On-Chain Data: Peak Bitcoin Hoarding Among Small and Medium Investors

Experienced traders usually consider whales piling up Bitcoin as a sign of buying at a bottom. However, new data shows that the growth of bitcoins held by small and medium investors in recent months has been too significant to be ignored.

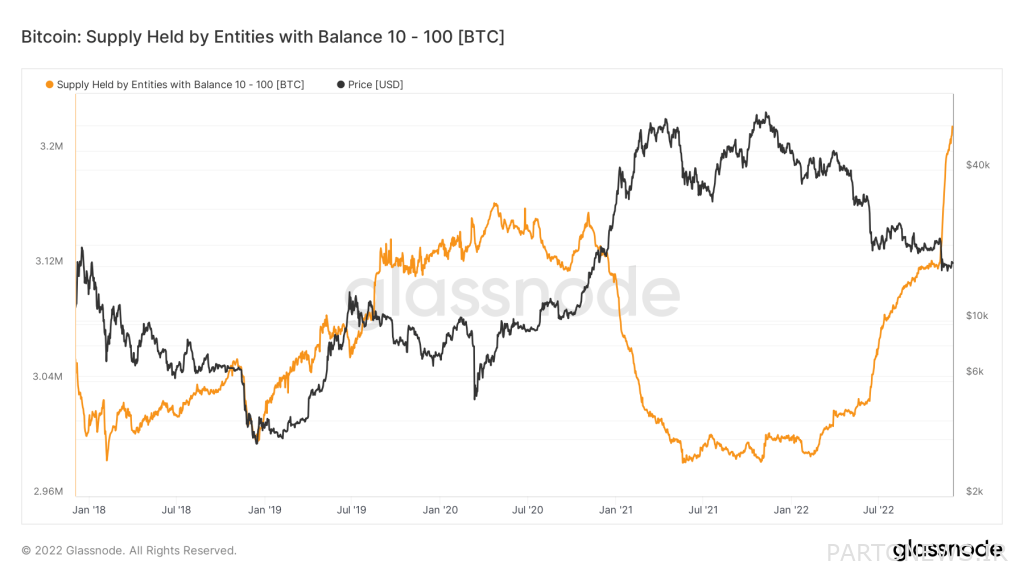

To Report Cryptoslates, wallets that hold between 10 and 100 bitcoins in balance, have increased their supply from 2.98 million to over 3.26 million bitcoins between 2018 and 2022.

Of course, there are some problems with the accuracy of these data. For example, it is unclear how many of these wallets belong to exchanges, over-the-counter (OTC) or other organizations rather than individuals.

In addition, on-chain trend data Adjusted Spent Output Profit Ratio (aSOPR) Bitcoin is also depicting a heavy sell-off at a loss throughout the open.

It is also unclear whether current or new users (as of this moment) have these wallets. Still, this data contains some interesting insight into Bitcoin’s price trend.

First, the number of wallets with balances of less than 1,000 bitcoins has increased significantly in recent months. This shows that there is a growing demand for Bitcoin among small and medium investors and a growing appetite to hold Bitcoin as an investment.

Also, the capital growth of wallets with a balance of 10 to 100 bitcoins has been much higher than the growth of wallets that have 1 to 10 bitcoins. This shows which groups have increasingly increased their investment in digital currencies during this period.

This data could indicate that Bitcoin is slowly becoming the mainstream of the financial system and more people are recognizing its potential for investment. The chart below shows the available supply of wallets that hold 10 to 100 bitcoins.

This indicator shows the accumulation of Bitcoin by two categories of small investors after the crash of the FTX exchange.

The first category, traders who use leveraged trading or derivative markets to trade digital currencies, and have started accumulating bitcoins since the beginning of November (mid-November).

The second category consists of smaller investors (other than whales). These investors have been buying large amounts of Bitcoin since mid-October when the market started to fall. It seems that these small and medium investors were not affected by the fear and doubt caused by the fall of the FTX exchange and the bearish market.

In addition, this data shows that the number of small and medium active investors (other than whales) has increased significantly since mid-October (late Mehr), which could indicate that small investors have more confidence in the digital currency market.

Small and medium-sized investors are probably buying the bottoms and have accumulated a significant amount of Bitcoin over the past few weeks. The behavior of this group of investors can be a sign of the formation of imminent bullish sentiments in the market, which will probably lead to the recovery of the price of Bitcoin in the short term.