Six conditions of the central bank for holding the assembly of Saman Bank

According to the reporter of Poli Mali news site, the audited financial statements of Saman Bank for the financial period ending on March 29, 1400 in the Kodal system show that the net profit of this bank has increased by 210% compared to the previous year to 2,186 billion and 698 million. Toman has arrived.

Therefore, the net profit per share of this bank has increased from 206 Rials to 638 Rials.

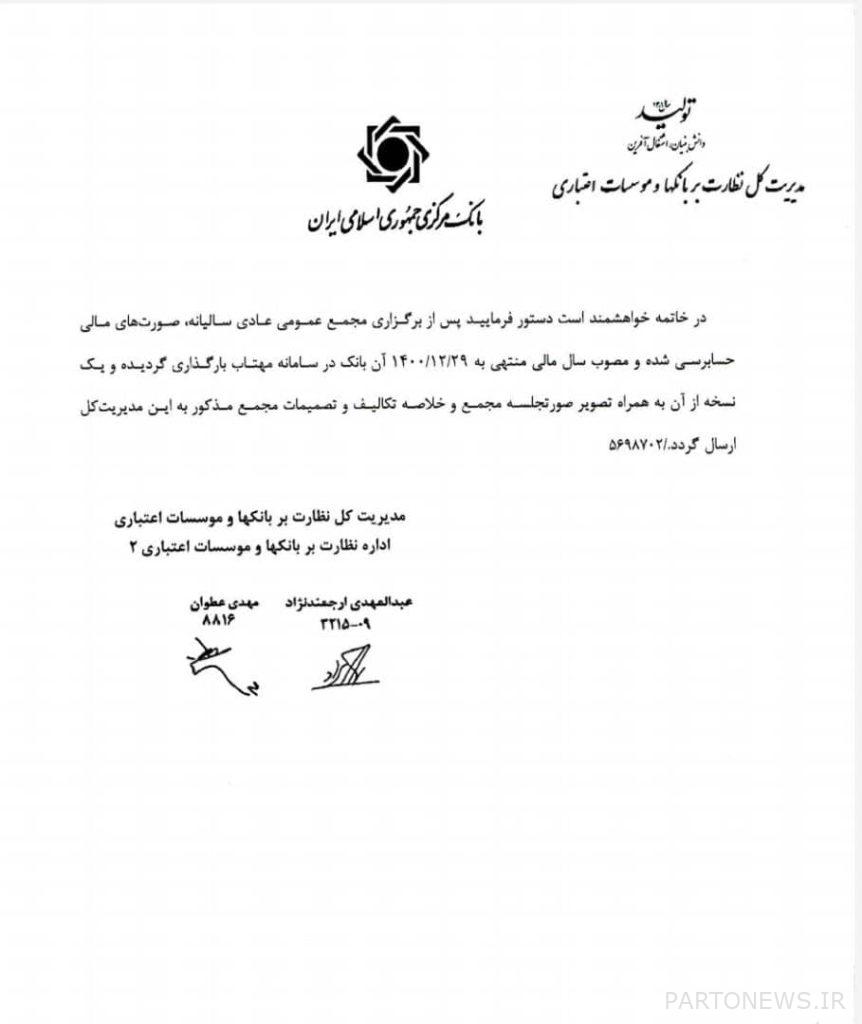

In the Central Bank’s letter regarding the issuance of permission to hold the annual general meeting of Saman Bank for the approval of the financial statements for the year 1400, it is stated that this permission will be subject to the plan of financial statements received.

The first condition of the central bank is to apply the necessary corrective registrations in the amount of at least 100 billion tomans to compensate a part of the deficit of the special reserve for doubtful debts (in addition to the one thousand and 148 billion tomans special reserve included in the financial statements) and to correct the bank accounts accordingly immediately after The holding of the general assembly is called.

The second condition of the supervisory body is to draw the attention of the shareholders in the assembly to three issues: “full compliance with the provisions of the asset classification directive; The subject of paragraph 4 of the report of the independent auditor and legal inspector”; He announced “the need to restore the regulatory capital and increase the bank’s capital from the shareholders’ cash contribution according to the ratio of capital adequacy stated in the financial statements” and “the excess interest paid by the bank to investment deposits in the amount of 131 billion 400 million Tomans”.

The Central Bank has stated its third condition for the holding of this bank’s assembly: “No distribution of exchange rate interest of foreign exchange items in accordance with the bank’s circular 376983/00 dated March 24, 1400”.

“Prohibition of profit distribution from the place of accumulated profit and current year’s profit, with the exception of the minimum stipulated in the Trade Law” is the fourth condition of the Central Bank for holding the Saman Bank Assembly.

The fifth and sixth conditions are the reading of the letter of the Central Bank in the General Assembly and its inclusion in the minutes and approvals of the General Assembly and uploading these conditions to the Kodal Exchange system.

The monetary supervisory body also asked Saman Bank to upload its audited and approved financial statements for the financial year ending on 29 March 1400 in the Mehtab system and send a copy of it along with a copy of the minutes to the Banks and Credit Institutions Supervision Department.