Shepna fundamental analysis / Fluctuation in profit making with dollar price impulses – Tejaratnews

According to Tejarat News, the annual financial statements of Isfahan Oil Refining Company published on the Kodal website show that at the end of 2011, the company was able to earn 339,730 billion tomans from the sale of its products. Of course, about 295 thousand and 275 billion Tomans of Shepna’s income have been spent on the production of products.

In total, Isfahan Oil Refinery was able to earn 41 thousand 815 billion Tomans from its operations in 1401, which has increased by 116% compared to 1400.

Shepna’s net profit in 1401

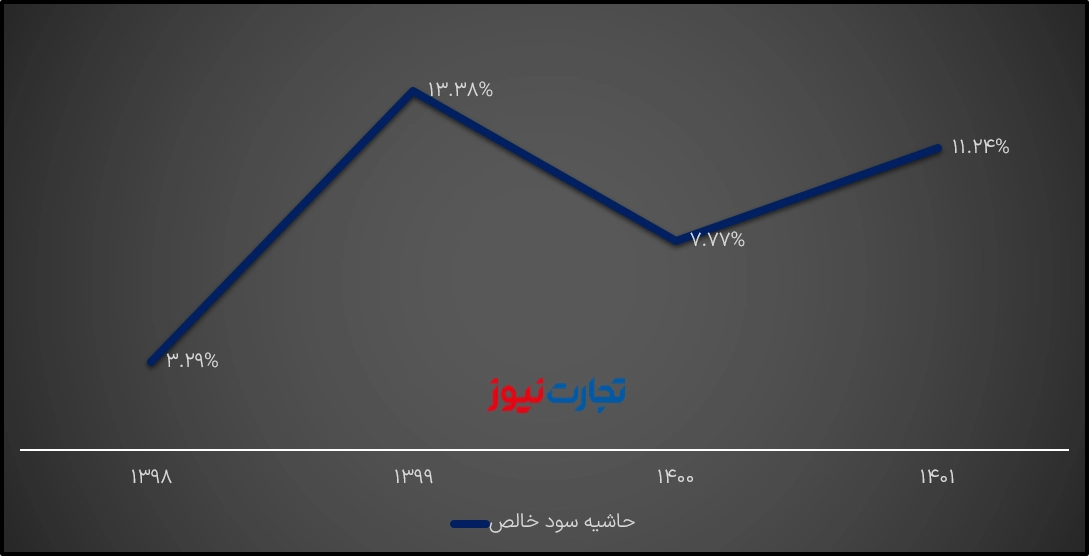

By deducting the financial expenses of 1401 from the operating profit, the net profit of 1401 of Isfahan Oil Refining Company is obtained. Based on this calculation, the company has been able to recognize about 41 thousand and 816 billion tomans of net profit in the fiscal year 1401, which has increased by about 130% compared to the year 1400. This has caused the company’s profit margin to grow by 3.47 percent.

Inflation profit of Isfahan oil refining

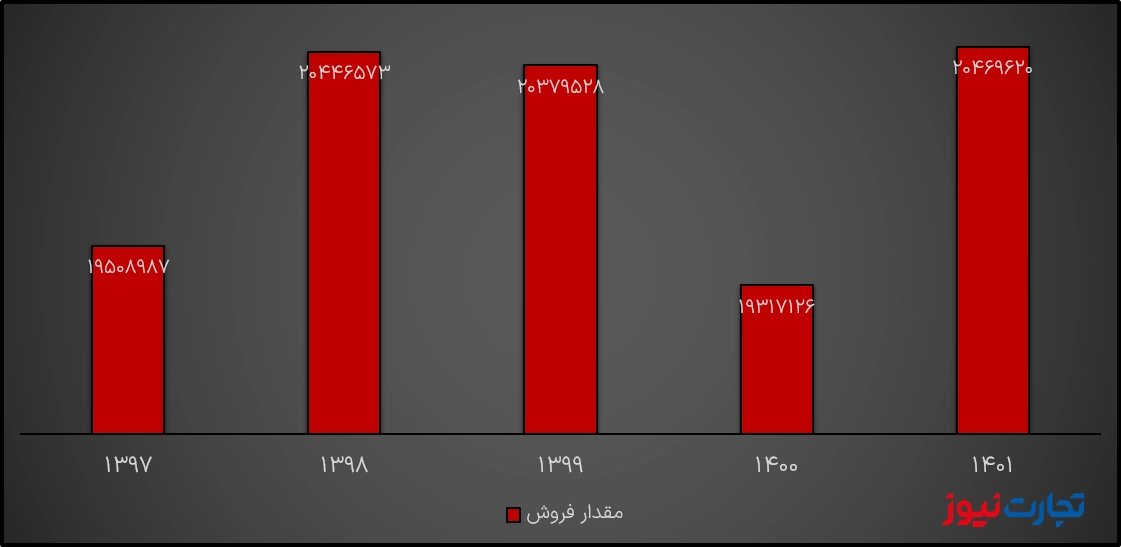

A look at the production and sales performance of Isfahan oil refining last year shows that the company did not record an extraordinary performance this year and the double increase in the company’s profitability was mostly due to the 85% growth of the dollar price. Because the sales amount of Isfahan oil refining in 1401 compared to 1400 has only increased by 6%.

Although export companies do not have the right to sell their dollars in the open market, selling dollars by money order at a price of 38 thousand tomans has been able to increase the profits of these companies.

However, the concern for Shepna and other refineries is their gas feed rates. Because if you pay attention to Shepna’s net profit and loss charts, the company’s net profit in 2019 also had a significant jump following the 60% increase in the price of the dollar.

But after this period, in 1400, Shapna’s financial statements reported a decrease in the company’s profit margin. Because in 1400, with the relative stability of the dollar price, the company’s income did not jump in dollars, but the company’s expenses increased due to the growth of the dollar in 1999.

Reduction of export advantage compared to competitors

There is a possibility of repeating this procedure for Shepna in 1402. Because currently (if the dollar rate remains constant at 28,500 tomans to determine the gas feed rate), this feed is sold to refining companies for about 15 cents.

Meanwhile, neighboring countries sell gas to their companies at prices of 5 to 9 cents; This cost reduction increases their profit margin and increases the advantage of production and export for them. On the other hand, Iranian refining companies are unable to sell their products in global markets at the price of other competitors due to existing sanctions, and in many cases they are forced to sell at a discount.

However, the refiners cannot convert the dollar income from sales even with their discount into Rials at the free dollar rate.

Now, if the government is going to give more expensive gas feed to the refineries than the neighboring countries, and on the other hand, does not stop imposing the remittance dollar rate on the refineries, the profit of the refining companies will still be temporary.

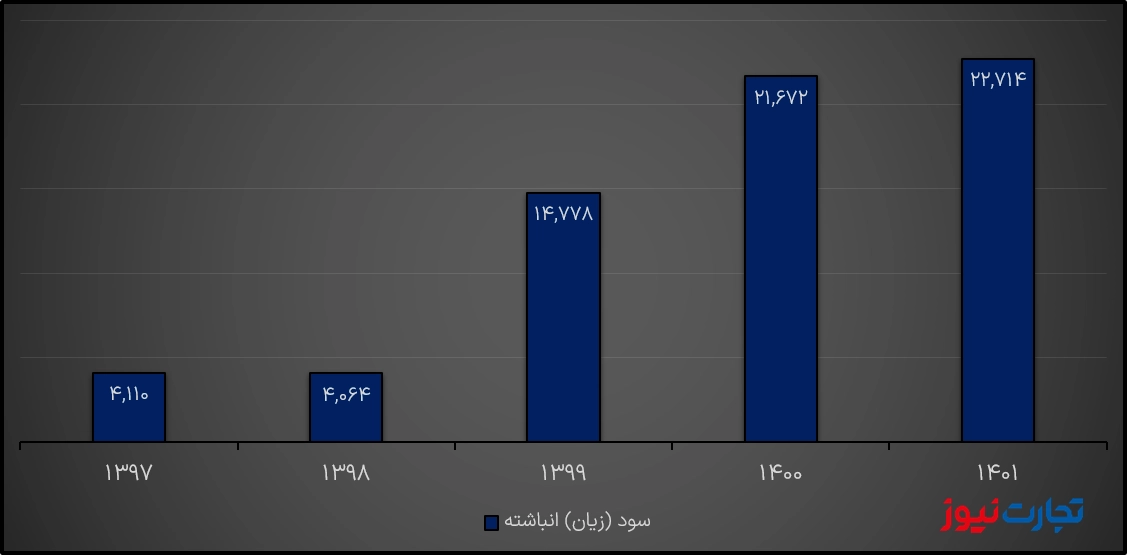

Shepna’s accumulated profit

Another look at Shepna’s financial statements shows that the company has been able to increase its accumulated profit to some extent by increasing its net profit. Because the accumulated profit of the company has reached from 21 thousand 672 billion Tomans in 1400 to 22 thousand 714 billion Tomans in 1401.

Read more reports on the stock news page.