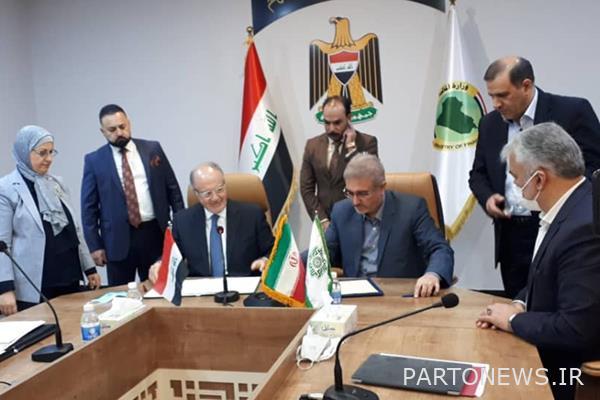

Signing of the amendments to the protocol amending the agreement on the avoidance of double taxation between Iran and Iraq

According to the Iran Economist, quoting the Iranian tax media, during a meeting between Dr. Davood Manzoor, Director General of the Tax Affairs Organization and the delegation, together with Dr. Ali Alawi, Minister of Finance of the Republic of Iraq, the amendment protocol protocol Signature received.

It is worth mentioning that this agreement, which was concluded in order to avoid double taxation between Iran and Iraq, as well as the exchange of information on income and capital taxes, removes tax barriers for stakeholders and facilitates and strengthens trade and economic relations between the two countries. And the expansion of stakeholder cooperation will be the subject of this agreement. With the signing and subsequent completion of the ratification process of the Amendment Protocol, the Law on the Avoidance of Double Taxation between the two countries will enter into force.

In this meeting, Dr. Manzoor expressed his hope that with the establishment of the new government in the Islamic Republic of Iran, the level of interaction between the two countries and the removal of tax barriers and the facilitation of economic and trade activities of the two sides will improve.

It is worth mentioning that the negotiations for concluding an agreement to avoid double taxation between the two countries started in 2009 and were approved by the Islamic Consultative Assembly in 2014, but the amendment protocol related to this agreement has been under consideration since 2014. In this final meeting And was signed by both parties.