Technical analysis of “Ghazer” / Will Piyazer company’s stock reach its goals? – Tejarat News

According to Tejarat News, the shares of Piyazer Agriculture and Sanat Company were offered for the first time in Tehran Stock Exchange in December 2018 at a price of 286 Tomans. Currently, the shares of this company are traded in the second market of the stock exchange with a market value of 839 billion tomans.

It should be mentioned that the company was registered in 1348 and at the end of Mehr of the same year and was put into operation three years after that. The main subject of the company’s activity includes the creation of a production line for drying all kinds of agricultural products, and the production of powder for food and agricultural products. In general, Ghazer is active in the processing and transformation industries of agricultural products.

Ghazer’s goals

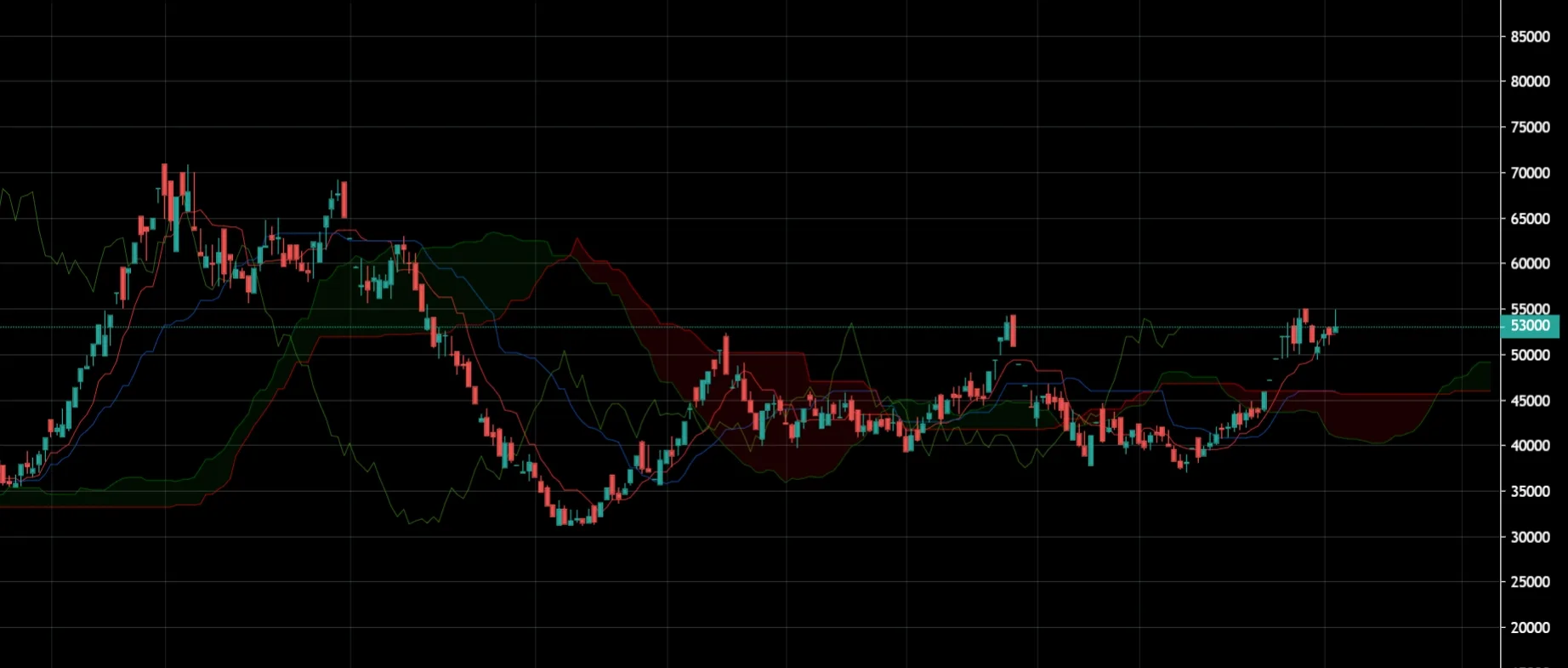

Examining the price chart of Ghazer shares shows that this symbol currently has a difficult way to reach its goals; Because the static and dynamic resistances of the share have high credibility and power, and to break them, the pressure of demand needs to increase and the value of transactions to increase.

As can be seen in Ghazer’s chart, the share has been able to form a strong upward lag from the middle of February 1400 to June 1401 and has given its holders a profit of about 170%. However, after reaching the range of 7,000 tomans, the share has gradually faced an increase in supply and has not been able to go further.

So that the share in this range formed a double top pattern and then broke the level of 5300 Tomans, it fell by about 55% and this process lasted until the middle of October last year.

Finally, Ghazer was able to end its price drop on the 17th of Mehr 1401 by reacting to the 3119 support line and start its new upward rally. Therefore, the share price has been able to increase to the level of 5300 Tomans by following its dynamic support.

It should be mentioned that Ghazer has a strong resistance box in front of him in order to continue his ascent, which, in addition to the increase in demand, requires the support of big money to break it. As indicated in the chart, Ghazer can reach the targets of 6,348 and 6,894 Tomans by continuing to grow the value of his transactions if this strong barrier is broken.

Drawing a Fibonacci extension on the last ascending log of the share also shows that if the identified targets are touched and also crossed, the level of 1.618 of this tool at the price of 7863 Tomans is another possible target. Of course, this goal will probably become possible in the next steps of the stock and it is considered as a medium-term target of the stock.

The Ichimoku indicator also does not report a dangerous signal for Ghazer, and as it is clear in the chart, the share above the Ichimoku cloud is fluctuating. Tenkensen and Kijensen are not in a dangerous position for the share, and it can be said that the only dead end is the red box of the chart (1).

Read more reports on the stock news page.