Reducing the inequality of granting bank facilities in the 13th government

According to Iran EconomistOne of the problems that the 13th government faced at the beginning of its work was the class divide and severe economic injustice. The 13th government started its work while the Gini coefficient (index of economic inequality) had reached from about 36% in 2012 to about 40% in 1400, which indicated the increase of the class gap and the unfairness of the economic situation of the members of the society.

The state of economic inequality is the result of different structures and policies in different areas, from budgeting to support and subsidy system, banking system, etc. The intensification of the class gap between 1992 and 1400 was the result of the confusion of these structures and the implementation of policies in the direction of injustice.

Based on this, the 13th government, which made justice its central slogan, pursued the reform of anti-justice structures and the implementation of policies consistent with justice. Banking system was among the areas where the 13th government considered the realization of justice in the reform of its structure and policy design. The 13th government started its work in a situation where it had to implement contractionary monetary policy to control inflation.

The implementation of contractionary monetary policy has limited the granting of facilities, and as a result, the difficulty of this policy may be transferred to ordinary people and microloan applicants. This was the issue that caused the government to facilitate the granting of microloans while implementing a contractionary monetary policy. Accordingly, the government provided conditions for people to receive microloans without the need for a guarantor.

In addition to these cases, the government’s insistence on the development of accreditation in the process of granting bank facilities provided the basis for a fairer distribution of facilities in favor of those with good accounts, a significant part of whom are ordinary people and small loan applicants.

With the development of validation in the banking network and making the granting of facilities conditional on the applicant’s creditworthiness, the access of bad credit applicants for large loans, including bank super-debtors, to bank facilities was limited and, on the other hand, the bank facilities were changed in favor of the general public and small loan applicants. This action led to another factor in making the distribution of bank facilities more public.

Of course, the government’s measures to improve justice in the distribution of banking facilities do not end with these two cases. Among other measures of the government was to oblige banks to publicly disclose information on large facilities and facilities of related parties, which made the atmosphere of violation unsafe for bank managers and thus laid the groundwork for granting facilities to be fairer.

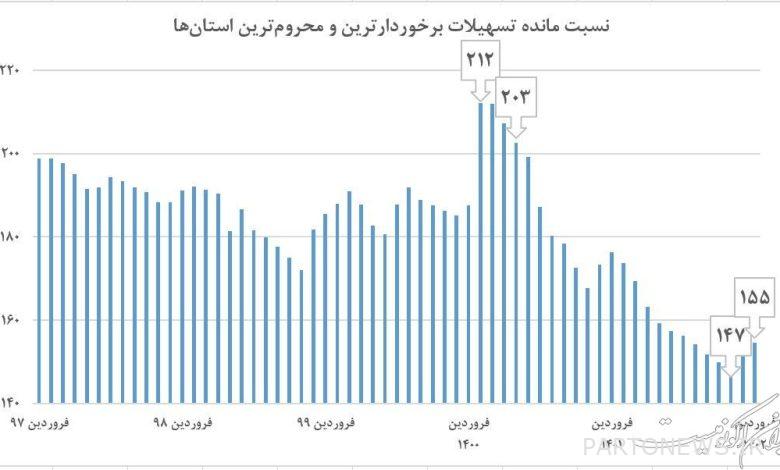

The result of these actions of the government has been the significant improvement of the facilitation justice in the country from the middle of 1400 until now. According to the official statistics, the ratio of facilities in the country’s most prosperous province (Tehran) to the most deprived provinces (Kohgiluyeh and Boyer Ahmad) has decreased significantly in the 13th government.

The latest statistics on the balance of bank facilities show that the ratio of the balance of the facilities of Tehran province as the most benefiting province from bank facilities to the balance of the facilities of Kohgilivye and Boyer Ahmad as the most deprived provinces has decreased from 203 in August 1400 to 155 in April 1402. In other words, the gap in access to facilities in the 13th government has decreased to a great extent, which shows that the government’s actions have been effective in establishing justice in facilities.