Open market operations Banks reduce demand in the capital market? / Investigate the outflow of money from the stock market

According to Fars News Agency’s economic correspondent, stock trading has always been accompanied by a period of recession and boom, and the existence of a recession in the market can not be considered a strange issue, but the recession that has prevailed in the market for some time is deep and unprecedented. Has not shown respect for the decisions taken by the authorities to improve the market situation.

Experts on the stock market downturn believe that it has never happened that a market enters a downturn and does not return to a boom, it is impossible; However, it should be emphasized that the exact time for the market to enter the boom period can not be announced.

Shareholders still hope to revive the stock market in the new government

Capital market shareholders, frustrated by the previous government’s performance, expect the new government to live up to its stock market promises. In other words, with the efficiency of the 13th government, many shareholders hoped to change the trends in the stock market. From the beginning of July, the capital market entered a balanced upward phase with the assurance that the decisions of the twelfth government had been completed. The index at this time increased from one million and 100 thousand units to one million 600 thousand units.

But with the appointment of the ministers of the thirteenth government, the capital market suddenly began to decline. At this time, the capital market reacted negatively due to the identification of serious government programs in the field of inflation control, reducing the budget deficit and keeping the exchange rate balanced.

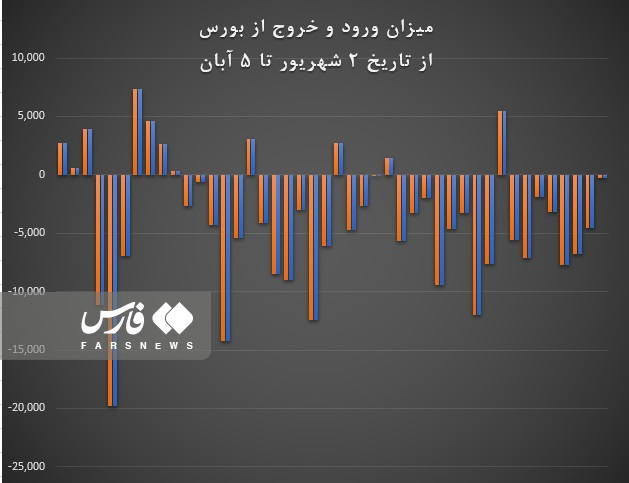

This caused the stock exchange to see a large outflow of money from real shareholders in the 70-day period from the beginning of September to the end of the first week of November. During this 44-day period, we saw cash inflows in 11 days and cash outflows in the remaining 33 days. In total, during this period, the outflow of money from the capital market has been about 165 thousand billion rials.

This amount of money leaving the stock market has been unprecedented since the beginning of the year. Many experts consider the outflow of money from the capital market, which has become a common issue in the stock market in the last 15 months, to reduce liquidity and demand in the stock market.

Who sells securities in the capital market? This has caused the stock market to stagnate in recent weeks. The decline in the value of retail transactions to the lowest level in recent months indicates this. In other words, the reason why the capital market is now entering a period of severe recession is the existence of a series of ambiguities in the capital market, such as the exchange rate and the government’s plan to sell securities in the capital market, which has created a worrying atmosphere in this market.

One of the issues that is being raised these days is the trading of securities in the capital market. Majid Eshghi, the head of the stock exchange organization, says in this regard: The main part of financing the government budget deficit will be from the place of asset generation. The government has not sold a single rial of bonds in the capital market in the last 40 days.

However, it should be noted that the capital market has witnessed the open market operations of banks during this period. This has caused the value of trading in the OTC market to increase sharply on certain days of the week, and this issue, according to many experts, has had a great impact on reducing demand in recent weeks.

Given that the capital market is currently in a severe recession, shareholders should consider that the market will inevitably change course and the current market trend will lead to a boom, but it is not possible to give an exact time to exit. The market announced a recession and its return to prosperity.

End of message / b

You can edit this post

Suggest this for the front page

.