Stopping the upward trend of Bitcoin; Is it still possible to fall to the floor of 12,000 dollars?

After a jump of about 21% in the past week, Bitcoin managed to reach its highest price level since November 8 (November 17). However, few analysts are still convinced that the bull market is back, with some warning that Bitcoin may fall to the $12,000 floor.

To the report Cointelegraph As Bitcoin’s key weekly candle closes near $21,000, analysts worry that the market’s good days may soon be over.

Will Bitcoin see a price correction before starting an upward trend?

The rapid growth of the price of Bitcoin in the last week has caused serious disagreement among analysts. While some believe that the possibility of a market correction (pullback) is very high, others have celebrated the premature end of the bear market.

Chris Burniske, former Head of Digital Currencies at ARK Invest, says:

Sellers are now hoping that the market correction will bring the price down again, but they don’t realize that the conditions have changed and the uptrend has started.

However, even bullish analysts like Burnisk don’t foresee a sustained bull run at the definitive end of Bitcoin’s bear market.

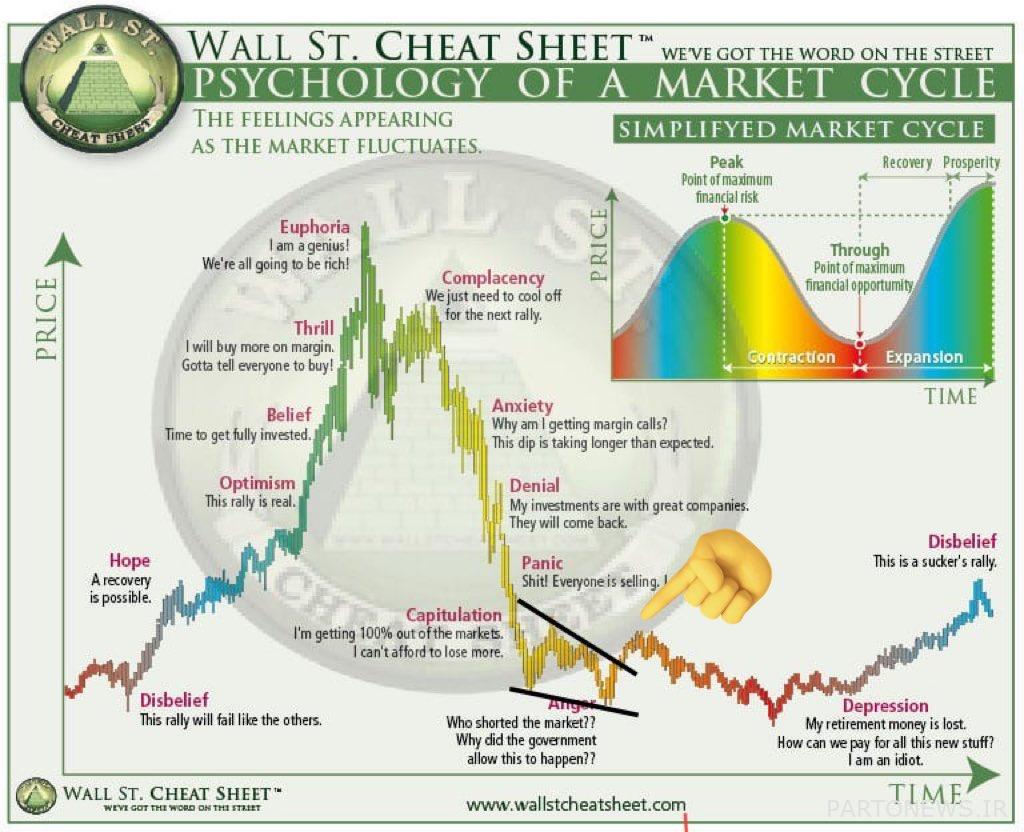

Popular cryptocurrency analyst TheCryptoLemon predicted that the price of the Bitcoin/USD pair will continue to decline, sharing a “Wall Street Cheat Sheet” graphic over the weekend.

Referring to market sentiment and Bitcoin’s move towards a price floor (in the current cycle), he told his Twitter followers:

I’m sorry but I have to be honest with myself. I imagine we are here on the path (where marked by the hand emoticon in the image below).

Lemon’s view is in line with comments that trivialize the latest Bitcoin price rally; Like Il Capo of Crypto who described the Bitcoin price spike as one of the biggest bull traps he’s ever seen.

In part of a series of tweets on January 14 (December 24), he wrote:

Despite the recent jump, the downside scenario is still possible. If you made a profit during these days, congratulations, but remember that now is not a bad time to save those profits.

He concluded that Bitcoin reaching the $12,000 price floor is still possible.

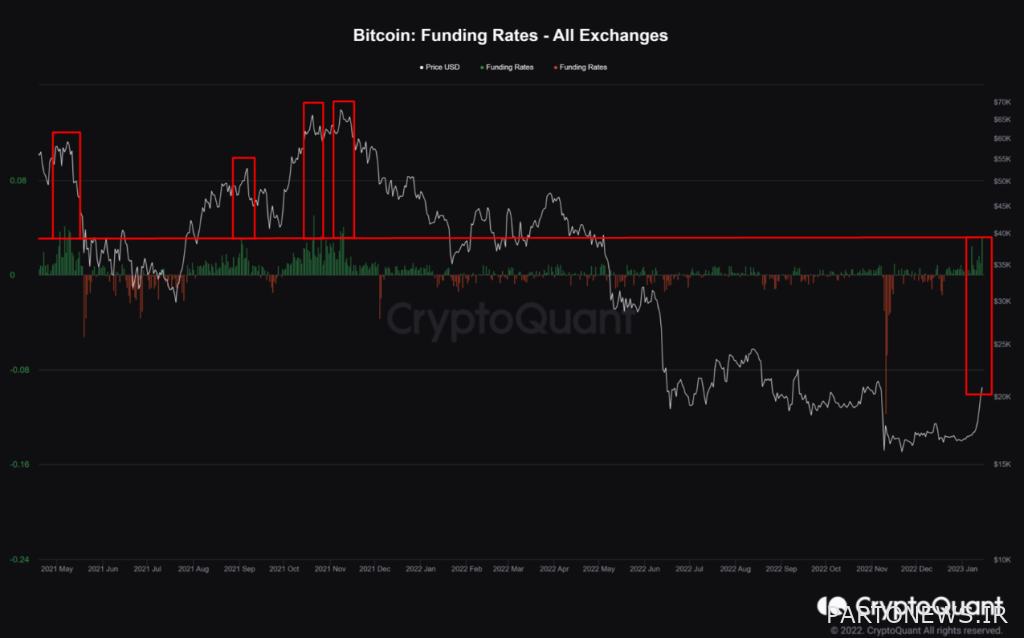

Funding rates at peak

Maartunn, one of the analysts of On-Chain, a cryptocurrency platform, has warned that a Bitcoin price correction will occur in the near future.

He wrote in a blog post on January 14 (24th) that funding rates in derivatives markets are reaching unsustainable levels.

He added:

Bitcoin funding rate has reached its highest level in the last 14 months.

The term capitalization rate in the futures market refers to the amount of fees that long contract holders (those who believe the price will rise) and short contract holders (those who believe the price will fall) must pay each other to keep the market in balance.

Positive rates mean long Bitcoin traders are paying to hold their trading positions. This could mean that the public believes that prices are going to continue to rise. Now, if the price moves contrary to public expectations, this condition can cause a major change in the trend and a series of liquidations will happen with the failure of key resistances.

Marton concluded:

Clearly, traders are betting on higher prices. However, an increase in the capitalization rate will not always mean an increase in the price. In previous periods when funding rates were as high as they are today, Bitcoin has seen price corrections.