On the occasion of World Suicide Prevention Day: Why do cryptocurrency traders commit suicide?

Yesterday (September 10) was World Suicide Prevention Day. Every year, more than 700,000 people in the world die by suicide. It is unclear how many of these 700,000 people are traders in digital currencies or other financial markets. However, Google News has more than 120,000 articles related to cryptocurrency suicides, 39,700 of which are from the past 12 months.

To Report CryptoSlate In the UK, suicide is the leading cause of death among people under the age of 35. On a global scale, death by suicide ranks fifth among the main causes of death for people under the age of 45. According to statistics from Forbes magazine, digital currencies are most popular among people under 49 years of age. This means that there is some age overlap between cryptocurrency users and people who die by suicide.

In 2020, The Open University of UK conducted a study on the relationship between stock market volatility and suicide statistics, which shows that there is a correlation between this factor and suicide of people (both men and women). In the text of the report related to this research, it is said that apart from the “wise man” species, there is no definite evidence to prove the existence of suicidal behavior among other living beings. Therefore, it can be said that suicide is a behavior specific to humans, in which society also plays a role.

Before the publication of this research, that is, before 2020, the nature of meme stocks (something similar to meme coins in the stock market) had not yet emerged. The WallStreetBets community on the Reddit social network, where information about many of these meme stocks is exchanged among its users, had about one million members in 2019; But now the number of its subscribers reaches more than 12 million users.

In January 2020 (D98), a 20-year-old man named Alex Kearns, while checking his account at the Robinhood brokerage, faced a negative figure of $730,000 in a part of his account. became. Kearns had mistakenly assumed that this represented his $730,000 debt to Robin Hood; But this number only represented his purchasing power and had nothing to do with his account balance or his debt to Robin Hood. Unfortunately, this mistake and of course the bad way of displaying the purchasing power figure on the Robinhood platform caused this 20-year-old young man to commit suicide as he failed to get a timely response from Robinhood’s support.

After the incident, Robinhood pledged to change the way user account information is displayed on its platform and donated $250,000 to a suicide prevention charity on behalf of the Cairns family.

In October 2020 (October 99), an Indian man who had incurred a heavy debt due to losses in Bitcoin transactions committed suicide. He is said to have borrowed a large amount of money from various people to trade in digital currency.

A little closer and following the unprecedented fall in the price of Luna in May this year, as well as the bankruptcy of the Celsius lending platform, there were many reports of suicides of people who lost their life savings because of these events.

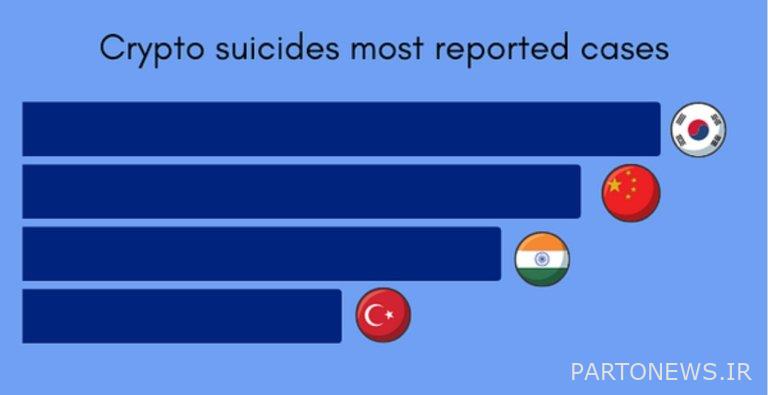

The Safe Trade group has also recently conducted a study that shows that South Korea, China, India and Turkey have the highest number of suicides related to digital currencies.

In 2018, after Bitcoin’s historic fall from $20,000 to $6,000, a dedicated suicide prevention hotline was installed at the top of Reddit’s r/cryptocurrency forum. Since then, this phone number has been considered a sign that a bear market has reached an end or bottom. Some Reddit users say that the current downtrend has yet to bottom out, as the Suicide Prevention Hotline has yet to be posted to the top of Reddit’s cryptocurrency forum page.

The normal attitude of users to such a painful issue is something that is not mentioned when prices rise and during bull markets. However, during falling markets, this subject should not be brought up in the media without any investigation and consideration; An era in which many users have seen a dramatic decrease in the value of their capital. In addition, the unpredictable events of the digital currency space can also make this problem bigger.

In order to deal with the economic problems that have spread all over the world, as well as to prepare for the possible movement of the economy towards recession, we all need to increase our awareness of financial affairs. Only those who understand the risks in the financial markets should use tools such as futures, options, and any type of trading leverage.

Learning how to recognize pump and dump schemes, observing security tips when working with decentralized applications (DApp), avoiding getting involved in phishing scams and maintaining the security of digital currency wallets are also of particular importance in addition to financial education.

Blackrock recently published a report that shows that less than 50% of people feel confident about their financial decisions. On the other hand, the number of users who use their mobile phones to invest in the American stock market is increasing, and the number of users of these applications has increased from 35.6 million people in 2017 to 150 million people in 2021.

Education is the key to making sure people experience safe investing More than you can They have not allocated money to trade in the financial markets.