Promising sign: Bitcoin and Ethereum futures trading volume is increasing

Futures help increase efficiency in the markets and are an excellent tool for hedging and risk management. Many analysts consider the re-entry of futures traders and the increase in the volume of these transactions as a good omen and a sign of the market’s return and the beginning of an upward trend.

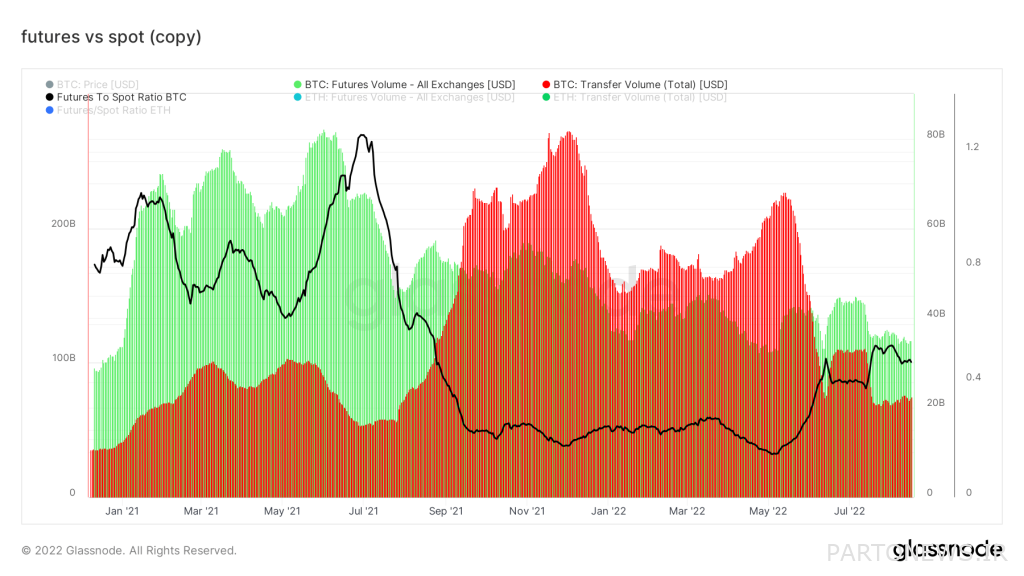

To Report CryptoSlate’s review of Bitcoin and Ethereum futures trading shows that the volume of transactions in these markets has once again exceeded the volume of on-chain transactions. The volume of intra-chain transactions means the amount of capital that is successfully transferred in the transactions of each network.

Futures traders buy and sell derivative contracts that represent the value of a specific digital currency. More experienced market traders prefer futures trading to spot or cash trading due to the possibility of profiting in both directions (upward or downward).

Under normal conditions, capital turnover in futures markets is higher than in spot markets. The reason is that experienced traders use trading leverage and usually have more capital than small spot market traders.

Status of Ethereum spot and futures markets

The chart below shows the overall trend of the intra-chain and spot trading volume lag of the Ethereum futures market. However, the spot markets were booming at the end of 2021 (Azer 1400) and entering the new year.

Since the end of June 2022 (Khordad 1401), the difference in volume between futures and spot Ethereum transactions has increased increasingly. Analysts speculate that the reason for this is increased speculation about the imminent implementation of the Ethereum network update event, or Merge; A major update where the current execution layer of the Ethereum blockchain is merged with the proof-of-stake-based layer.

Status of Bitcoin spot and futures markets

Examining Bitcoin spot and futures transactions will show us a different picture of the market. The chart below shows that Bitcoin futures trades have had significant volume amid the bull market of 2021.

However, after the price of Bitcoin reached its all-time high in the fourth quarter of 2021 (Fall 1400), the tables turned in favor of spot trading. From June 2022 (June 1401), after the re-stabilization of the position of futures traders, the volume of these transactions exceeded the intra-chain transactions.

The ratio of futures transactions to spot bitcoin and ethereum

The lower line chart shows the ratio of futures to spot trading volumes. As you can see, after June 2022 (June 1401) and with increasing speculation about the merger event, Ethereum futures to spot trading ratio has rapidly overtaken Bitcoin.

A resurgence in Bitcoin and Ethereum futures trading volume suggests that derivatives traders are once again investing in riskier assets. The return of these traders to the market can show that everything will probably return to the previous state after the crisis of the Tera network crash.