Rising digital currencies and predicting further fluctuations

The price of bitcoin has remained almost constant overnight, which may indicate a decrease in the fear of market traders. However, the price of sandboxes has increased by 7% during the same period.

To Report Quinn Desk Most quinces grew yesterday and offset some of last week’s price declines. Dicenterland, for example, experienced a 3% price increase yesterday to keep its price unchanged from the previous week. The other Metatarsi digital currency sandbox had a 7% price increase.

Yesterday, the Federal Reserve released its meeting report for the beginning of the month, which showed an increase of 50 bps in future interest rates.

US stocks rose slightly overnight on the overnight, while the US Treasury 10-year gold and bond price chart fell.

Fluctuations will increase

Usually, after the price fluctuates within a certain range for a while, the resistance or support for the price of digital currencies finally breaks down.

The chart below is Bitcoin’s Open Interest Index, which shows the number of futures contracts for this digital currency per day. As it turns out, this is an uptrend. In a report this week, Arcane Research sees the significant growth in the index as a sign that big market movements are imminent.

In July, for example, the Open Interest Index rose in July last year before a short-term sell-off. Short Squeeze occurs when short-term traders are forced to exit their trading positions. For example, when the price of bitcoin fell from $ 30,000 to about $ 48,000, there was also a push to sell debt, where the open interest index also rose.

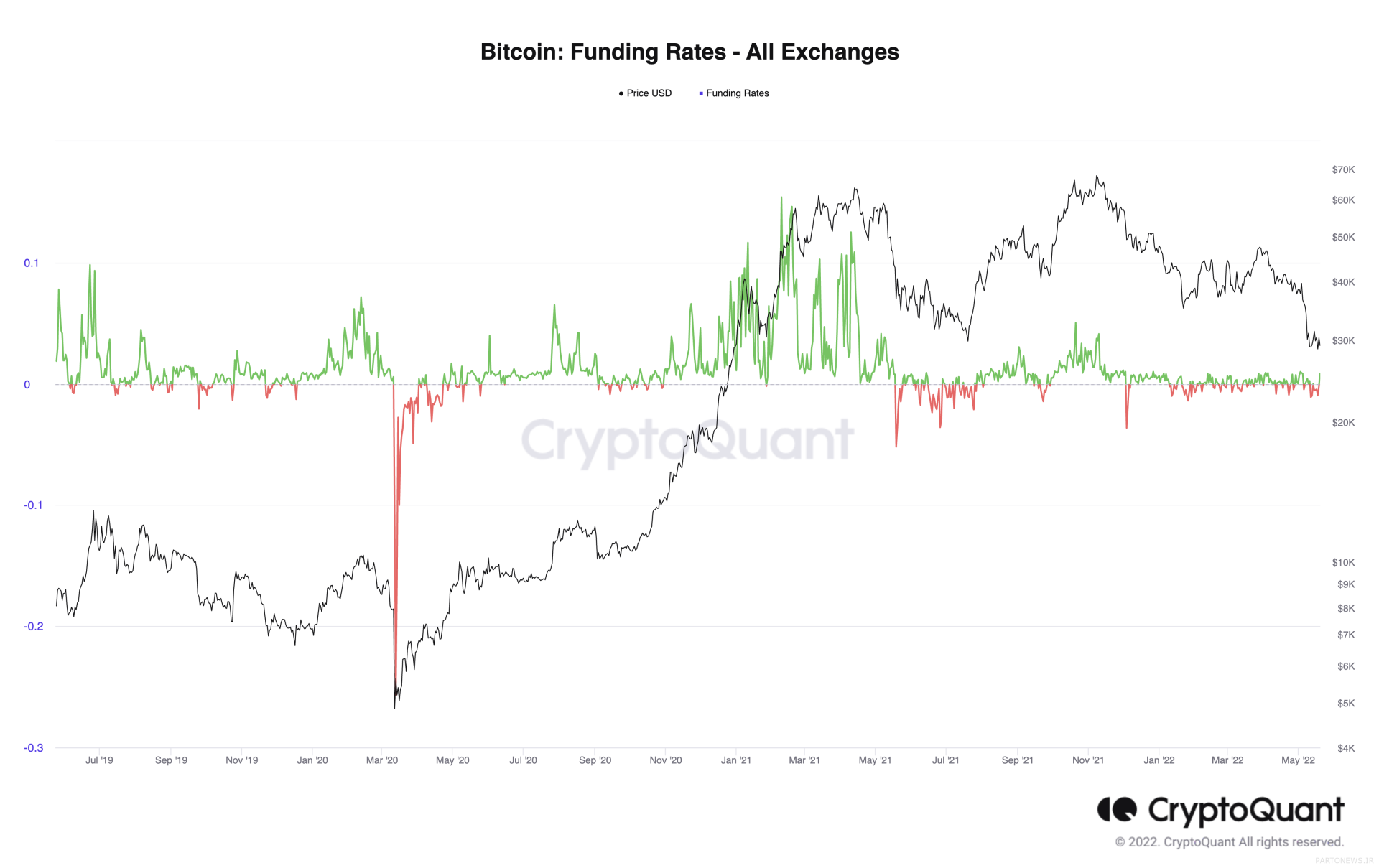

Although the market trend is unclear, traders were reluctant to move up or down. For example, over the past few months, the Funding Rate used by exchanges to balance transaction risk has been either zero or negative.

This means that most situations were in the form of shorts (sales).

Also read: What is the position of Short and Long? Make a profit by reducing the price!

However, in the current situation, this rate has not been as negative as when prices are very down, and on the other hand, it has not been as positive as when prices are very up, and it has been neutral. So it can be concluded that this type of trading has decreased and the situation is not like the bullish markets of the last one or two years.