Shareholders are concerned about the impact of interest rate increases on the stock market

According to Tejarat News, the increase in the interbank interest rate in the last week of July 1401 caused concern among shareholders The effect of interest rate increase on the stock market has been

According to most of the capital market experts, interest rate growth has always acted as an inhibiting factor for the growth of financial markets. This is why some stock market analysts use this economic component as an indicator to identify the trend of the capital market. Of course, this is not only limited to Iran and domestic markets.

In the United States of America, there is also such a relationship between interest rate fluctuations and the expectations of market participants. For example, in a situation where US inflation has increased to a record low, the Federal Reserve also increased the interest rate by 0.5%. Immediately, the stock markets received a negative signal, which led to a drop in the trading trend in this area.

The effect of interest rate increase on the stock market

Most of the capital market activists believe that the continuous increase in interest rates means that the government’s promise to support the stock market is back. Of course, whether the interest rate should increase due to the rampant inflation that has gripped the economy is another matter. Because many economists emphasize that using the interest rate channel to control inflation is one of the necessary measures.

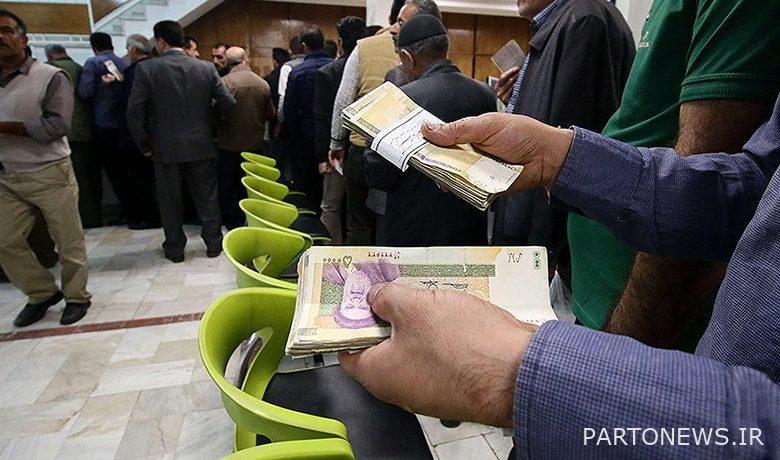

However, shareholders are worried that the rate of withdrawal of real money from the market will intensify. The trend that has continued in the past weeks and caused a significant decrease in the value of transactions during the last month. Stock market experts also believe that the reason for this is the tendency of real people to make deposits following the growth of interest rates. Now, with the continuation of the interest rate increase, there is a fear that the real people will leave the market and turn to deposits.

Why do shareholders complain about the government?

Seyyed Ehsan Khandozi had made a promise in the fall of 1400, but now considering the interest rate fluctuations, it can be said that he has practically broken his promise. A promise that was designed in the form of a support package for the stock exchange and was supposed to set the interest rate ceiling at 20%. Of course, this action of the Minister of Economy was widely criticized by economic experts. But at the same time, the shareholders expressed doubts about the implementation of this clause of the support package.

Now it seems that capital market activists have no way back and no way forward! The promises of the government have not been implemented and they are still facing heavy losses in the market. In other words, they cannot leave the market, nor do they see a clear prospect in front of the market. Now we have to wait and see what will be the reaction of the government to the complaints of the stock exchanges about the performance of the cabinet. This is while the Ministry of Economy has not provided a specific explanation regarding interest rate changes and its contradiction with the 10th paragraph of the stock market support package.