Paid bank loans exceeded 3 thousand billion tomans

During the first eight months of this year, the country’s banking network has paid the equivalent of 3,333 hemats of facilities to business owners and households, and the share of households has increased to 17.3 percent.

According to this report, during the first eight months of this year, the country’s banking network has paid 3,333 Hamats of facilities to business owners and households, which has increased by 17% compared to the first seven months of last year.

According to this report, the share of business owners in the amount of facilities granted by banks during the mentioned time period was 82.6% and the share of households as final consumers was equal to 17.3%.

During the first eight months of this year, households have received 578 loans from the banking network.

Households’ share of bank loans increased

The details of the loans paid to the household sector as the final consumer were included in the reports of the central bank from April last year, so that the process of providing facilities to this part of the society is also determined.

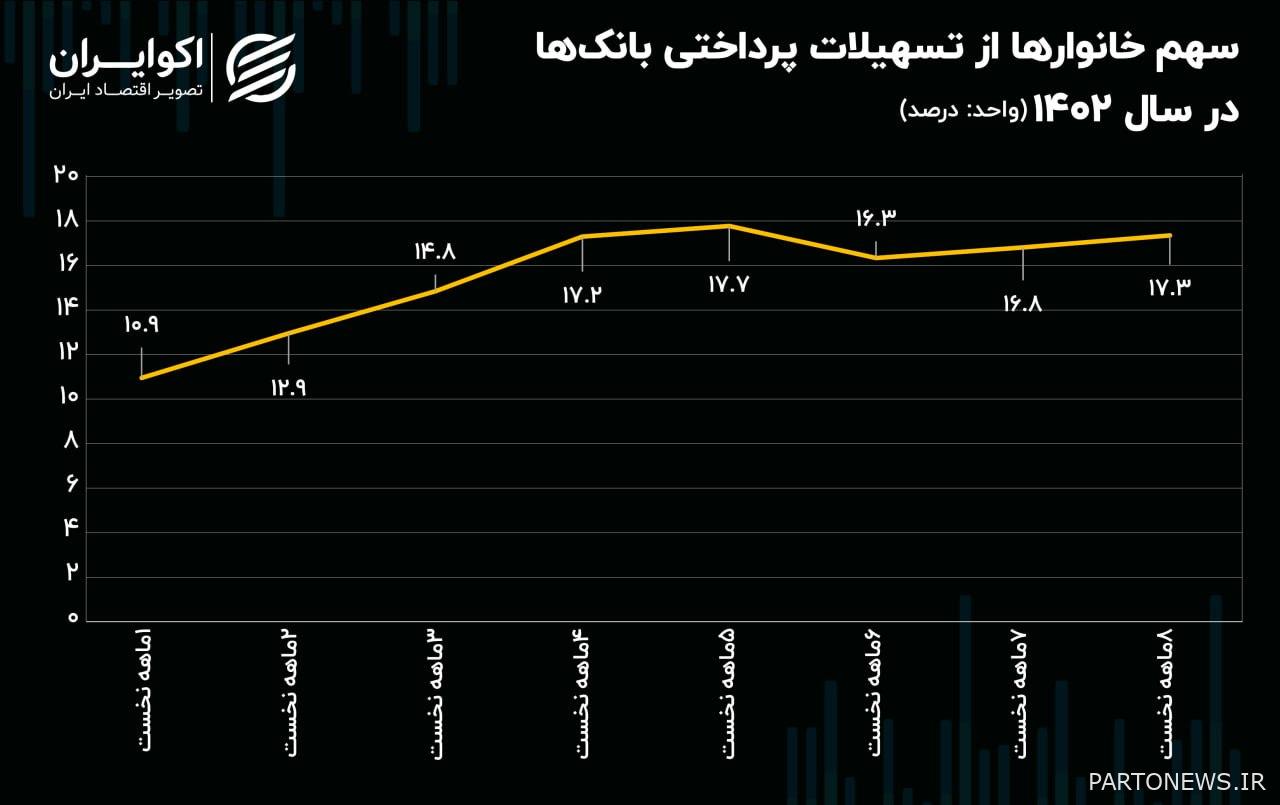

In this regard, the analysis of the share of households in the amount of banking network facilities since the beginning of this year shows that the share of this sector has increased at the end of November compared to the end of October.

The household’s share of the bank network’s facilities, which was at its lowest level of 10.9% in April, gradually increased.

In the spring and summer of this year, the amount of facilities paid to households has been on an upward trend, and with the increase in the amount of facilities paid to households, their share of the total facilities paid by banks has also increased, so that in August of this year, it reached its highest level of 17.7 percent.

In this summer, additional pressure was put on the banks in order to pay the mandatory facilities for marriage, childbearing and housing deposit, and this caused an increase in the share of households in the loans of the banking network.

The share of households in the payment of bank facilities, which reached 16.8% at the end of October this year, increased to 17.3% at the end of November.

Housing remained from bank loans

A significant part of the facilities paid to households is related to loans for marriage, childbearing and housing deposit; This facility, which is in the category of debt facilities and the government has been responsible for paying it to the banks, is always criticized by some banking activists. This category believes that the payment of this type of facility will put additional pressure on banks and cause them to face a lack of resources to pay facilities to other economic sectors.

However, as mentioned, the household sector alone received more than 578 hemats of facilities during the first eight months of this year, which is double the facilities paid to the commercial sector (equivalent to 274 hemats) and more than 3 times the facilities paid to the housing and construction sector (152 Hemat) and also agriculture (184 Hemat).