Technical analysis of “Packerman” / price targets of shares of Barez Industrial Group – Tejaratnews

According to Tejarat News, the construction project of Barez rubber factory was started in 1364 in Kerman city, and this group started its commercial activity in 1372 with an initial capacity of 25,000 tons per year to produce all kinds of tires, tubes, tapes for light and heavy vehicles. And also started agricultural tires.

At present, this complex is known as the largest tire factory in the country with a production capacity of 125,000 tons, and has a 46% market share in Iran. About 36% of the share of radial passenger tires, 24% of radial cargo tires and 40% of agricultural tires in Iran belongs to Barez Industrial Group. Barez is known as the leader of the Iranian tire market and the most up-to-date tire maker in the region.

Barez Industrial Group has several subsidiaries, including Kerman Rubber Industries Complex, Bazar Kurdistan Rubber Company and Sirjan Rubber Company.

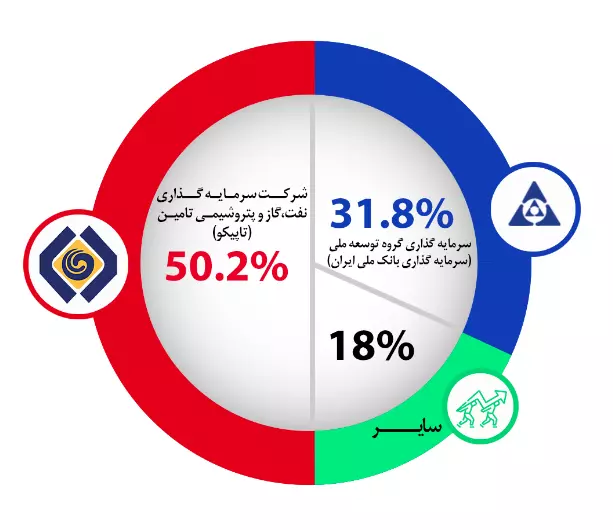

Tamin Oil, Gas and Petrochemical Investment Company, which is active in capital market transactions under the symbol “Tapico”, is the major shareholder of this company with 50.2% of “Pekerman” shares. Also, National Development Group Investment Company, Middle East Bank Mutual Fund, and Makin Company are other major shareholders of Packerman.

Technical analysis and price targets for “Packerman”

The first point of interest in Packerman’s price chart is that despite the 180% growth from November last year until now, the share price has not yet reached its historic peak in July 2019.

After registering the historical ceiling in July 2019, Packerman, like most stocks, was in a downward erosion trend. The downward trend of Packerman’s stock price had a channelized behavior. Price encounters with the ceiling and floor of Packerman descending channel are drawn in its price chart.

By doubling the size of the channel width, we can expect the ceiling of the next channel to be the medium-term target of “Packerman”. On the other hand, the stock price of Barez Industrial Group has reached its static resistance limits with its good growth in the past months.

It was last week that the price entered the correction by reaching the red range.

Has the correction process of “Pakkerman” finished?

Examining the stock chart of Barez Industrial Group in the daily time frame presents two scenarios for predicting its price in the coming days.

In the optimistic scenario, by repeating the previous corrective measure, we expect it to move from the current range to the price target of 3,811 Tomans. This range is the intersection of the roof of the Andrews fork and the doubled channel (poi). The trigger for buying Packerman shares will be issued for short-term shareholders after breaking the red downward trend line and its high stabilization.

In the pessimistic scenario, however, if the current corrective trend continues and its size exceeds the size of the previous corrective wave (which happened in February last year), the price will advance to its support range.

The two supporting steps of our packer are first the trading node marked with a green box. The second step of support is the range of two thousand and 120 tomans, and with the reduction in the strength of the correction process, it is unlikely that the price will decrease to this range.

Read more market analysis reports on the stock market news page.