Shepna’s fundamental analysis/decrease in the spread of work of refineries – Tejaratnews

According to Tejarat News, the spring 1402 performance report of Isfahan Oil Refining Company was published on July 29; A look at this financial statement shows that the amount of production and sales of this company has increased this spring compared to the spring of last year. So that the amount of production of the company reached five million and 492 thousand cubic meters from five million and 61 thousand cubic meters in the spring of 1401 with a growth of 9%.

This issue has been repeated in the comparison of this spring’s production with the winter of 1401. So that Isfahan Oil Refinery has increased its production in the first quarter of 2012 by about two percent compared to last season.

This issue can also be seen on the sales side of the company; So that the sales amount of Shepna in the first quarter of this year has increased by 11% from four million and 971 thousand cubic meters in the spring of 1401 to five million and 534 thousand cubic meters.

Shapna’s income generation challenge

But where does the problem of Shepna’s profit loss come from? To answer this question, it should be said that the increase in the company’s sales did not increase the quarterly income of Isfahan oil refining. Because the sales rate of this company’s products in the spring of 1402 compared to the same period last year has decreased drastically.

In this way, the sales amount of the company reached 82 thousand 540 billion tomans from 94 thousand 87 billion tomans in the spring of 1401 with a decrease of 12%.

Falling global prices

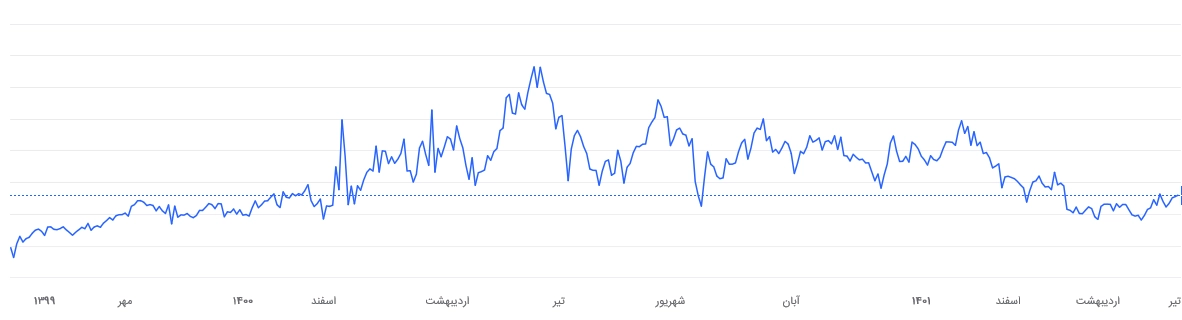

A look at Isfahan’s oil refining business process shows that the company’s profitability is highly dependent on the price of oil, the price of oil products, and the exchange rate of the dollar. Now it should be checked what changes have occurred in the above factors from the first quarter of 1401 until now.

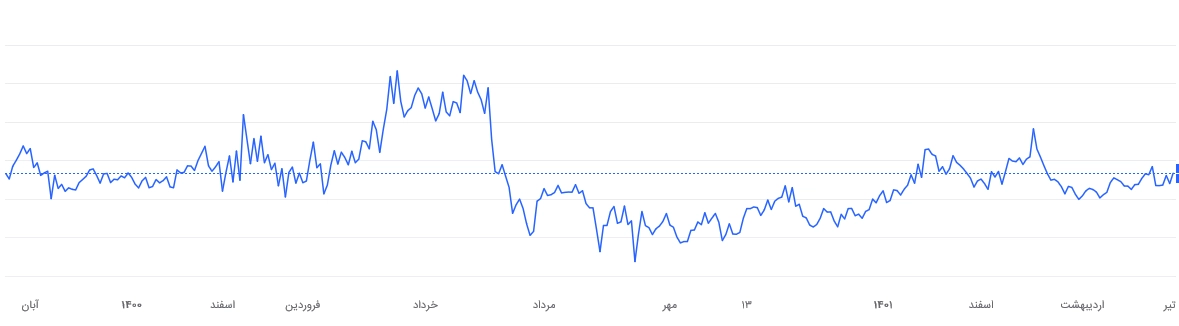

A review of the global price of the company’s products shows that the price of Shepna’s products has decreased since the spring of last year. The drop in spreads has made Isfahan Oil Refining unable to earn a good profit from the sale of its products.

The exchange rate of the dollar remains constant

On the other hand, it should be said that Isfahan Oil Refinery is obliged to exchange its dollar at the rate of 28,500 Tomans. Therefore, Shepna has not profited from the jump in the price of the dollar in the past year. Naturally, if the dollar exchange rate for Shepna was calculated with the free or even exchange rate of the dollar, the current situation would be different.

Although the company’s expenses were affected by inflation in the last year, Isfahan Oil Refinery was able to reduce its cost price by four percent compared to the spring of last year. This is while the company’s sales have increased in this period.

It should be noted that the decrease in the company’s cost price in this season is mainly due to the decrease in the rate of direct consumables.

Reducing Shepna’s profitability

Finally, it should be said that the most important factor in the decrease of Shepna’s quarterly income was the drop in crack spreads. This caused Shepna’s profit to decrease sharply in the first quarter of this year. So that the gross profit of the company reached 9 thousand 320 billion tomans from 17 thousand 772 billion tomans in the spring of 1401 with a decrease of 48%.

The chart below shows Shepna’s gross profit margin in the last five quarters. A look at this chart clearly proves that the gross profit margin of Isfahan oil refining depends to a high extent on the crack spreads, and with the decrease of this parameter, the gross profit margin of Shepna also decreases.

The operating profit of the company also decreased by more than 50% and recorded the figure of eight thousand and 341 billion tomans. Also, Shepna’s net profit in the spring of 1402 was recorded at about seven thousand and 594 billion tomans. It should be mentioned that this number has decreased by 42% compared to the first quarter of 1401. The lower net profit of Shapna was due to the increase in other operating incomes of Isfahan oil refining in this period.

It should be noted that taking into account the capital of 22 thousand and 700 billion tomans, each share will receive about 33 tomans of profit this season, which was 57 tomans recorded in the spring of last year.

Read more reports on the stock news page.