Stock market forecast for Wednesday 24 June 1402 / Where is the technical support of the total index? – Tejarat News

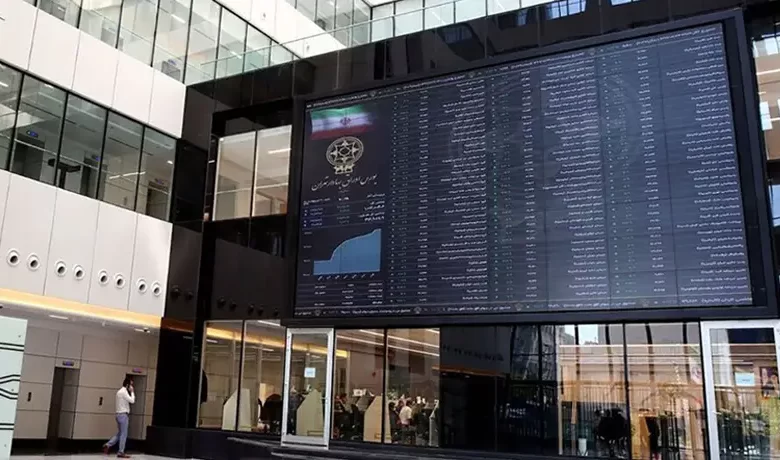

According to Tejarat News, Tehran Stock Exchange has experienced a 15.81% drop in only 23 trading days since the middle of May. After the continuous correction of the stock market since Wednesday of last week, finally, the indices of the glass hall in the stock market on Tuesday were able to show a green face.

Accordingly, the total index stood at a height of two million and 155 thousand units with a growth of 9,777 units, which is equivalent to 0.46% of the height of this indicator. On the opposite side, there is the equal weight index, which is difficult to use the word “growth” in relation to the performance of this indicator in the Tuesday stock market. The equal weight index ended its work with an increase of 0.09% in the range of 482 thousand units.

As mentioned in the previous report, when the total index reached the important support range, it was predicted that the flow of demand would increase and balance would prevail in the market.

The result of trading flow on Tuesday, the weight of most of the symbols was positive. Accordingly, 60% of active symbols in the positive market and 40% of the market were in negative conditions.

Tehran Stock Exchange under the microscope of statistics and figures

However, the investigation of the ownership statistics of real people indicates that real people’s capital left the stock market on the third trading day of the week. The capital inflow and outflow index at the end of yesterday’s stock market trading shows that 135 billion tomans of money was withdrawn from the stock market.

On the other hand, the Tehran Stock Exchange board shows the volume of transactions on Monday at 10.870 billion and the value of transactions at 6.339 billion tomans. The significant drop in the value of transactions compared to the days before the fall, shows that the stock market has not yet given the green light to investors and even short-term traders to return to the upward trend.

It is worth mentioning that the mass production group and the investment industry accounted for the largest amount of money inflow with 59 and 53 billion tomans, respectively. On the other hand, the group of banks and financial institutions and automobile manufacturers accounted for the largest amount of money outflow with 112 billion and 55 billion tomans, respectively.

Wednesday stock forecast

The correction of the overall index, which started in the middle of May last month, has gone through two kinetic steps so far. Experts believe that the end of the second kinetic step of the correction process can coincide with the return to the upward trend of the market.

Based on this, we obtained the support for the total index using the Fibonacci regression tool. The first support of the index was its 61.8% level, equivalent to the height of two million and 144 thousand units, which succeeded in establishing a balance between supply and demand after the falls on Saturday and Monday.

In the scenario of the continuation of the correction, which seems probable with the lack of growth in the value of transactions and remaining in the corridor of 6 thousand billion, the previous ceiling of the index in the range of 2 million and 100 thousand units can be considered a strong stronghold for buyers.

On the other hand, the overlap of the mentioned level with the level of 78.6% of the Fibonacci regression tool drawn on the first two waves of the corrective trend increases the validity of this range. However, if the transaction value indicator does not increase to the level of 15 thousand billion, another scenario can be imagined for the index, and that is the index’s floor in that range and more time correction.

Read more reports on the stock news page.