Short-term traders are becoming long-term bitcoin holders

Recent market data show that the number of short-term bitcoin investors is declining and their capital losses continue to increase. Analysts, however, see this as a sign that they are becoming long-term investors and have no desire to sell at those prices.

To Report Coin Telegraph Last week, long-term bitcoin traders increased their sales to a minimum to minimize their risk. However, long-term maintenance is still their main strategy for investing in this market.

According to data from Chinanode, a blockchain analyst at Glassnode, a lack of confidence in macroeconomic factors over the past week has led long-term investors to increase their sales and short-term investors to pull out of their trading positions. 5% of last week’s total sales were for bitcoins that had not been traded for at least six months. This amount has not been observed since November.

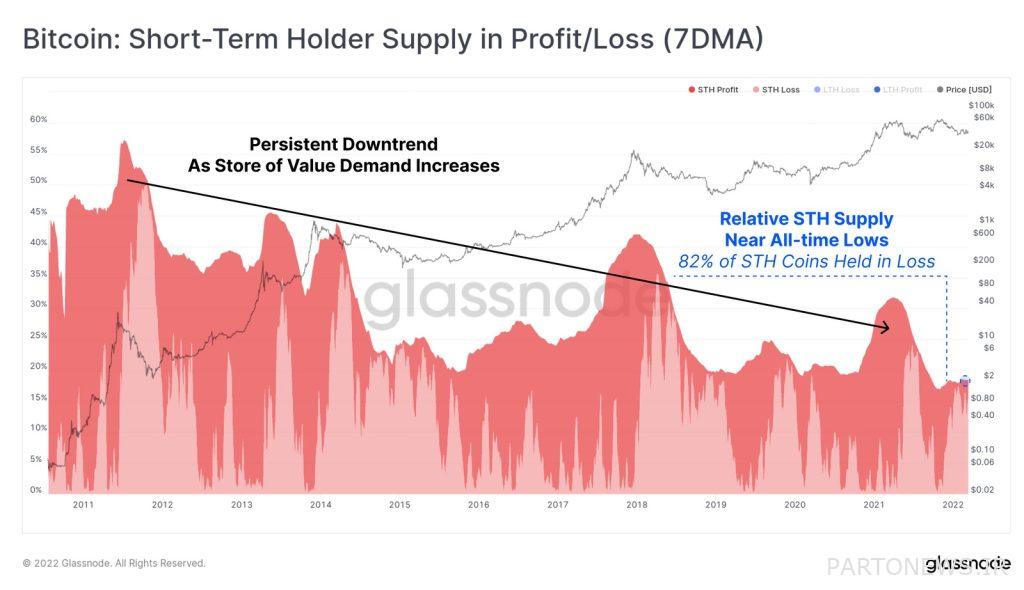

The number of short-term traders who hold bitcoins for less than 155 days is still declining, but not necessarily because they sell. This shows that they have become long-term holders. Although most short-term traders sell their digital currencies, Golsnood explains, the recent decline in these traders’ inventory “is due to the fact that a large portion of their bitcoins have not been traded and their hold time has exceeded 155 days.”

According to the indicators related to bitcoin accumulation, there is no sign of declining behavior in the market of this digital currency; Because its overall selling pressure is still constant. Also, despite the recent increase in sales pressure, more than 75% of the bitcoin supply in circulation has been inactive in the last six months. According to Golsnood, this means that current investors are mainly looking to maintain their assets.

Golsnood added that these cross-sectional jumps in sales pressure have entered a relatively strong market that has so far avoided any significant uptrend or downturn and has remained in a certain range for most of this year. These conditions prevent investors from leaving, who often give in at the end of downtrends and sell their digital currencies. According to the CoinGecko Institute, a significant number of market investors have not left the market since May, when the price of Bitcoin fell from $ 58,771 to $ 34,977 in 15 days.

The period between May and October (May to October) was the last time investors surrendered and sold their bitcoins. This caused the market to show signs of decline.

The profit-loss ratio of short-term traders’ inventories remains close to the lowest level recorded in mid-2021. Currently, short-term traders hold 82% of their bitcoins at a loss. According to Golsnood, this is a sign of the next stage of a downturn in a market where smart investors are sending bitcoins to their wallets to wait for a positive return margin.

It is worth noting that the flow of bitcoins out of digital currency exchanges is still high. Last week, only 31,130 bitcoins left the Coinbase exchange, the largest one-year outflow in five years. Withdrawal of bitcoins from exchange offices shows that bitcoin credit has increased. This is why experts believe that this digital currency is an essential element of the portfolio of investors in today’s world, and they are not interested in cashing in on their assets.