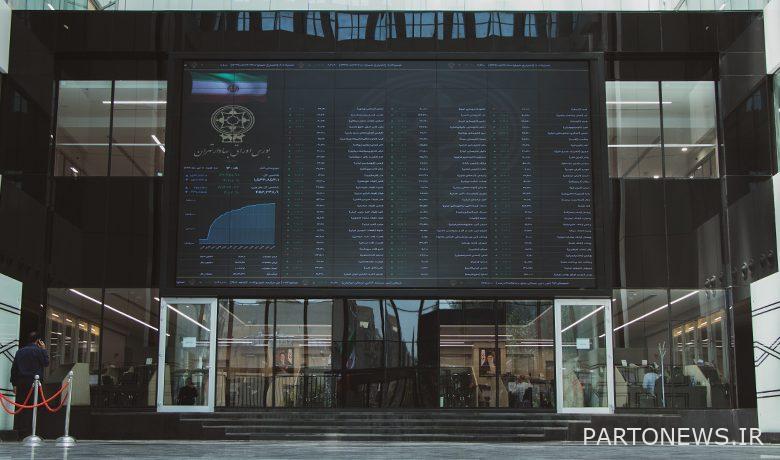

Stock market forecast today, October 11 / The possibility of further decline of the index decreased

According to Tejarat News, Habib Faraji Dana, a capital market expert, told Tejarat News about the coming days of the stock market: “The most important factor in the market is the publication of companies’ six-month reports and expect significant reports from petrochemical, refinery, iron ore and cement companies.” There is in the market.

Farajidana continued: “If these reports are better than forecasts, the market will react better.” As a refinery group, we are close to publishing six-month and three-month reports, and this factor is creating a positive trend in the market.

Regarding the negative factors affecting the market, he said: “If world prices are declining, the market trend is declining.” But commodities are unlikely to fall in price.

The market expert said in another section: “The market has moved towards shares that have a better p / e, and these groups are more successful. Refineries, urea manufacturers and petrochemicals are in this category.”

The world of economics wrote:

Cautious and waiting

Beyond yesterday’s movements of stock market indicators, but there is another important issue that has received less attention from micro-investors. An examination of the figures recorded over the past day shows that despite the slight fluctuations in stock and OTC indices, what has happened under the skin of prices well shows how cautious the market is and its approach to the current uncertainty. This uncertainty is nothing but the future of Barjam; The outcome of the negotiations, which in the opinion of micro-market participants is no more than two-sided: in this view, either the negotiations will bear fruit and the growth of the dollar will continue or fail as in the years of Rouhani’s first administration. Puts in another cycle of inflation climbing.

Whether or not this simple view is sufficiently probable to occur, or whether it takes into account all probabilities; This is not the subject of this report. However, the experience of all the world’s financial markets and the performance of the country’s stock market for nearly 6 decades shows well that it will have a heavy weight in the direction of the market, because in any case, prices will face reality much later than expected. But signs of market caution can be seen in the steady decline in the value of retail transactions.

Yesterday, this measure of measuring the enthusiasm of real investors decreased again in the stock market and reached about 2,794 billion tomans. The registration of such a figure is unprecedented since June 20 this year, and indicates that the Tehran Stock Exchange has followed a negative trend in retail transactions. As mentioned in yesterday’s report, there is a possibility that with the breaking of the upward trend in the value of small transactions, we will see it fall to the range of 1,200 billion tomans, which is a record decrease on April 6, 2010. On the other hand, the small volume of buying and selling queues indicates that there is no noticeable excitement to sell stocks in the market, and what has now given way to the fear of the first days of spring this year is not fear and excitement of selling, but only a sense of need. More caution. On the day when the total index of Tehran Stock Exchange was accompanied by a growth of 0.13 percent, out of 343 traded symbols, the closing price of 127 shares (37%) was positive and 208 shares (61%) were traded at negative levels. On this day, 19 symbols (6%) formed a purchase queue worth 71 billion tomans, but in contrast, we witnessed the formation of a sales queue in 25 stock symbols (70%) worth 73 billion tomans.

Inhalation and exhalation of Tehran Stock Exchange

After two days of decline in the overall stock index, the third day of the week was followed by the growth of the main indicator of the Glass Hall and the positive reopening of the global market caused commodity-based companies to be accompanied by a relative stimulus to demand. However, the growing reluctance to participate in stock trading and, of course, the holding of stock market activists has led to a weak atmosphere. Where, without any trace of heavy sales queues, the value of retail transactions after 4 months again dropped to levels less than 3 thousand billion tomans.

The overall index was slightly positive at the end of yesterday’s trading. The growth of 0.13 percent achieved on this day was able to bring the main indicator of the stock market to the range of one million and 457 thousand units.

At present, these small fluctuations seem to continue for some time. At the same time, the available evidence of the declining trend in the value of small stocks and the negative net purchase of real estate indicates that investors are more skeptical than in the past. Therefore, it is not unreasonable to say that the stock market is on the verge of trading. In such a situation, despite the decline in the value of small transactions, there is no news of the formation of heavy queues on both sides of stock trading; An event that indicates a lack of excitement and a pre-determined approach to buying and selling stocks and holding investors back for a while.