Satran’s fundamental analysis / 194% jump in net profit in 9 months of this year – Tejaratnews

According to Tejarat News, Tehran Cement Company was established in October 1333 with an initial capital of eight million and 500 thousand tomans. This company operates in the field of construction of cement factories, exploration and exploitation of mines and export of cement products.

The main products of this company include bag and bulk cement in three types, one, two, five and pozzolanic.

The shares of this company were offered in Tehran Stock Exchange in April 2010 at a price of 914 Tomans.

Among the most important risks of this company are sanctions, extreme exchange rate fluctuations, increase in transportation costs and energy carriers.

Setran, with a market value of five thousand and 923 billion tomans, is considered one of the most important leaders of the Cement Group.

Kaveh Pars Mining Industries Development Company is the largest major shareholder of this company by taking over 50% of Setran’s shares.

Radis Company and Alborz Insurance Company are considered as the other major shareholders of this cement company, each having 5.32 and 2.98 percent of the shares of Tehran Cement Company.

It should be noted that 42% of the company’s shares are also in the hands of small or so-called floating shareholders.

Comparing the efficiency of Setran with the index of the cement group

Examining the yield table of Tehran Cement Company shares shows that the shares of this company have gained more yield than the average of the cement group in the medium term.

Of course, in the three-year period, the numbers are slightly different. So, during this period, Tehran Cement shares have grown by only 36%.

Meanwhile, the index of the cement group and the total index have increased by 148 and 261 percent, respectively.

9 months report ending in Azar 1401

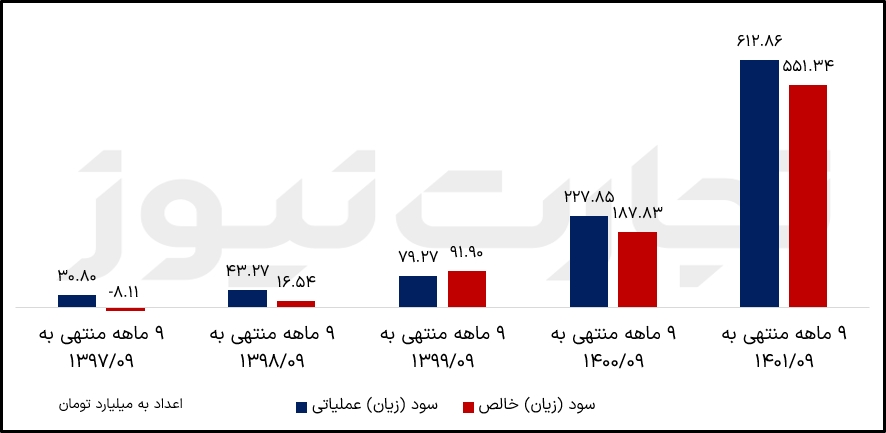

Examining Setran’s 9-month financial statements shows that this company was able to increase its operating profit and net profit by 169 and 194% in this 9-month period.

Based on this, the profit from the operation of this company and the net profit of Setran in these 9 months have been recorded as 612 billion tomans and 551 billion tomans, respectively.

Also, in this period, this company managed to realize a profit of 288 Tomans per share, which has increased by 82% compared to the 9 months of 2014.

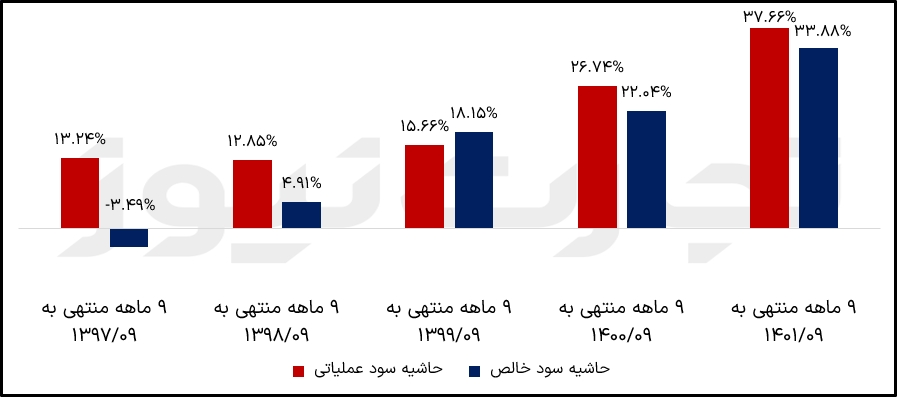

The financial ratios of this cement company for 9 months of 1401 also report an increase of 10.92 and 11.84 percent in the operating and net profit margins of this company.

Based on this, Setran’s net profit margin has reached 33.88% and its operating profit margin has reached 37.66% in this 9-month period.

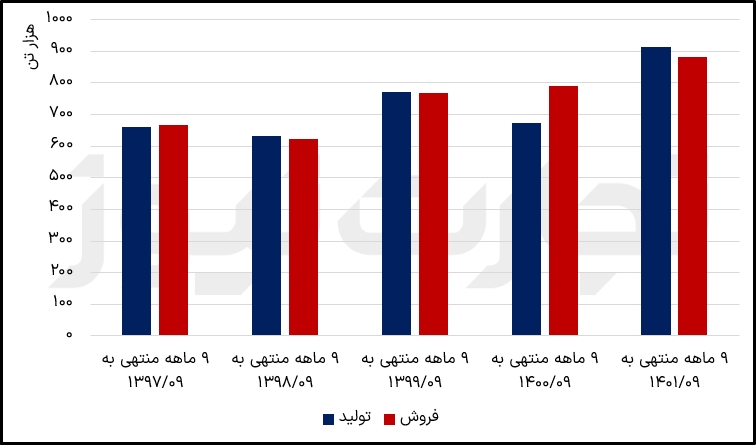

The production and sales reports of Tehran Cement Company show that the production and sales of this company have grown by 36% and 12% respectively in 9 months of 1401 compared to the same period last year.

Based on this, in the period of 9 months of 1401, the total amount of production of this company was 912 thousand 386 tons and its total sales amount was 882 thousand 373 tons.

Read more reports on the stock news page.