Strange thing in the household budget / housing rent swallow half the costs!

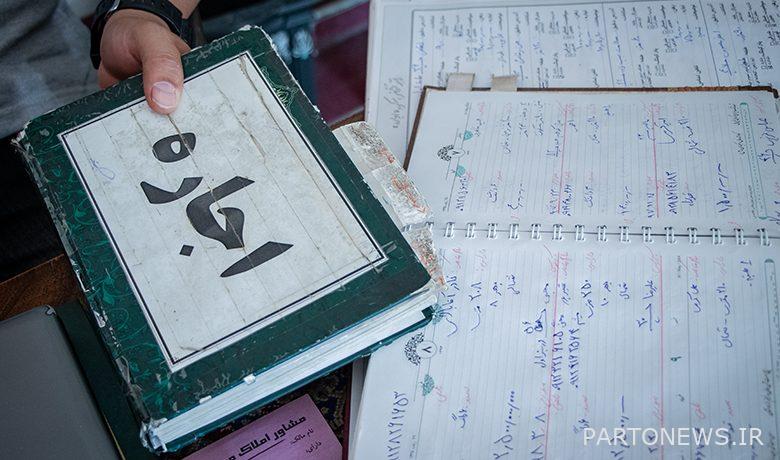

According to Tejarat News, the share of housing in the consumption basket of Iranian households reached an unprecedented figure. According to a new official statistic, households in the country’s cities spent an average of 43% of their monthly expenses on “rental housing” during 1999. The weight of housing in the household budget has reached its highest historical level.

Tenants in the mid-1980s paid about 28 percent of the cost of living for rent, which was one of the busiest periods in the rental market at the time, given the conventional ceiling on housing costs – 30 percent.

At present, however, the cost of rent has become a super-cost of the household budget, largely due to a 42% jump in rents last year, which has been driven by high inflation over the past three years and a jump in housing prices.

In Tehran, rents consume more than 60% of household expenses. “World of Economy” earlier – September 26 this year – in a report entitled “Provincial Map of Housing Poverty” described the consequences of price inflammation in the property market, according to which the sub-population of “housing poverty” in Iranian cities during 1998 to more than 4 deciles Receipt. The current state of housing and rental costs indicates an increase in the population below the “housing poverty” line.

The latest official statistics on the share of various items in the expenditure basket of urban households show that the cost of renting housing has become super-expensive at the present time. According to statistics, the share of housing in the household budget has reached 1.3 times the “allowable limit”.

Based on the latest official statistics on the share of various parameters in the household expenditure basket, studies show that the cost of rent in the country’s cities increased to 43% in 1999, which is a historical record for the weight of housing in the consumer basket.

This share was 34% in the early 1990s and 33% in the mid-1990s. The fact that the share of housing costs (rents) in the household expenditure basket reaches 43% of total household expenditures indicates an unprecedented increase in rents. This share is not only unprecedented in the last decade, but also in the last decade and a half, it is the highest share of housing costs in the expenditure basket of urban households.

New statistics published by the Statistics Center of Iran show that the cost of providing housing for rented households in the country’s cities has become superfluous compared to the early 1990s and mid-1980s. In 1984, the share of housing costs (rents) in the household expenditure basket was 28%. This share reached 33% in 1990 and 34% in 1995. In 1999, however, this amount increased to 43%.

This shows that the share of housing costs (rents) in the cost basket of urban households in the late 90s compared to the beginning of this decade, is equal to 1.3 times and compared to the mid-80s has also increased 1.5 times. The ratio of net housing costs to total household expenditures (the ratio of rents to other costs of urban households) also increased to 35.52 percent in 1997, 39.82 percent in 1998, and 439 percent in 1999. Studies show that in countries around the world, this share is equivalent to 30%.

What about Tehran?

In Tehran, too, statistics show unprecedented growth in rental costs and the share of housing costs in the household expenditure basket. The latest official statistics published by the Statistics Center of Iran show that the average rent in Tehran this spring has increased by 51% compared to the spring of last year. The average rent per square meter of a residential unit in Tehran this spring increased to 84,000 tomans. Meanwhile, in the country’s urban areas, the average rent has risen by an average of 50% in all the months since 1400. These figures show severe inflation in the rental market of Tehran and other cities in the country at the present time. Rents are now the biggest sucker for household budgets. But the important question and point is why the cost of rent in cities and in the cost basket of urban households has become superfluous? In answer to this question, three important reasons can be identified. In fact, it can be said that for three important reasons, the share of rents in the expenditure basket of urban households has become superfluous and absorbs a large part of the income of urban households. The first reason is related to the higher growth of household expenditure compared to the growth of household income. In fact, in recent years, general inflation has overtaken the growth rate of household income, which also means a decrease in real household income. “World Economy” surveys, according to official statistics, show that general inflation was 37% last year. In 1998, this rate (general inflation) was 34%. First, household incomes have not increased as much in the last two years, and more importantly, the cost of living, including the cost of food and housing, has grown much more than the general inflation rate. Housing prices are related to rents. Since part of the growth of housing rents is always subject to the growth of housing prices, the jump in housing prices in the country’s cities, which began in 1997, gradually spread to the rental market and the level of rents was affected by the jump in housing prices and was strongly affected. Increased. The third reason is the near-zero economic growth in the 1990s, which reduced the level of welfare and consumption of Iranian households.

Three harms of increasing rents

The increase in the share of the cost of housing (rents) in the household budget has caused at least three major damage to the lives of urban households. The first damage is related to the decrease in the quality of life of households living in cities due to the increase in the share of housing costs. The conversion of housing costs into super-costs in the household budget last year has had a negative effect on the “quality of life” of households. The quality of life of households has been affected and reduced in various ways because as a result of rising rents, many households have been deprived of access to real estate and many others have been forced to live in units with smaller area, longer life and located in weaker areas. .

The second disadvantage is related to the reduction of “calorie consumption” of households following the increase in the share of housing costs in the household budget. The real costs of urban households in the late 1990s have dropped by 20% compared to the beginning of the decade. In general, households have been forced to reduce the share of calories, recreation, health and culture due to the increase in the share of rents in the household budget.

In this decade, the average consumption of meat among urban households has decreased by 50% and the consumption of dairy products by 35%. The significant decrease in the level of household welfare is the third damage that has occurred in terms of increasing the share of rents in the household expenditure basket, and has affected the lives of urban households.

Rental inflation in the country reached an average of 42% last year, which is now more intense, and in 1400 it was recorded at an average of 50%, which indicates a further deterioration in the situation of households in terms of housing rent growth. In the current year compared to the year 99 and all previous years.

However, the findings of the “World of Economy” show that another negative event has occurred in the rental market in Tehran; The fact that mortgages paid to tenants under the Corona Act has become an excuse for landlords to increase rents by at least the same amount.

However, studies show that the terms and conditions of this loan are so difficult that the rent loan is given only to government employees. Banks only ask for a government guarantor to pay their rent. But the landlords’ perception in the rental market is that all tenants have entered the market “on credit”, so the rent must increase at least as much.

Source: the world of economy

Read the latest housing news on the Tejarat News Housing Market page.