Over the past year, miners have deposited 57,000 bitcoins to exchanges; Has the sales pressure decreased?

Bitcoin miners in 2022 went through one of the most difficult times of their work. However, not all metrics related to their activity this year are negative, and promising signs can also be seen in the on-chain data related to the miners of this digital currency.

To the report Crypto Slate, 2022 was a very bad time for Bitcoin miners. Earlier this year, the military conflict between Russia and Ukraine began, and as a result, energy prices increased worldwide; The incident ended at the expense of digital currency mining as one of the energy-related industries.

Further, the collapse of the Terra network brought the price of Bitcoin to its lowest level in the last two years and destroyed the last bit of profit that was left for the miners of this digital currency.

With the passing of the summer of this year, which was accompanied by a sudden increase in energy costs, the market was once again affected by a crisis; Bankruptcy of “FTX” exchange.

The turbulent conditions of 2022 hit both small miners and large Bitcoin mining farms. In fact, the biggest damage was done to large companies whose shares were also traded on different stock exchanges. The damage done to the big companies active in the field of extraction was more because they had increased their debts (loans) and started huge projects to expand the scope of their activities, relying on their huge profits during the 2021 bull market. .

The pressure on Bitcoin miners in 2022 is not just a story. On-chain data confirms that 2022 has been a very turbulent year for miners of this digital currency.

The income of Bitcoin miners per second of processing power has been continuously decreasing since the beginning of this year. Their income in terms of dollars has been in the same situation as a whole, and it can be said that the reason for the massive sale of miners this year is largely explained by this index.

Also read: What is On Chain Analysis?

Ribbon hash index also confirms this pressure. By examining the 30-day and 60-day moving averages of Bitcoin, this measure shows the timing of miners’ collective selling periods. When the 30-day moving average exceeds the 60-day moving average towards down If it stops, it means that the Bitcoin mining costs have gone up and it is a sign to start mass selling among brokers.

On the other hand, if the 30-day moving average is the 60-day moving average upward It means that Bitcoin mining has found the necessary profitability again and the mass selling of miners has ended.

Since the beginning of 2022, the market has witnessed 3 intersections in this index, two of which are considered to be downward and one is considered to be upward. Now, the formation of another bullish crossover could seal the end of the miners’ mass selling period.

You can clearly see the massive selling of Bitcoin miners since the beginning of this year in other on-chain indicators; But this does not mean that they have put everything they had for sale.

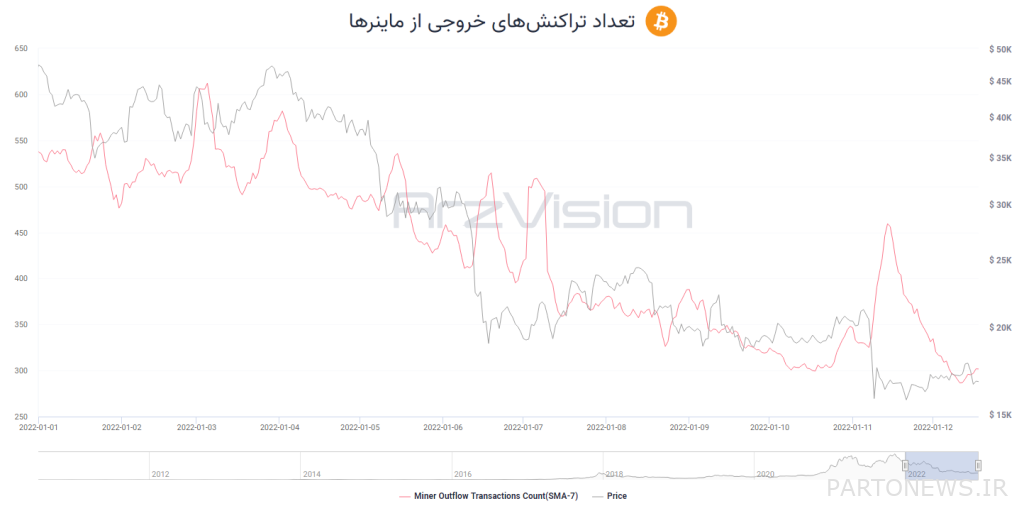

The decrease in the number of Bitcoin miners in recent months is quite noticeable. On the other hand, the number of outgoing transactions from addresses belonging to miners has been decreasing since the beginning of this year; Except for November 2022 (Aban), when this index experienced a temporary jump.

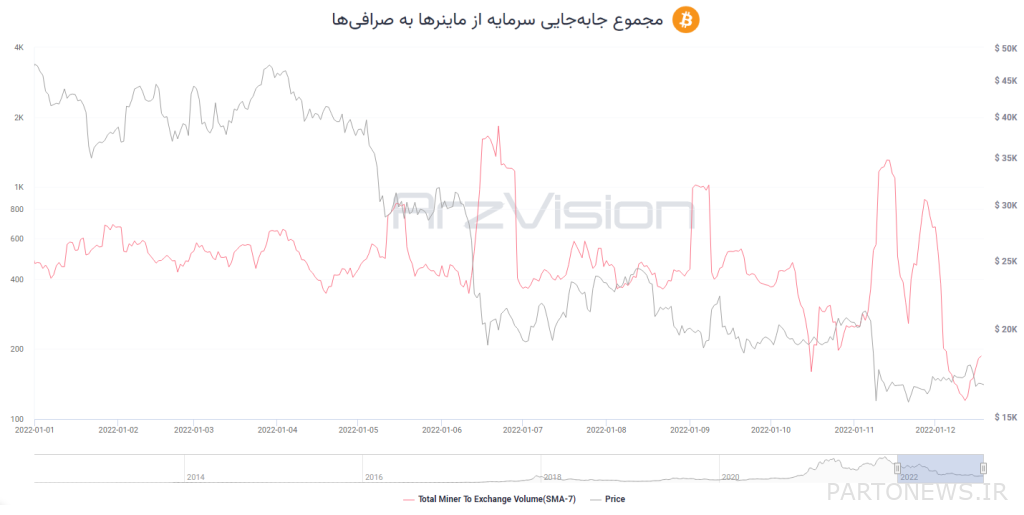

Data related to Bitcoin deposits from miners’ addresses to digital currency exchanges also confirms this flow. Since the beginning of 2022, the volume of Bitcoin deposits from miners to exchanges has generally decreased (regardless of temporary jumps).

The miners of this digital currency have sent a total of 57,000 units of Bitcoin to exchanges this year, of which 18,500 units were transferred to Binance and 12,500 units to Coinbase.

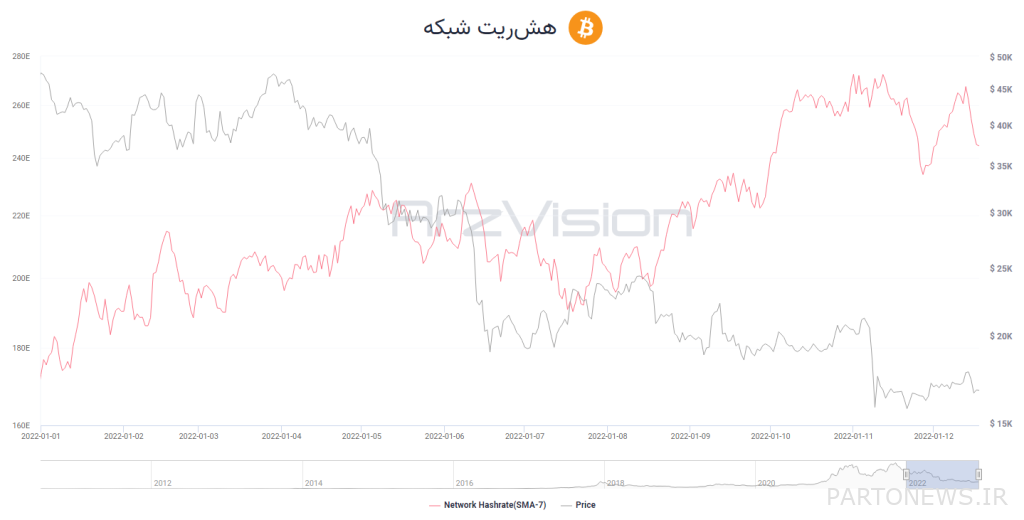

Changes in the overall hash rate of the Bitcoin network during 2022 also show that the network strength of this digital currency has not decreased. That is, if we consider the performance of the hash rate in the whole year, the price drop and the increase in energy costs did not have a negative effect on the hash rate. In fact, the overall hash rate of the network is not far from its historical peak even now.