Stabilization of prices after the 10% fall of Bitcoin; How long will the fall from the $ 69,000 peak continue?

Over the past week, we have seen price corrections in the bitcoin and digital currency markets. Some experts believe that such corrections are normal during uptrends and do not harm the overall market trend. However, some believe that this slight correction could be a sign of a deeper correction in prices.

to the Report Bitcoin Desk The Bitcoin market fell 10 percent over the past week, however on Friday the price was able to maintain its position in the range of $ 57,000. The price of this digital currency has not fluctuated significantly in the last 24 hours, however, Atrium and Solana have each experienced a jump of 6% and 9%, respectively.

Ki Young Ju, CEO of CryptoQuant analytics website, wrote in an article yesterday:

Market sentiment in the short term indicates limited and declining price fluctuations. Traders enter short (sell) positions in the Bitcoin permanent futures market.

Analysts believe that the use of more trading leverage could be a sign that the market is reaching a price floor; What happened last week liquidated a significant amount of traders’ long trading positions.

Technical indicators also show that the long-term uptrend will remain intact as long as the support price is above $ 53,000.

How long will the fall from the $ 69,000 peak continue?

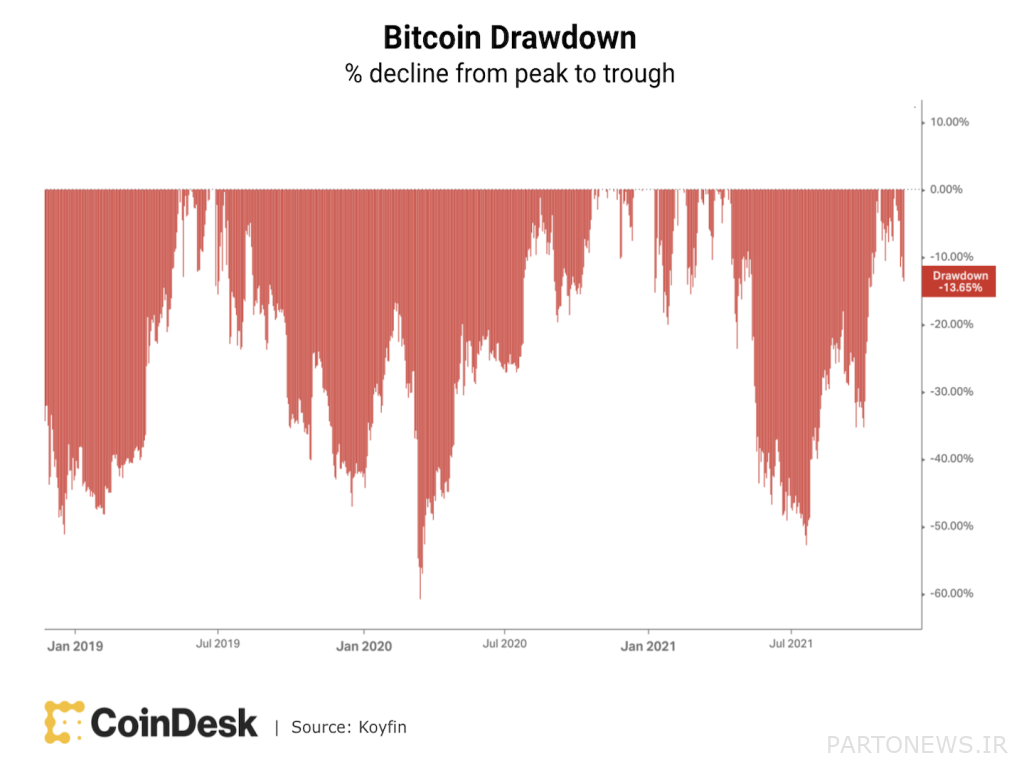

The chart below shows the bitcoin crashes from historic highs to price lows. The digital currency has recently experienced a 13% drop from its historic high of $ 69,000. After reaching historical highs, a slight decrease in price is normal, and it is possible that during the upward cycles, the price will be between 10 and 15% away from the historical high.

In the long run, each time Bitcoin experiences a wider uptrend, it remains more vulnerable to deep price corrections. However, as can be seen from the chart below, the fall from pre-price highs is limited to somewhere between 50 and 60%.

Some analysts believe that the recent fall in prices from the high of $ 69,000 could be a sign of further declines in the bitcoin market.

Alex Kuptsikevich, an analyst at FxPro, said:

A further 5% drop in the total market value of digital currencies is a sign of the beginning of a downtrend, assuming that digital currencies follow the same psychological rules that underlie technical analysis.

He added:

The digital currency market selling pressure ended only after the market currencies lost more than half of their price after reaching price peaks in May. It is also more likely that sellers will be active until the price reaches $ 48,000; However, there are still some notable price barriers.

Bitcoin holders are idle

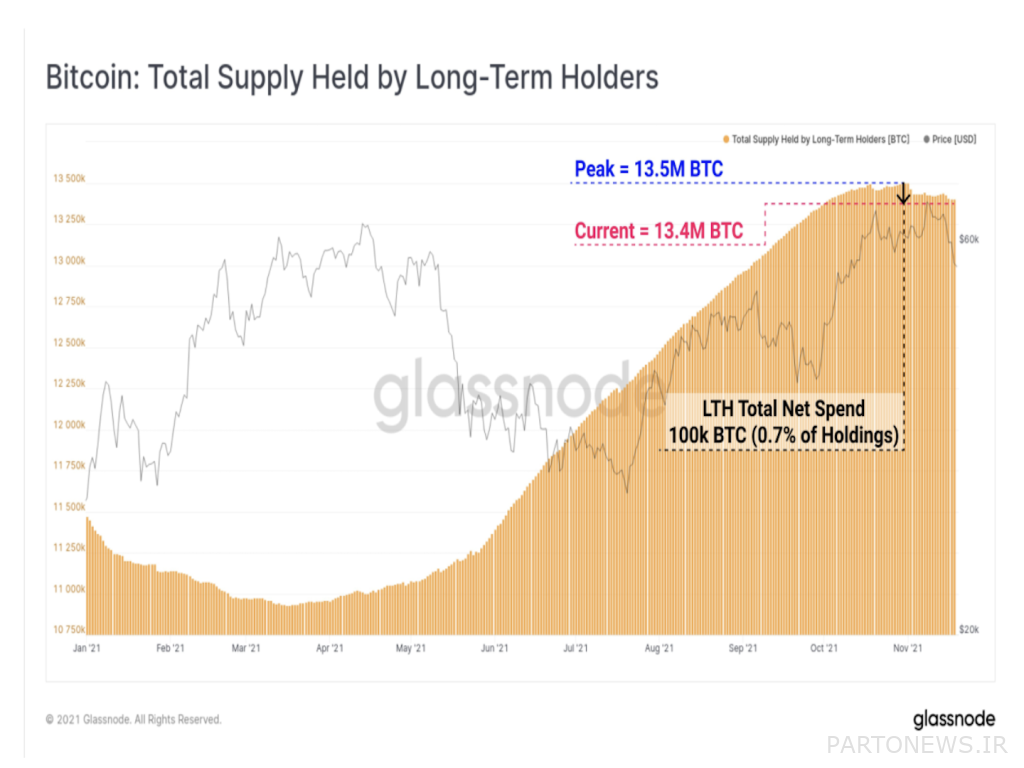

Intra-chain data now show that demand for bitcoin has remained stable. Even after a 20% drop in price from the recent high, it does not appear that long-term bitcoin holders are willing to sell their capital for fear of further market collapse.

The analytical website Glassnode tweeted yesterday:

after that [حجم بیت کوینهای نگهداریشده توسط هولدرهای بلندمدت] Reaching a peak of 13.5 million units, long-term investors have spent only 100,000 bitcoins out of their holdings over the past month, which is equivalent to 0.7% of their total capital.

Glasnood said there was still a possibility that long-term holders would continue to react to the recent fall in bitcoin prices.

Market situation of Altcoins

Better performance of first layer network tokens compared to Atrium: According to Delphi Digital Research, the growth of alternative atrium ecosystems is one of the main trends this year, and various networks such as Terra, Olench and Solana have been heavily used during this period with increasing attention to multi-chain networks. Luna, Olench and Solana digital currencies performed better than Atrium, especially in the second half of this year.

Addition of the second layer Arbitrum solution to the networks covered by Bainance Exchange: Bainance has just started supporting the main Arbitrum One network. This will help make more use of Atrium and allow exchange users to transfer Atrium and other tokens based on the ERC-20 standard through this second-tier, lower-cost solution.