Stock market forecast for Saturday June 6, 1402 / Will the stock market come back to life? – Tejarat News

According to Tejarat News, although a generally green map was presented to the shareholders in the stock market trading in the first week of June, the upward trend was the main indicator of the low-flowing stock market. Because despite four consecutive positive days of stock market indicators, the total index grew only 1.03 this week.

In this way, the main index of the glass hall during this week was able to reach 2 million and 345 thousand units from 2 million and 321 thousand units.

But this week, the equal-weighted index surpassed the total index, which shows the better growth of medium and small market stocks. Based on this, during this week’s stock market trading, the equal weight index increased from 760 thousand 973 units to 792 thousand 907 units. In this way, the index of medium and small companies of the capital market grew by 4.19% in the first week of June.

The market’s concern about the process of decreasing the value of transactions

This week’s transactions, the average daily value of small stock market transactions was 12 thousand 332 billion tomans. The capital market needs numbers much higher than these ranges to return to its upward trend. Because a stable upward trend is only possible if the value of high transactions occurs along with the injection of money into stocks.

Compared to the previous weeks, the value of the stock market’s micro transactions has faced a sharp decline. Another negative point is the continuation of this downward trend in the value of small transactions, which indicates that optimism for the market has become weaker than one to two months ago.

On the other hand, the capital market witnessed the withdrawal of 89 billion tomans of real money this week. This shows that the stock market is in a dichotomy. Because the growth of the market this week can also be attributed to the good annual reports of stock companies on the Kodal website.

the fate of the exchange rate; Determining factor for listed companies

The last trading day of this week coincided with the letter of the requirement to remove the currency of 28 thousand and 500 tomans from the Islamic Council and then the government’s position against it. The market’s reaction to this event was divergence and increase in supply. Experts believe, the group of refineries and aromatic products industry will benefit from the removal of 28 thousand 500 tomans. For this reason, at the beginning of the market, we saw heavy queues for the symbols of these industries. However, as we neared the end of trading, lines of these symbols were also offered and faced selling pressure.

On the other hand, from the perspective of stock market traders, the petrochemical industry suffers from the country’s new foreign exchange law. Because petrochemical companies used to receive feed at the rate of 28,500 Tomans, and now access to this main production input for these companies has become uncertain.

Now, it has to be seen in the end, which institution’s words will prevail; Government or Parliament. The people of the capital market hope that with the removal of the fixed rate of 28,500 tomans and the closeness of the exchange rate of companies to the real prices of American bills, a new upward wave will begin in the market.

Saturday stock market forecast

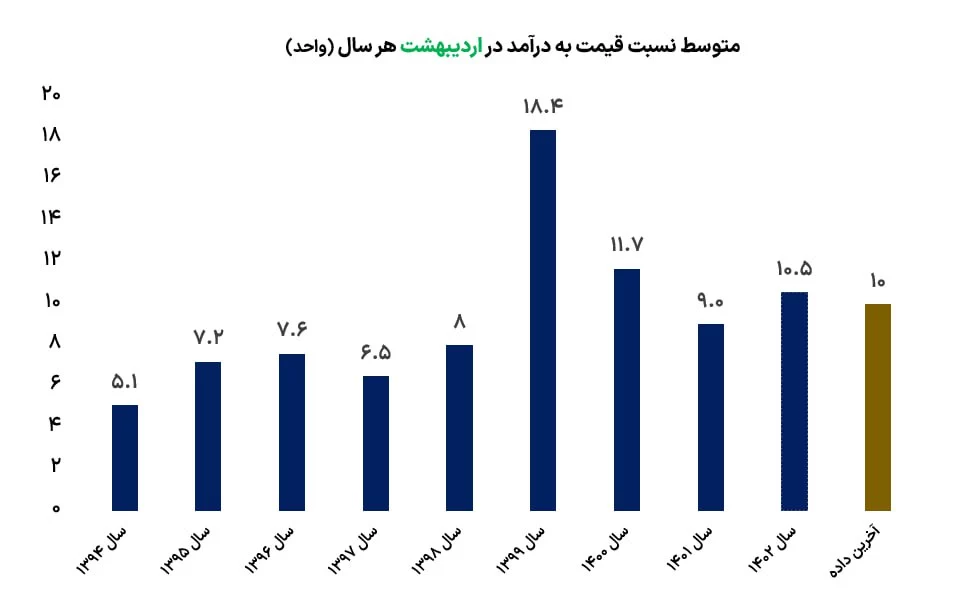

Sellers and buyers are looking at the P/E of 10 units of the stock market right now and are waiting to interpret it with macroeconomic variables. Because this amount is not so attractive to attract all the buyers and liquidity in other markets, and not as scary as the p/e of 1999. Therefore, it seems that investors should at least wait a little longer to make a final decision until certain factors influencing the market become clear.

Therefore, considering that the stock markets are waiting for the end of the conflict between the parliament, the government and the central bank, the trading map on Saturday will be balanced.

Read more reports on the stock news page.