Petro (Petro), digital currency of Venezuela; Stablecoin made of oil!

The influence of digital currencies has expanded to the extent that, in addition to online traders and businesses, it has affected the political and economic priorities of countries. In this context, some politicians are looking for the supply of digital currencies linked to the central bank of their country to improve economic systems without the need to print cash. Venezuela was one of the first countries to implement its government digital asset offering and made headlines with the Petro digital currency.

Petro was the project of Venezuela’s national digital currency, which was released with the aim of improving the critical situation of the country’s official currency, the Bolivar. The former president of Venezuela, Nicolas Maduro, tried to save the economy, which had been in a steep decline since 2006, by launching this digital currency. The purpose of offering this digital asset was to open the doors of economic investment, especially for investors from other countries. However, Petro failed to deliver on many of the promises made by the president, Maduro and his aides.

In this article, we try to look at Petro and its history to examine one of the national digital currencies that tried to be a pioneer in this field; But in achieving his goals, he was left behind by many competitors. At the same time, we will point out the mechanism, characteristics, goals of Petro and some obstacles that have stood in the way of the acceptance and development of this national digital currency; So stay with us until the end.

What is Petro?

Petro digital currency, also known as Petromoneda and the abbreviation PTR, is the national digital currency of Venezuela, which was launched in February 2018 at the suggestion of the President of Venezuela, Nicolás Maduro, and by the Central Bank of this country. Petro is the first national digital currency in the world; But due to the lack of wide acceptance and acceptance, it has not been able to be a pioneer currency in this field and be a model for other national digital currencies.

It should be noted that the word “Petro” is derived from the word “Petroleum” which means “oil”. The choice of this name for Venezuela’s national digital currency is not without reason; Because its support is oil, natural gas, gold, diamonds and mineral resources.

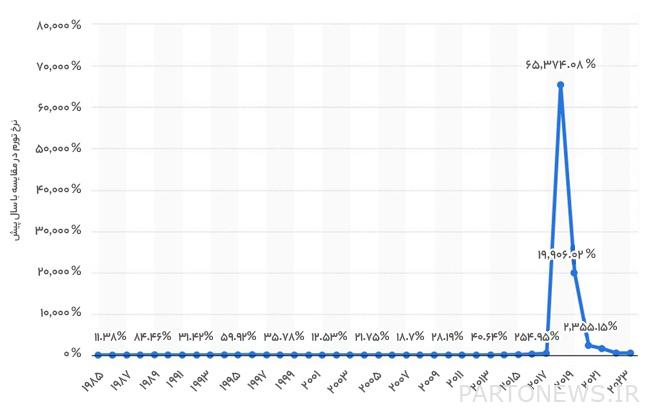

Venezuela is one of the richest countries in the world in terms of mines and natural resources. Venezuela’s economy is basically based on oil, and 95% of the country’s exports include oil and oil products. However, the international sanctions of the United States and the European Union have had such an impact on the economic and political development of this country that they have increased the inflation rate several hundred times in recent years.

This country is also struggling with other economic problems such as currency devaluation and global bankruptcy and long-term recession. The president of Venezuela, Maduro, and other senior officials of this South American country believed that the Petro digital currency would solve Venezuela’s economic problems and open a new way for foreign investors to access the country. However, Petro did not attract the attention of foreign investors as much as it was claimed and advertised, and it did not achieve widespread popularity and acceptance among the citizens of this country.

It is interesting to know that in addition to being the first national digital currency to be officially launched, Petro is the first digital currency to face international sanctions. The United States of America banned the cryptocurrency on March 19, 2018, just one month after its launch, preventing widespread adoption of Petro on trading platforms.

History of Petro

In the beginning, Hugo Chávez, the president of Venezuela at the time, had proposed the idea of creating the Petro. He believed that natural resources can be a strong support for the new national currency. Chávez proposed this idea in the wake of the widespread financial crisis that has plagued Venezuela since 2006 and reached its peak in 2008 and 2009. However, the government’s lackluster history of issuing alternative currencies meant that the idea did not materialize until five years after Chávez’s death in 2013.

Read more: Venezuela crisis and the impact of Bitcoin and digital currencies in this country

At the beginning of 2018, Nicolás Maduro, the successor of Hugo Chávez, announced that Venezuela would issue 100 million PTR tokens, which at the time was valued at $5.9 billion. The pre-sale of this token started in February 2018 and ended a month later. The government sources of this country announced that this event was accompanied by the achievement of securing capital of 3.3 billion dollars.

The government statistics of Petro sales became controversial when users complained of technical problems when buying this token, and some opponents of Petro attributed the presentation of these statistics to government propaganda. Also, the way this token is offered on the “ICObench” platform scores only 1.6 out of 5. Many other reputable platforms have not provided specific statistics in this field due to the lack of independent audits.

In addition, the nature and technical framework of the Petro was initially unclear, and although the whitepaper announced its immediate launch as an ERC20 token on the Ethereum network, Venezuela’s national digital currency later emerged from the NEM blockchain. It is said that the Venezuelan community supporting Dash also supported this project. Also, Petro’s white paper was translated into different languages; But each version of it provided conflicting information.

Read more: What is a white paper and how to read it?

The technical contradictions and many dark spots seen in the Petro project became the source of many criticisms of this project. Ultimately, Venezuela’s National Assembly opposed the president’s decision, calling it an illegal and unofficial asset offered by a government in dire need of cash.

What is the mechanism of Petro?

The mechanism and technical details of Petro’s operation are not complete and comprehensive, just like the ambiguous story of its launch, and the technical knowledge about the network of this national digital currency is limited to the points published in Petro’s white paper or classified and announced by government institutions. Some of the important things that are still unknown about Petro include the cryptocurrency’s cryptographic technology and digital signatures, and the current size of the blockchain and the number of nodes in the network.

Although Petro is said to depend on the performance of nodes and miners and masternodes, complete information on these essential network details is not provided. In fact, this digital currency operates on the basis of a private blockchain, the exact mechanism of its nodes remains hidden from technical observers.

Petro is said to use a consensus mechanism combining proof-of-work and proof-of-stake that generates a 4MB block every 60 seconds. Masternodes whose identity is still ambiguous can benefit from a 0.001% transaction processing bonus. Also, the total supply of this digital currency of 100 million units and its structure design is based on DASH software.

Is Petro a digital currency?

Venezuela’s government regulators and regulators are declaring the Petro as the national digital currency. However, the many controversies surrounding the white paper and the exact delivery and performance of Petro have raised many questions about its nature. In fact, it can be said that although Petro is ostensibly considered a digital currency, it lacks many of the criteria that valid digital assets must demonstrate in order to prove their effectiveness and widespread adoption.

Initially, the presentation of government data about the amount of pre-sale of this token without providing documents and documents provoked criticism of the project. Then, Petro’s controversial technical details opened up to the criticism leveled against it. Due to the complete involvement of the government and the closure of the supply and development process of Petro, this asset cannot be considered a decentralized digital currency. The source code of this project and the software repository of the state-owned company providing it, i.e. “Suncrip” (SUNACRIP), has not been available to auditors and technical supervisors. It is not bad to know that there are legal and judicial ambiguities about Suncrip and its performance.

Also, structural problems, including the lack of clarity about the asset’s creator and development team and its roadmap, fuel the uncertainties raised about Petro. The application programming interface (API) of this project is not available for creating third-party applications, and the only active API of this system is available to users for requesting prices. Also, the Petro White Paper has introduced it as a minable currency; But normal users cannot work as a miner in this network.

The problem of Petro’s technical bugs became more prominent when, in an unforeseen event, users’ data was erased in April 2020 and the history of all transactions made before May 6, 2020 was lost. This issue caused a financial blow to many Petro support businesses. It should be noted that the Petro network website and browser only work with Venezuelan IP, which adds to the difficulty of tracking transactions in this network.

In addition, the only international exchange supporting Petro is the centralized Russian exchange YoBit (YoBit), which shows that this token is also facing many liquidity problems in international markets. At the same time, the president of Venezuela, Nicolás Maduro, tried to make this currency widely accepted on various platforms and exchange it with prominent national currencies such as the yuan and the euro. It is said that Petro’s non-compliance with anti-money laundering and customer identification (KYC/AML) laws is one of the obstacles to listing this digital currency on international reputable exchanges.

Applications and obstacles and problems facing Petro

The goals that politicians in Venezuela were pursuing through the supply of petro seem complex and diverse. Some of these goals include dealing with economic problems, reviving industry, countering currency devaluation, and fighting international sanctions by the United States and the European Union.

The petro was used as a medium of payment, especially in international transactions for the export of Venezuelan oil and petroleum products. Also, domestic applications such as intermediary in paying taxes and government debts along with acceptance in various national businesses were some of the other proposed applications for Petro.

In addition, to expand the acceptance of the petro, the government considered facilities such as a 10% discount for individuals and businesses that use the petro instead of the traditional Venezuelan bolivar currency to pay their taxes and other debts.

It goes without saying that the obligation to pay Petro for the cost of gasoline for cars and airlines, to do business with Brazil, and to reward government employees in the form of Petro are some of the measures that Nicolás Maduro has used since 2020 to increase the rate of Petro use; Actions that seem to have failed to bring fruitful results.

It should be mentioned that considering the capacity of 30 million users of Venezuela’s national digital currency, if this asset was presented with a defined economic model and open source development and a clear road map along with a clear legislative framework, it could undoubtedly help improve Venezuela’s economy at the national and international level.

However, many internal problems and the non-acceptance of Venezuela’s economic allies, including Russia, China, and India, caused many of the goals of this national digital currency to fail to be realized even after four years of Petro’s release. It is not bad to point out that legally, none of the government assets in this country can use natural resources as a support.

TotalTheclassification

In this article, we examined Petro, the national digital currency of Venezuela, from different angles and took a look at the history of its design and launch. This national digital currency was the first among its peers; But he could not achieve much success and faced many technical and legal problems. Also, we learned that a major part of Petro’s mechanism and goals are hidden from users and technical observers; Therefore, all of our data from this network is limited to information provided by the Venezuelan government.

Overall, given the Maduro government’s control over the Petro digital currency, it is unlikely that this token can become a mainstream digital asset with widespread adoption. Currently, the digital petro is not more effective than the traditional bolivar currency in this country. The shaky internal politics of this country has also made even testing this digital currency look dark and ambiguous to curious foreign individuals and businesses.

In addition, Venezuelan citizens’ acceptance of top digital currencies such as Bitcoin is another factor in the failure of the Petro. At the same time, it seems that the Venezuelan government has largely given up hope on the success and efficiency of the Petro. Actions such as the mining of Bitcoin by the Venezuelan army and the legalization of digital currency mining with a government license and the import of goods from Iran and Turkey through Bitcoin also show that the Venezuelan government does not consider the future of this national digital currency very bright.