Price fluctuations continue to increase

The feelings of bitcoin traders have been in the “extreme fear” zone for several days, and the price has been fluctuating at certain intervals. Given the recent market developments, analysts expect the price of bitcoin to fluctuate further.

To Report Kevin Desk, the overall digital currency market on Friday, was down for the second day in a row, and Bitcoin was able to reach above $ 40,000 again. The price of Bitcoin, which fell 2.9 percent on Thursday, reached a high of $ 40,869 on Friday.

The digital currency is currently hovering near the $ 40,000 support level, which is higher than the floor in the first quarter of 2022 (winter 1400). However, the bitcoin price trend has sounded the alarm for some traders.

“Alex Kuptsikevich, chief financial markets analyst at FxPro, said:

Confirming the break of $ 40,000 support could mean a possible fall in price below its previous low of $ 38,000. Conversely, if Bitcoin can break out of this downtrend and move upwards, the importance of this balanced uptrend will increase.

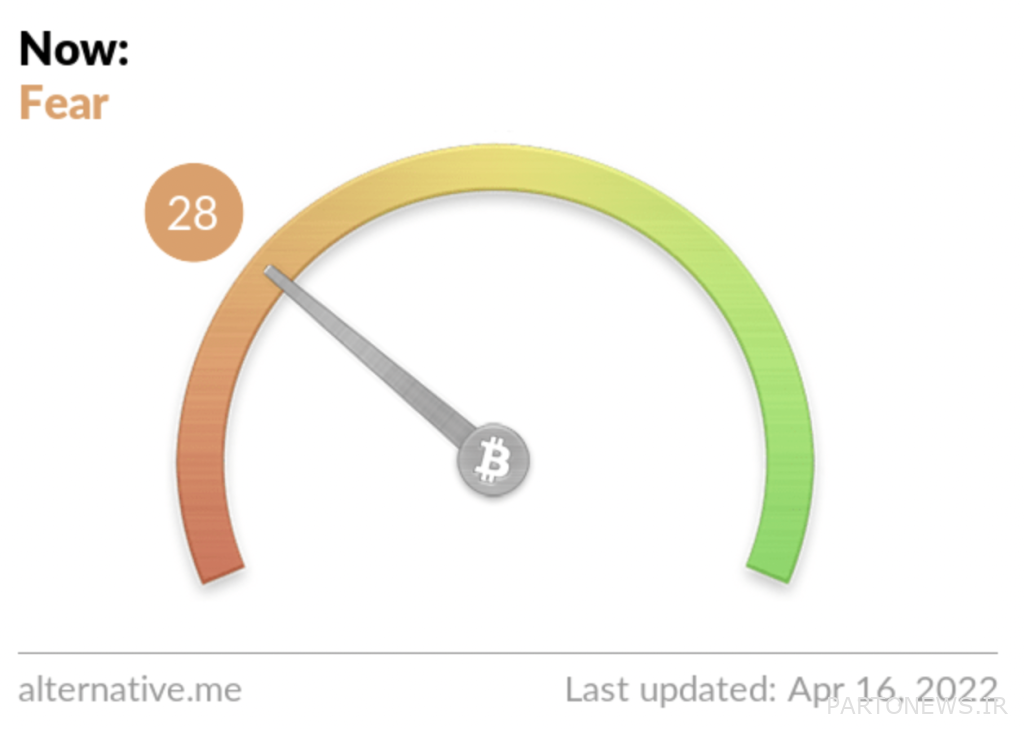

The Fear and Greed Index is a popular tool provided by the Alternative.me website that reflects the feelings of traders. On Saturday, April 16 (April 27), the index reached 22, which indicates the fear of traders. It is worth mentioning that the level of fear of investors in the digital currency market has increased compared to the previous week, which was in the range of 37.

The index shows a number between 1 and 100, with the number 1 indicating the intense fear of digital currency market traders and the number 100 indicating their intense greed. In other words, when the fear and greed index approaches 1, traders are selling and when it is close to 100, traders are buying.

Analysts say the Bitcoin range may fluctuate further in the coming months.

Paul Robinson, a DailyFX strategist, said:

Bitcoin faced strong selling pressure in the fourth quarter of 2021; But in the first quarter of 2022, it went through a period in which there was no clear direction. The narrowing of the Bitcoin price volatility range over the past three months could further increase the directional price fluctuations in the short term. However, it should be noted that the range of fluctuations in financial assets increases over time, and after periods of low volatility, periods of high volatility occur. In addition, we need to consider the fact that we are talking about bitcoin. Given these points, it can be said that the fluctuations of this digital currency are likely to increase by mid-2022.

It is worth noting that in the history of the bitcoin market and other digital currencies, April (mid-April to mid-May) has always been bullish.