The divergence of the dollar and the stock market; This time for the benefit of the capital market – Tejaratnews

According to Tejarat News, today’s stock market transactions took place while the total index took a step against its previous day’s direction; Accordingly, the main index of the glass hall faced an increase of 31,941 units, which is equivalent to 1.8% of this index. Based on this, the total index stood at the level of 1 million 817 thousand units at the end of today’s trading.

The equal-weighted total index behaved in line with the total index and reached the level of 545,656 units with a growth of 1.4 percent.

Also, the board of Tehran Stock Exchange shows the volume of today’s transactions at 17.720 billion and the value of transactions at 8.356 billion tomans.

Investigating the ownership statistics of real people indicates the entry of real capital into the stock market. The capital inflow and outflow index at the end of today’s stock exchange reports that 345 billion tomans worth of money has entered the stock market.

Divergence between the exchange rate and the indicators of the glass hall

The effectiveness of the glass hall indicators of Ferdowsi Square transactions has always been reflected in the decisions of shareholders and stock exchanges. This effect has always been the same that the increase in the exchange rate has caused the upward trend of the capital market.

This time, however, at the same time that the dollar rate has taken a downward trend, the capital market has presented its mostly green map to the shareholders. The mentioned trend in the two mentioned markets has rapidly increased the dollar value of the capital market.

If we take a look at the chart of the dollar value of the capital market, we will notice its long-term downward trend after recording the historical peak on August 19, 2019. Currently, this chart is on the verge of breaking the red downtrend line. The failure of this line will promise the growth of the capital market to shareholders and capital market activists.

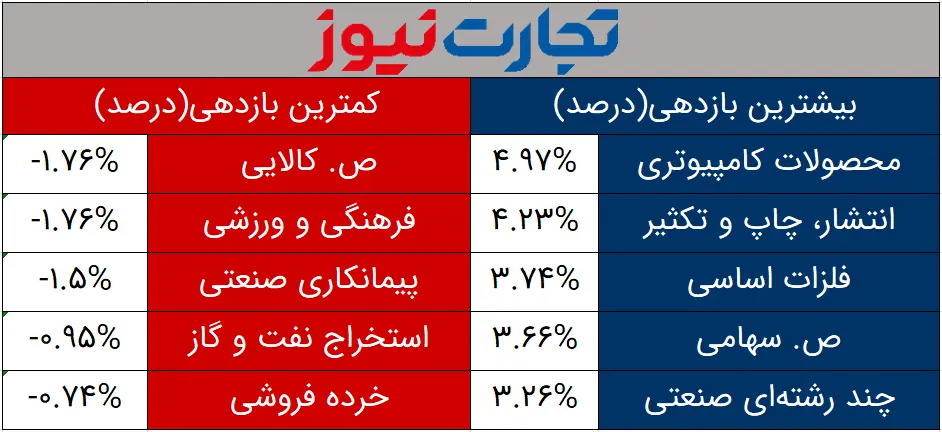

The highest and lowest productivity of industries

At the end of today’s trading in the capital market, the groups of power plant industries, technical and engineering services and manufacturing of metal products gave the highest returns to their shareholders with 2.46%, 2.11% and 2.04% respectively.

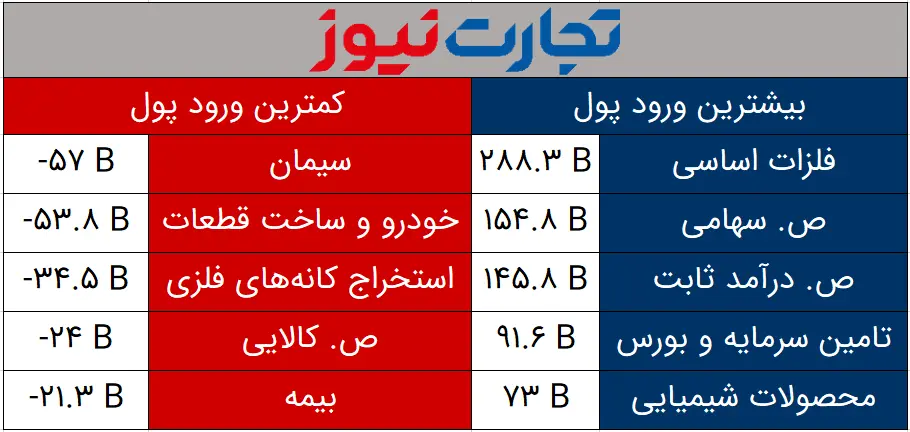

Inflow and outflow of money by industries

In today’s negative market, after the basic metals group with 288 billion tomans, equity funds accounted for the largest amount of money inflow, amounting to 154 billion tomans.

Also, on the other side, Cement Group experienced the largest outflow of money among industries with 57 billion Tomans.

Read more market analysis reports on the stock market news page.