stock market overtaking inflation; Reality or optimism? – Tejarat News

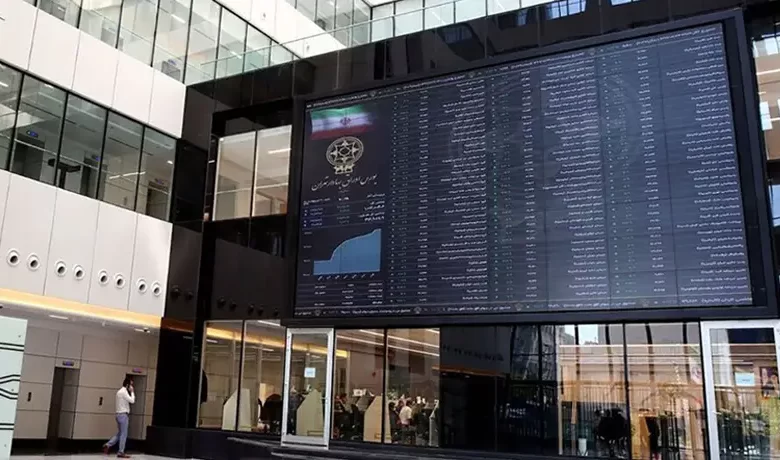

According to Tejarat News, the beginning of the new year was good for the stock market and the total index was finally able to break the historical ceiling of 1999 after 2.5 years of effort. In the meantime, the market has managed to break the record value of retail transactions several times. The upward trend of the capital market has caused some individual shares of the market to experience a balanced growth and make up for their lags.

At the same time, these days, with the general change in the conditions of the stock market, we are witnessing the arrival of new liquidity and increasing the confidence of shareholders. The same influx of money and trust makes the total index grow without manipulation and with a real trend, which means the beginning of profit making in the stock market.

Due to the situation, most experts believe that the total index of the stock market can reach three million units by the end of the year and please the taste of old and new shareholders.

Contrasting the stock market growth with inflation

On the other hand, some experts say that the stock market grows with inflation, which is to compensate for the recent lag, and after that we will not see a particular rise in the market. Based on this, Amir Ali Amir Bagheri, the capital market analyst, has analyzed the situation facing the market in an interview with Tejarat News.

This capital market expert said about the growth of the market: “If we go back to the past and calculate the compound inflation and the average growth of the capital market within the last 20 years, 15 years and 5 years, we come to the conclusion that the stock market can not only recover from inflation but also from Parallel markets will also grow more.

He continued: “Therefore, it is not right to just use a basket of goods as a criterion. Some of the items in the product basket follow the command pricing; However, the requirement that the capital market grow as much as it does is not compatible with any economic logic.

Amir Bagheri explained: “When companies have assets, they use debt leverage for their growth, and naturally, if the growth of the capital market or the internal growth of companies is equal to inflation, investment in the market will fall, and people will prepare an inflation portfolio with similar items and they’re keeping.”

He emphasized: “Comparing the growth of the stock market with inflation is basically a mistake. You can consider the inflation rate as a benchmark, and premium and margin should also be included for the expected rate of return.

Will the stock market index remain bullish?

Amir Bagheri said about the fact that the stock market index will remain bullish for a while: “One of the anomalies of the capital market is the influence of the index on people’s mentality; This is if, more than the total index, the weighted index can indicate the real state of the stock market. But due to the fact that large stocks have an impact on the index, if they are positive, the index will jump heavily.”

He emphasized: “It is not right to tie the market to the total index; But still, the index has some effect on the decisions of the shareholders of the capital market.

Referring to the market trend, this capital market expert said: “If we consider the general trend of the capital market instead of the index, it seems to be an upward and reasonable trend in the medium and long term. Of course, in this case, intra-channel corrections may also occur; But its material is not falling. Because most of the real people, legal and managers, have the experience of 99! In this way, the explosive growth of the index will probably be prevented from the side of the regulator and capital market activists. Therefore, if the market gets excited and the prices move away from the intrinsic value, the activists will start selling and adjust the profit.

The importance of real money entry index to measure the market situation

Regarding the value of transactions, Amir Bagheri said: “The value of transactions alone cannot be a criterion for judging the capital market. Because in the falling phases of the market, if the transactions are not locked in the queues or the queues gather, the value of the transactions will increase; As a result, the mere high value of transactions cannot be a criterion for judgment.”

This capital market analyst said: “Besides the value of the transactions, the real liquidity inflow or outflow must be checked. Of course, there are other indicators that activists should keep in mind; But besides the transaction value, we need to know whether the incoming cash flow is positive or negative. In recent times, the cash flow to the market has been positive, which indicates growth expectations and inflationary expectations on capital market symbols.

As the analysis of capital market behavior shows, it seems that regardless of the overall index, the performance of individual stocks and market industries is very good in the medium term and shareholders can also earn a good profit during this period.