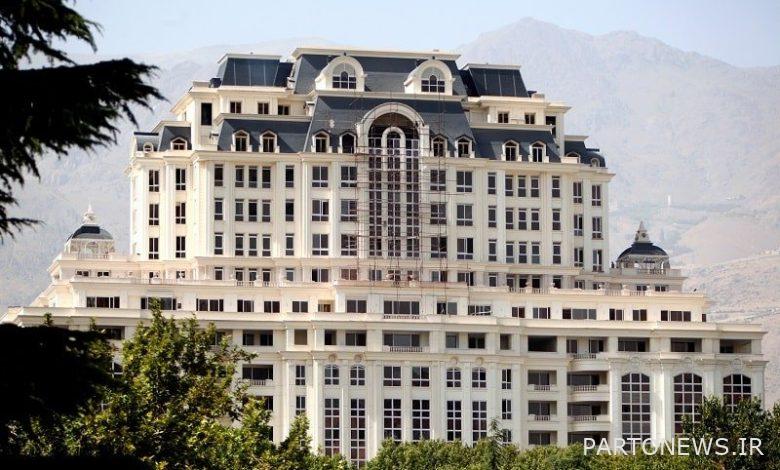

Tax payment deadline for owners of expensive houses

According to Tejarat News, quoted by IbenaIn the implementation of the budget law of the year 1400 of the whole country, the tax collection executive form Expensive houses It has been issued to the owners who have not paid the relevant tax so far and they have been notified through the electronic notification portal of the Tax Affairs Organization and informed through SMS.

According to the announcement of the Tax Affairs Organization, these persons have a maximum of one month to pay their taxes by referring to the my.tax.gov.ir portal, otherwise, through the seizure of movable or immovable property, the tax will be charged in addition to ten percent as a fee. .

Protesting taxpayers can declare their objection by registering “non-acceptance” in the same system so that it can be processed.

Don’t pay taxes until next month, your property will be seized!

Quoted from ISNAIn a notice to the owners of houses and luxury cars who have not paid their taxes, the Tax Affairs Organization announced that they have one more month to pay taxes; Otherwise, it collects taxes through executive operations and confiscation of their properties.

The Tax Administration announced in an announcement: following the announcement of the tax on expensive residential units and the tax on the owners of cars with a total value of more than one billion Tomans, in the implementation of clause (x) and (h) note (6) of the budget law of the year 1400 of the whole country, The said tax collection executive will be issued to the owners of the mentioned units who have not yet paid the due tax and will be notified through the national electronic services portal of the Tax Affairs Organization at the address my.tax.gov.ir and will also be notified via SMS. has been

Therefore, these persons have a maximum of one month to pay taxes by referring to the mentioned portal. Otherwise, tax collection and 10% of it will be taken as a cost through executive operations and seizure and arrest of property, both movable and immovable.

Also, dear taxpayers who object to the tax announced by the Tax Affairs Organization can register their objection in the mentioned system by registering “non-acceptance” so that their objection can be processed.

According to this report, the annual tax rate of luxury houses is as follows:

1- Regarding the surplus of 10 billion to 15 billion tomans; one in a thousand

2- Regarding the surplus of 15 billion to 25 billion tomans; Two in a thousand

3- Regarding the surplus of 25 billion to 40 billion tomans; Three in a thousand

4- Regarding the surplus of 40 billion to 60 billion tomans; Four in a thousand

5- In relation to the surplus of 60 billion tomans and above, five per thousand

Also, the annual tax rate of the total daily value of all types of passenger cars and double cabin vans is as follows:

_ Up to the amount of 1.5 billion tomans compared to the excess of one billion tomans equivalent to one percent

2- Up to the amount of three billion tomans compared to the excess of 1.5 billion tomans, equivalent to two percent

3- Up to the amount of 4.5 billion compared to the surplus of 3 billion tomans equivalent to 3%

4- Regarding the surplus of 4.5 billion, equivalent to four percent

On the other hand, the review of the quarterly performance of tax revenues in the current year shows that during this period, the equivalent of 5 billion 853 million 600 thousand tomans of tax was collected from expensive residential units.

Also, in the first quarter of this year, taxes equivalent to 34,455,300,000 tomans were collected from all kinds of passenger cars and vans with expensive personal police numbers.