Possibility of Atrium price jump against Bitcoin

At the same time as the digital currency market rose in the last days of last week, Atrium outperformed Bitcoin. As it turns out, investors’ risk-taking has increased in the last few days, and now altcoins can outperform bitcoins in the short term.

To Report Kevin Desk On Friday, at the end of a volatile week for the market, many digital currencies rallied. Meanwhile, the 5% jump in Atrium prices was more pronounced than other digital currencies. However, as the price of Atrium failed to reach above $ 3,000 for two weeks, this time it failed to cross this level. Bitcoin, meanwhile, jumped 3 percent to $ 42,200.

The global stock market was bullish yesterday as well, while gold, which is largely considered a safe-haven asset for investment, fell in price. The upward return of corporate stock prices and the further growth of coins compared to bitcoins indicate that investors are more willing to take risks.

Some analysts believe that there is still a possibility that the volume of digital currency price fluctuations will continue to increase.

“Sean Farrell, a senior fellow at the FundStrat Investment Institute, said:

Although investors’ risk appetite increased this week, we may see more price volatility in the short term. We also believe that any fall of Bitcoin and Atrium to lower price levels is a good opportunity to buy.

After the price jumped on Wednesday, the volume of bitcoin transactions in digital currency exchanges fell again. In addition, the ratio of the volume of purchase orders (long) to sales orders (shorts) in the futures market of exchanges reached equilibrium on Friday; This means that yesterday’s jump in the price of bitcoin was not necessarily due to a change in traders’ views.

On the other hand, the average bitcoin financing rate has recently risen, indicating that traders’ sentiment may have been somewhat higher. The term capitalization rate in the futures market refers to the amount of commission that long-term holders (those who believe prices are rising) and short-term holders (those who believe prices are falling) must pay to keep the market in balance.

On the other side of the market, ApeCoin, a token associated with the Bored Ape Yacht Club (NFT) token set, jumped 90 percent from the $ 6.48 floor on Thursday on its second day of launch. $ 15 back. The strong uptrend came after the Ipcoin market fell 80 percent on Thursday.

What is the condition for Atrium to jump against Bitcoin?

Atrium price growth is partly influenced by the progress of the network development team in transferring the Atrium consensus mechanism from proof of work to the new stock proof model.

By the middle of last week, Atrium’s experimental transfer to the stock proof mechanism was successfully completed. Now in the Kiln test network that hosted the transfer, it is the credentials that create new blocks and process transactions instead of miners.

“David Duong, a senior researcher at Quinbase Digital Currency Exchange, said: ‘

Number of active Beacon Chains, [شبکه نسخه دوم و مبتنی بر اثبات سهامِ اتریوم], From late February (February 26) to March 17 (March 26) has increased from 300,702 to 315,576. This means that the number of credentials increased by 4.9 percent in just 7 days, while the growth of this figure during the months of February (February) and January (January) were 3.9 and 4.8 percent, respectively.

If we want to look at the charts, we must say that Atrium price growth has been stronger than bitcoin in these few days, and this superiority may be more noticeable in the short run. As the 1-day Atrium / Bitcoin market outlook shows, the price has returned to the upside after hitting support at 0.064 and is now trading at $ 0.073, which is 4% away from current levels. .

Add to that the fact that analysts have recently noticed a decrease in the volume of Atrium’s intranet activities.

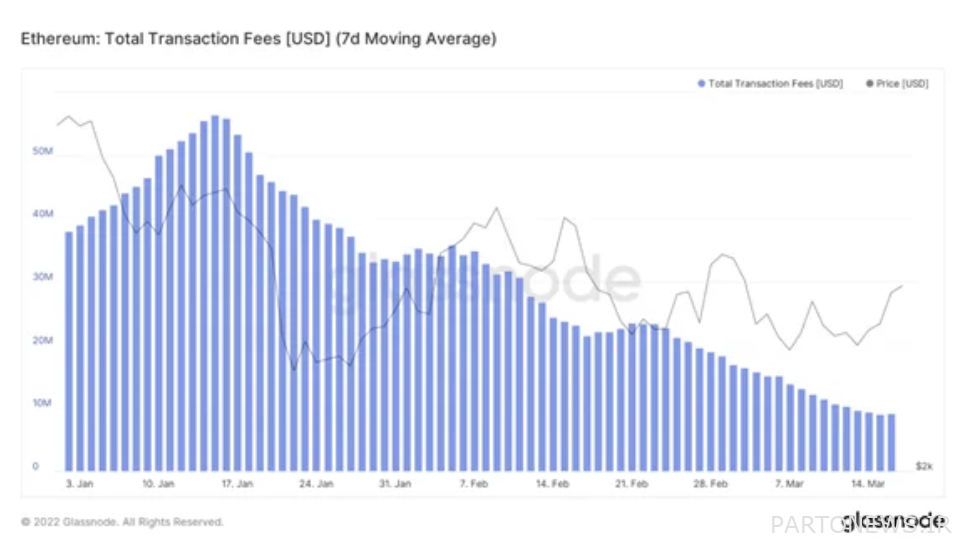

The chart below shows the total fees paid by users on different days of the year, from which it can be seen that Atrium miners have recently earned less from the source of fees.

Farrell said one of the reasons for the decline in Atrium’s intra-chain activity is the declining demand for expensive NFTs; Assets that are primarily constructed and traded on the Atrium network. The FundStart analyst says that since mid-January, when the volume of Internet searches related to NFTs on Google broke, the interest of users in this field has decreased.

Farrell also notes the multiplication of Atrium’s “price-to-sales” ratio, which has risen from 17 to 50 in just a few months. Price-to-revenue rate is obtained by dividing the market value of a digital currency by the total revenue of that currency protocol, and increasing it means that the token associated with that protocol is priced higher than its actual value.