Signs of a change in traders’ emotions; Will the downtrend be reversed?

The situation of some indicators related to digital currencies shows the change of traders’ feelings from downward to upward. However, some analysts still believe that the market outlook for the long term is declining.

To Report Last week, the total value of the digital currency market rose 10 percent to $ 1.68 trillion, indicating a 25 percent improvement over January 24. It is not yet possible to say with certainty that the market has found its price floor; But two key indicators have risen recently. The Tetra / Yuan premium index and the price index of the Chicago Mercantile Exchange (CME) futures contracts with current markets have recently risen, indicating that traders’ positive sentiment is the main reason for the current price growth.

A trader should not just look at the price chart to imagine that the downtrend is over. For example, between December 13 and 27 (December 22 to December 6), the total value of the digital currency market increased from $ 1.9 trillion to $ 2.33 trillion. However, with the market falling on January 5, this growth of 22.9% completely disappeared within 9 days.

The Federal Reserve has less room to raise interest rates

Despite the change in the current trend, sellers believe for some reason that the long-term 3-month downtrend channel of the digital currency market has not been broken yet. For example, the February 4 uptrend could be a reflection of recent negative macroeconomic data. Among them is the 2% annual growth of retail activities in the EuroZone in December, which was much lower than the market forecast of 5.1%.

Lyn Alden, an independent financial markets analyst, recently suggested that the Federal Reserve may delay raising bank interest rates following the release of disappointing US employment data released on February 2. . The ADP Research Institute also said that 301,000 private sector jobs were cut in December, the worst figure since March 2020.

Regardless of the reason for the 10% increase in the price of Bitcoin and Atrium on Friday, the Tetra Premium Index at the “OKX” exchange has reached its highest level in the last four months. The index compares the price difference between Tetra and the US dollar in peer-to-peer (China-Yuan) peer-to-peer transactions.

Excessive demand for digital currencies causes the indicator to go above a reasonable value or 100%. On the other hand, in declining markets, investors tend to rush to Tetra, which will cause the indicator to fall by 4% or more. Thus, Friday’s uptrend has had a significant impact on Chinese digital currency markets.

Forex traders are no longer sellers

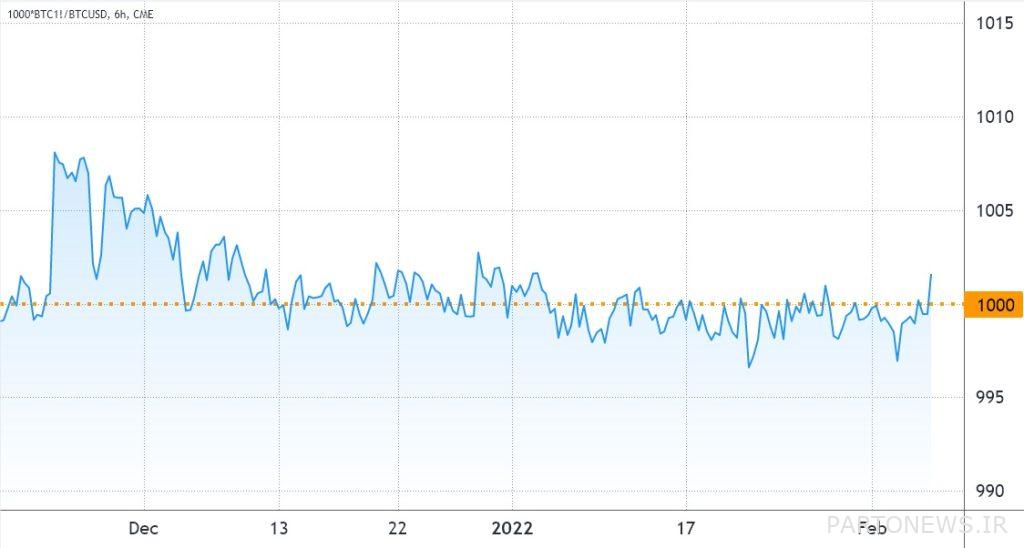

To further demonstrate that the digital currency market structure has improved, traders should also analyze the index of bitcoin futures on the Chicago Mercantile Exchange. This chart compares the market price of long-term futures and the current market price.

Whenever this indicator goes down or down, it will be a warning to the market; Because it shows the downward sentiment in traders.

Fixed-Calendar Contracts are usually traded at a small price difference, indicating that sellers expect higher profits for long-term maintenance. Fixed-term contracts are a group of financial products that are traded over a period of time. As a result, one-month futures contracts should normally trade at 0.5 to 1 percent per annum. This equilibrium in the annual premium rate is called Contango; That is, conditions in which the price in futures markets is higher than the current market.

The chart above shows how this indicator entered a downtrend on January 4 (January 14) when Bitcoin fell below $ 46,000, and Friday’s move shows the first change in the sentiment of traders in the past month.

Data on price differences in futures markets suggest that institutional traders’ sentiment remains below neutral, yet at least this data denies that the overall market structure is declining.

While the yuan / tetra premium index may have shown a reversal, the Chicago Mercantile Exchange premium index reminds us that there is still a lot of uncertainty about Bitcoin’s ability to withstand inflation. However, the lack of excitement among Chicago Mercantile traders could be exactly what Bitcoin needs to further strengthen its uptrend after breaking the $ 42,000 resistance.