Redemption of 120 thousand billion tomans of bonds by the central bank

According to Iran Economist, according to the central bank’s prediction of the liquidity situation in the interbank market, the operational position of the central bank this week was the repurchase agreement. Therefore, this bank implemented open market operations in the form of a repurchase agreement in the amount of 953.1 thousand billion Rials.

Despite the decrease in demand in open market operations and the increase in regular credit balance last week, it seems that the increase in the repo balance in the interbank market has been effective and the interbank interest rate has been accompanied by a slight increase. Also, last week, the government sold another 1,588 billion tomans worth of its bonds to bring its total sales in seven auctions to 27.2 billion.

Despite the decrease of 10 thousand billion tomans in the demand in the open market operations and its reaching to more than 110 hemats, as well as the decrease of about 1.5 thousand billion tomans in the regular credit balance last week, unlike the previous weeks, it seems that the increase of 3.8 thousand billion tomans in the balance Repo has been effective in the market and the interbank interest rate has not only not increased but has reached 23.55% with a slight decrease of 0.02 percentage points.

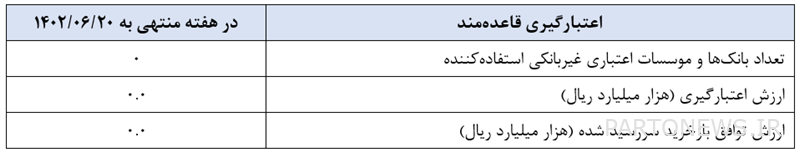

In the framework of the liquidity management required by the Riyal interbank market, the Central Bank implements open market operations on a weekly and case-by-case basis. The operational position of this bank (buying or selling through existing tools) is announced based on the prediction of the liquidity situation in the interbank market and with the aim of reducing the fluctuations of the interbank market rate around the target rate, through the publication of a notice in the interbank market system. Following the aforementioned notification, banks and non-bank credit institutions can send orders through the interbank market system by the specified deadline in order to manage their liquidity in the interbank market.

Banks and non-banking credit institutions can, on Saturdays to Wednesdays, use regular credit (receiving credit with collateral from the central bank in accordance with the established criteria), subject to the possession of government Islamic financial bonds and in the form of a repurchase agreement with the ceiling rate of the interest rate corridor (24 percentage) use.

end of message/