Payment statistics for housing facilities 1401 – Tejaratnews

According to Tejarat News, Saeed Shirzadi, CEO of Maskan Bank Financial Group, introducing this financial group in a report of the activities carried out, said: Bank Maskan Financial Group is a subsidiary of Bank Maskan and the main shareholder of this company is Bank Maskan.

Capital market companies, money market and construction companies, including different tools and companies such as Bank Maskan capital, Bank Maskan exchange company, Bank Maskan brokerage company and Bank Maskan Thamskan Investment Company, which itself has 17 provincial construction companies, are a subset of this financial group. . Navako, as a technology-oriented company of Maskan Bank, is also a subsidiary of this financial group.

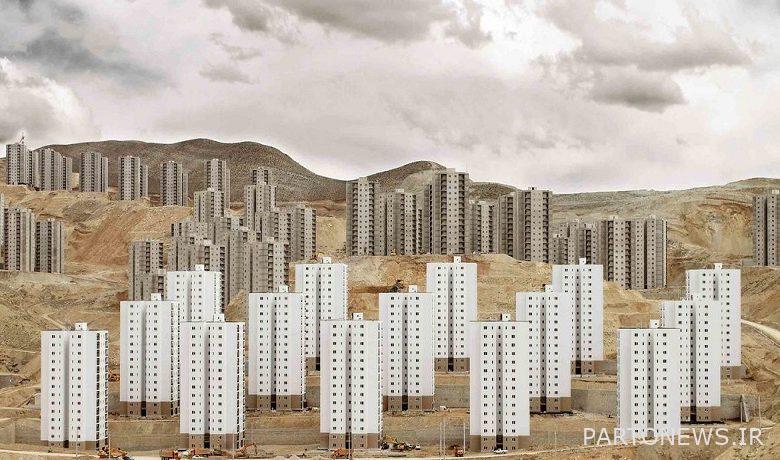

Regarding the overall strategy of the housing finance group, Shirzadi said: The development and increase of residential housing construction capacity, except for commercial and office buildings, along with influencing the country’s real estate market, is one of the goals set by this financial group. The final goal of the housing finance group is to be able to develop the housing business and increase residential buildings in terms of financing and providing capacity.

Referring to the slogan of the 13th government in the realization of the national housing movement, he added: Our duties have multiplied due to this and in this regard, we were able to start good projects, part of which is related to the projects of the national housing movement under the responsibility of the National Housing Group.

Capital market capacities are used to finance housing projects. During the exhibition of Kish’s investment opportunities in the field of housing, memorandums of understanding were signed with Farhangian Cooperative and Kish Free Zone Organization Cooperative, and their implementation will begin soon.

Shirzadi stated about the provincial projects of the National Housing Movement by the subsidiary companies of the Housing Finance Group: Zayandeh Rood Company has the National Housing Movement project, and Se Gharb Investment Company (Northwest Housing) is in charge of a part of the National Housing Movement project.

Tehran Housing Investment Company is one of the other subsidiary companies of this financial group, which is responsible for the same task. Currently, the housing financial investment group has 20 thousand residential units in 2 million square meters for the implementation of the project.

Considering that there is more capacity for this investment group in the field of housing, we are concluding new contracts.

The CEO of the Housing Finance Group stated that we are waiting for the land supply from the land and housing company to start the construction work, and added: based on the registration of people, if there is a need to buy land or take possession of the land and the land is provided, the work will be done. Execution will begin. In the cities that were announced, the project work is progressing according to the schedule, for example, the construction of housing by the Zayandeh Rood company is two years.

He stated that another memorandum of understanding has been signed with the army, which will be announced soon, and said: A good memorandum of understanding for land supply has been concluded with Imran Maskan, which has provided us with land for construction around Tehran in the cities of Pardis and Andisheh. .

Financing by Maskan Bank is in accordance with the ceiling set for this company, like other companies active in this field, which is done easily and quickly.

In the capital market, the financing rate is high and expensive, and in the national housing movement plan, it is very difficult to match the rate of funds. Currently, financing is done entirely by Maskan Bank, and fortunately, Maskan Bank has fully fulfilled its capacity in the field of the financing contract of the National Housing Movement.

While criticizing that Iran has not yet designed an attractive tool for financing housing through the capital market, Shirzadi added: Land and building funds have not been well received, the reason being the registration and document problems that properties have.

The tool designed by us is called “parallel loan” or “sale of metered land” based on which the buyers of units of investment funds can have the meterage of an apartment as a document.

If this path is paved, people’s small investments will become a percentage of an apartment. With the efforts of the capital supply company, this work is being pursued, and I hope that by the end of the year, we will be able to start the construction of some of these houses after being approved.

He added: Housing Investment Investment Company has built 50,000 residential units so far, which has been accomplished without having financial means and only by providing from the company’s own resources.

Our goal is to finance and provide capital through the housing investment company, which is being realized, and we hope that by the end of the year, one thousand billion Tomans will be financed from the sale of housing meters to start new financing projects.

Referring to the contracts concluded with the financing of the Persian Gulf and Bank Mellat, the CEO of Maskan Financial Group explained: Our goal in concluding the contracts is to form a consortium to attract the activities of investors in the field of housing by this company so that this capacity can be used. .

Shirzadi added: The reality is that it is not customary for commercial banks to enter the housing sector anywhere in the world, and it may not have the necessary efficiency for the banks. Governments allocate subsidies in this field.

By the 13th government, the statute of the “National Housing Fund” was proposed, which was also approved in the parliament, and it has been almost a month since its operational and executive works started, and it has even been heard that a large amount of financial resources have entered this fund.

The purpose of establishing this fund is to provide financial assistance to construction and projects that may not be economically justified for banks, that is, it is actually a subsidy support to banks, and 38 thousand billion tomans of money is supposed to enter these funds every year. In the places where banks cannot enter for financial support, it is provided through these funds.

Stating that last year, 78 thousand billion tomans were paid by Maskan Bank in the field of housing construction, he said: It is expected that other banks will enter in this field as well. The first thing that needs to be done to finance the housing so that all the pressure is not on one bank, is to increase the funds.

In this regard, we are developing the land and building fund, the asset fund, and the brokerage fund is becoming profitable, and construction projects are being completed. The project of Andisheh and Kish has reached almost 95% progress and is in the final stages of the Tehran project.

In addition, Javaheri, the chairman of the board of directors of Maskan Bank’s financial group, regarding the country’s current need for housing according to the needs assessment, stated: the need for housing is over 4 million in the next four years, and the government’s slogan of one million a year based on the needs assessment is clear. has been The sector in which the housing bank or the financial group operates is related to the middle income classes, construction is done.

As it was announced, Maskan Bank offers facilities for the entry of mass builders in order to fulfill the government’s slogan for housing construction, according to the latest statistics provided by the head of Maskan Bank regarding the granting of facilities, for the 210 thousand units that have been allocated, 150 thousand units of facilities have been provided so far. is paid. In order to realize the national housing movement, 20% belongs to Bank Maskan and 80% to other banks.