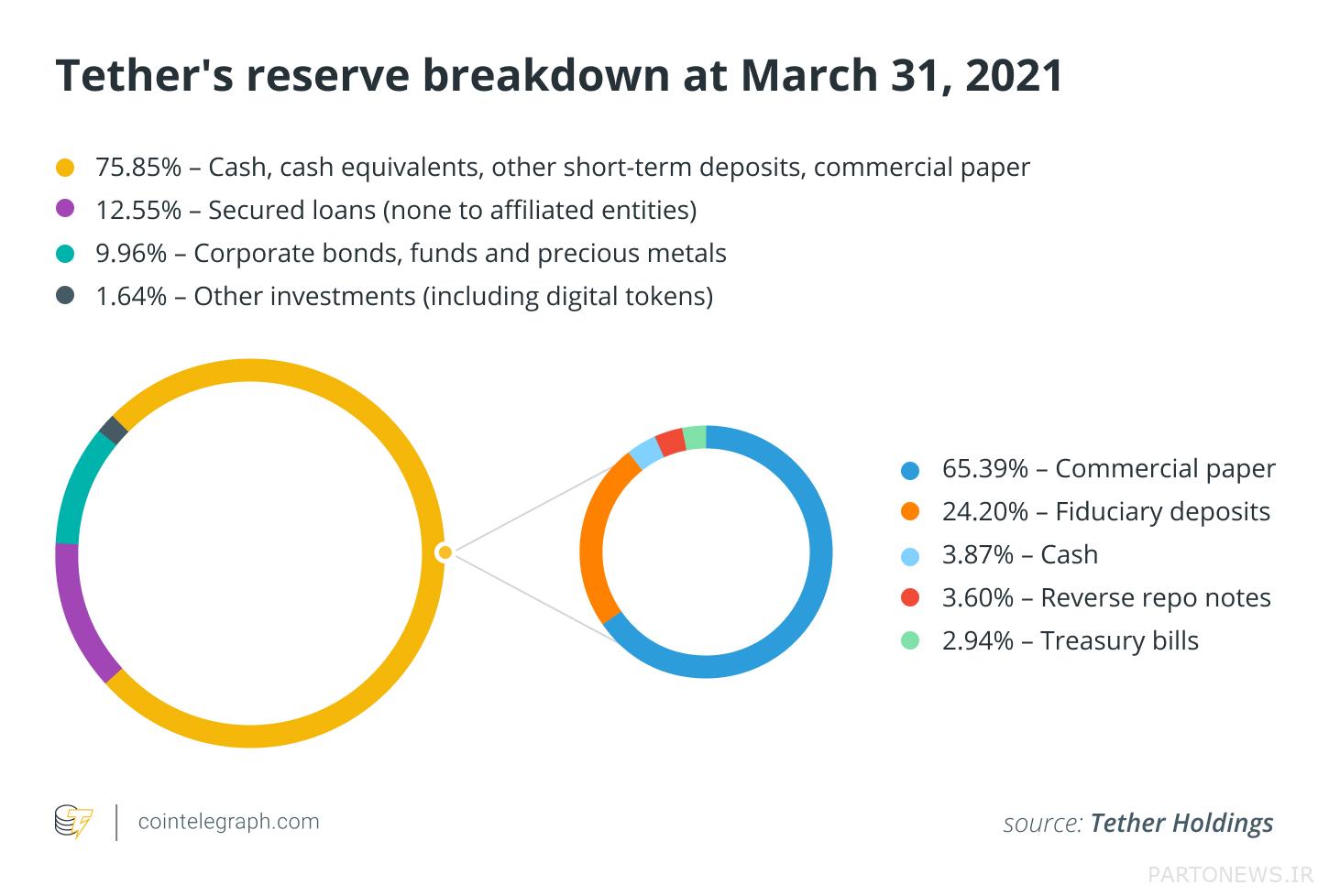

But there are other types of stablecoins that are backed by assets such as fiat currencies. Tether (USDT), the world’s largest stablecoin by market capitalization, has released data on its backing assets to show that it won’t be troubled by this. Even during the recent market declines, the value of Tether remained stable against the dollar and showed a bit of volatility only on May 12 (May 22), when the price reached $0.97.

Jeremy Allair, CEO of Circle, stated in a Twitter note that USDC, the second largest stablecoin by market capitalization, is also fully backed by various assets.

Given that USDC’s primary function is to fully align with the US dollar, this digital currency has even outperformed Tether.

The slowness of the legislators

Although before the collapse of Terra, the regulators had focused their attention on the investigation of stablecoins, but according to what happened, it seems that their reaction was a little late. On March 9 (18 March) in the United States, US President Joe Biden issued an executive order to ensure the responsible development of digital assets, which was a positive and unexpected signal for the digital currency industry.

In early April, the United Kingdom announced that the regulation of stablecoins would still remain unclear. That same month, Senator Patrick Toomey, a senior member of the US Senate Banking Committee, introduced the Stablecoin Transparency of Reserves and Uniform Safe Transactions Act of 2022, which It is called the Stablecoin TRUST Act for short and it deals with digital currencies whose price is dependent on the US dollar or other assets.

Ironically, in his interview with the Financial Times on May 6 (May 16), while the downfall of Terra had just begun, this senator asked the legislators to take more measures to legislate stablecoins before something bad happens. However, it seems that even he did not foresee how fast the fall would be.

He opposed some of the stricter measures proposed by Democrats, believing that stablecoins are now too valuable and should be regulated like banks.

From then on, things spiraled faster. From around May 5 (May 15) when Terra began to fall, the regulators quickly increased their level of vigilance. In a report published on May 9, the US Federal Reserve said that stablecoins are vulnerable and their assets lack transparency. US Treasury Secretary Janet Yellen recently said that this decision is very appropriate, regarding the urgent need to increase the level of protection. Soon and this year, there will be laws on this issue. In June, Japan became one of the first countries, and arguably the largest economy, to regulate some form of non-fiat digital currency when Japan’s parliament passed regulations on yen-linked stablecoins. This was not caused by the collapse of Terra, but was based on a legal plan that was first proposed by the Financial Services Agency of Japan in March 2021 (March 2019). The new law guaranteed par value redemptions, limited the creation of stablecoins to regulated institutions and proposed stricter anti-money laundering measures.

Neglected point

Despite the growing warnings and recent policies, the distinction between algorithmic stablecoins and asset-backed stablecoins seems to remain neglected. The government should regulate fiat stablecoins with the ability to hold assets and establish rules for the amount of capital adequacy. What can be done with stablecoin reserves should also be legislated.

Algorithmic stablecoins, if they want to remain, must provide investors with the necessary warnings before attracting capital and provide the necessary information about the risks that will be on their shoulders. This type of digital currency is one of the latest innovations along with other innovations. It won’t be long before new innovations are introduced, and legislators should prepare for them now. Of course, the fact is that people should take care of their property and wealth first. In any decentralized ecosystem, it is necessary for its people to closely and vigilantly take care of their assets.

And given that reality will overtake regulators, the existence of fully backed digital currencies, such as the USDC, would seem to address any need for the United States to develop its own national digital currency.

Darkness before sunrise

At the time of writing, only a few weeks have passed since the collapse of Terra. As a result, stablecoins are still in doubt, and the long-term impact of this on the broader cryptocurrency ecosystem is still unclear. An ecosystem that has been far from its peak period since September 2021 (1400) and has been under pressure ever since.

Many analysts have been amused by the sadness of the current state of digital currencies, fueling the skepticism that ordinary people have had about digital currencies.

According to Cointelegraph analyst, as far as stablecoins are concerned, the current situation is perhaps the darkest part of the night before dawn. Most people don’t realize that not all stablecoins are created equal. Algorithmic stablecoins as they are now known are a disaster waiting to happen, but fully-backed stablecoins overseen by regulators in major countries like the US, UK, and Japan would be a perfectly reasonable option for future economies. Economies that will have a mix of digital and fiat currencies. The time has come to pay attention to these currencies.