Stock market forecast today, December 18th

To forecast the stock market today – Saturday, December 17 – we look at the stock market trend in recent days. On Wednesday, the total stock index rose 1,377 points, but the homogeneous index fell 960 points and the total OTC index fell 20 points.

At the end of trading on Wednesday, there were 155 symbols of price growth and 321 symbols of price decline, in other words, 31% of the market had a price increase and 65% of the market had a price decrease.

Ascending shares

On Wednesday, in the stock exchange of Osweh Pharmaceutical Company (Dasveh), Fanavaran Petrochemical (Shefan) and Iranian Credit Investment (and credit) recorded the highest price increase. In the OTC market, Atrin Nakh Qom Company (Natrin), Ghaed Basir Petrochemical Company (Shabsir) and Madiran Industries Company (Madira) had the highest price increase.

Descending shares

On the stock exchange of Piazar Agro-industry Company (Ghazar), Iran Radiator (Khotour) and Azar (Kazer) refractory products had the highest market price decrease on Wednesday, and in OTC trading of Iranian Investment Development Company (Vogster), Minoo Shargh Food Industries Company (Ghamino) and Aweh Sina Pharmacy (Dawa) had the highest price reductions.

Market supply and demand

Supply and demand Exchange At the end of trading on Wednesday, it is an efficient signal to forecast supply and demand in the stock market on Saturday. At the end of trading on Wednesday, the market was closed with a supply surplus of 107 million Tomans.

At the end of trading on Wednesday, 64 symbols had a sell queue and the number of buy queue symbols was 26 symbols. Also on this day, the value of the final sales queues of the market decreased by 31% compared to the previous day and became 141 billion Tomans. The value of shopping queues also decreased by 8% compared to the end of the previous working day and stood at 34 billion tomans.

Demand Shares

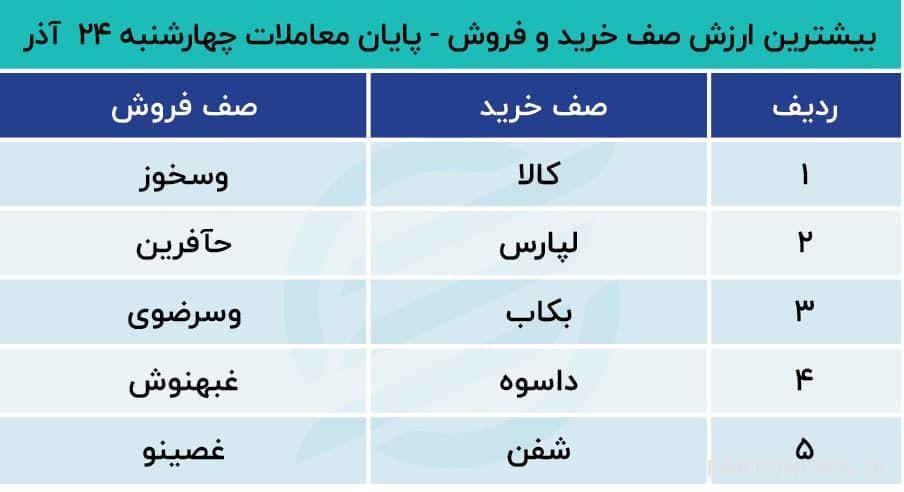

On Wednesday, the symbol of goods (Iran Commodity Exchange Company) topped the market demand table with a buying queue of 6 billion Tomans. After the goods, the symbols of Lapars (Pars Electric Company) and Bekab (Yazd Welding Industries Company) had the highest purchase queue.

Sales queue shares

On this day, the largest sales queue belonged to Veskhoz (Khuzestan Province Investment Company), which had a sales queue of 22 billion Tomans at the end of transactions. After Veskhoz, the symbols of Haafarin (Raf Pardaz Noafarin Company) and Vesarzavi (Justice Equity Investment Company of Khorasan Razavi Province) had the highest sales queue.

Forecast the stock market today

In recent weeks, the overall stock index fell in the first 4 days and rose slightly on Wednesday. At the end of this week, the index was 56 thousand units lower than the previous week.

Although the overall stock index rose on Wednesday, the market downtrend did not stop and the stock index and the total index OTC They also descended. Market trading closed with a surplus and real money went off the market for the 15th day in a row.

On the last working day of the week, 370 billion Tomans of real money left the stock exchange and the largest outflow of real money was allocated to the shares of BPAS (Pasargad Insurance Company), the value of which changed from real to legal ownership was 24 billion Tomans. After Bepas, the two big car symbols of the market, Khasapa (Saipa Company) and Khodro (Iran Khodro Company) had the most real money outflows. In addition, the value of small transactions decreased again and decreased by 15% to 2,435 billion tomans.

However, analysts do not only look at internal market factors to predict stock market trends. Barjami negotiations, currency price fluctuations, 1401 budget bill and similar factors also affect market price trends and may have a greater impact than internal stock market trends. Experts call these out-of-market risks systematic. Risks that shareholders can not control by diversifying their portfolio. The increase in systematic risks has caused many shareholders who can not bear this level of risk to leave the market. Also, increased risk and market uncertainty have caused most shareholders to look at the market short-term and tend to fluctuate. When shareholders look at the market in the short term, they are highly sensitive to political news, and the market is shaken by any news. In addition, price fluctuations quickly change buyers’ strategies to sell or vice versa.

In such a situation, the stock market needs to increase predictability. If the government can Barjam Revive parallel markets such as currency and coins Housing Traders can also have a longer-term view of the stock market. In this way, the role of the government in future market trends is decisive. The government will either push the market to lower channels or stabilize the market.

A group of analysts to forecast the market today to Rising currency prices At the end of last week, they are paying attention and believe that with the persistence of the dollar and the euro in the current prices, the stock market outlook will also be upward. These analysts assess the growth of the Senate dollar price as a positive signal, but consider the elimination of the 4,200 Toman currency as reducing the profitability of some market groups, including pharmaceutical companies, at least in the short term. Therefore, it seems that in the coming days, the news and developments of the final negotiations and fluctuations The price of the dollar They will affect the market trend.