The efficiency of the markets in February / the influx of small capital towards speculative markets

According to Tejarat News, the financial market avalanche finally ended while all types of coins changed channels and the dollar also went up five steps to be on the verge of entering the ninth step of the 40 thousand toman channel. In this way, the price of the dollar recorded a return of 12.26% for one month until the moment of setting this report.

In the meantime, the market maker could not adjust the prices and even until the last trading hours of the last day of February, the price was growing in all markets. At the same time, the prices in tomorrow’s dollar market also indicate the possibility of this currency reaching new peaks.

This is despite the fact that all stock market indices faced a decline in February and recorded negative returns. Also, while the foreign exchange, gold and coin markets witnessed the inflow of money, the stock market experienced the outflow of more than 11 thousand billion tomans of real money.

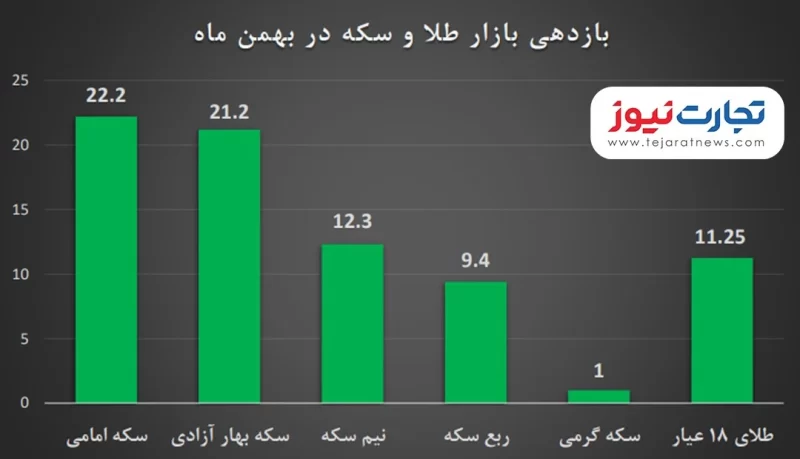

18 carat gold shine

In February, the price of gold (18 carats) was facing growth; In such a way that from two million and 33 thousand and 500 tomans at the beginning of the reopening of the markets in February, it reached two million and 262 thousand tomans in the thirtieth of this month. In this way, 18-carat gold registered a yield of 11.25% in the eleventh month of the year.

coins and conquest of new channels

All kinds of coins hit new ceilings in February and entered new channels. In this way, the coin market recorded a positive return in this month.

The price of Imami coin, which started trading this month at 23 million and 649 thousand tomans, reached 28 million and 900 thousand tomans by the 30th of this month and recorded a yield of 21.2 percent.

The Bahar Azadi coin, which started trading in February with a price of 22 million and 197 thousand tomans, reached 26 million and 901 thousand tomans on the 30th of February and recorded a yield of 21.2 percent.

At the same time, the price of half a coin also faced growth in February, and from the price of 13 million and 800 thousand tomans at the beginning of the opening of trading in the month of February, it reached 15 million and 500 thousand tomans in the last trading of this month, so as to achieve a yield of 12.3%. .

It should be noted that the price of the quarter coin was facing growth despite the Central Bank’s efforts to control the market through the auction of the country’s gold reserves and the stock market offering of this type of coin, and recorded a return of 9.4% during February; In such a way that from the price of 9 million and 500 thousand tomans at the beginning of the reopening of transactions in February, it reached 10 million and 400 thousand tomans on the last day of this month.

On the other side of the market, the price of the gram coin grew by only one percent and reached five million tomans at the beginning of February to five million and 50 thousand tomans at the end of this month.

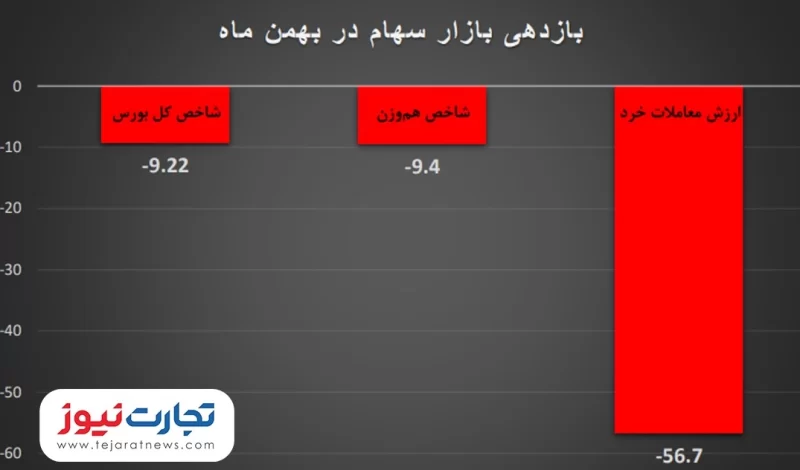

56% drop in the value of small transactions in the stock market

The stock market went through one of its worst periods in February this year; A period full of marginalization for the capital market and publishers, which led to an increase in investment risk and the withdrawal of real money from this market.

From the challenge of supplying cars in the commodity exchange to the central bank’s marginalization for half a dollar, all and every bit destroyed the investors’ confidence in the future of the stock market, so that this market, unlike the parallel markets, retreated in February.

During the month of February, the stock market experienced the outflow of real money, or in other words, the change of ownership from real to legal, on all trading days. In such a way that during the 19 trading days of February, 11,246,000 billion Tomans of real money were withdrawn from stocks, pre-emptive rights and mutual funds.

The important and clear point in this month was the decrease in the value of small transactions again; In such a way that although on the last day of January, the value of retail transactions reached 9,599 billion tomans, but by the end of February, this trend began to decline and on the last day of the month, it reached 4,156 billion tomans, a drop of 56.7%. Register!

In this period of one month, the total index of the stock market decreased by 9.22% to reach the level of 1 million 533 thousand 366 units from the height of 1 million 689 thousand 144 units in the first trading hour of February.

The equal-weighted index, which represents the situation of small and medium-sized companies, had a 9.4 percent retreat this month and reached 476,719 units at the beginning of February trading from a height of 526,187 units.

Forecasting markets

As the macroeconomic variables show, there is no news of price reduction in the markets. At the same time, due to the growth of inflation and the inflationary outlook, speculative demand in markets such as gold, coins and dollars, which are more liquid, has increased, which in turn causes prices to grow again.

In this way, if the government and the decision-making economic complex of the country do not think of a solution to change the economic situation and get out of this crisis seriously, the turbulence of the markets will increase on the eve of the new year.

In the meantime, it seems that the biggest obstacle to getting out of the economic crisis is the non-acceptance of the crisis by the government and policy makers; It was on this basis that during the recent period, the government only resorted to superficial treatments and started policies such as foreign currency exchange, so that now the central bank is facing the problem of lack of foreign exchange resources.

But will this policy of patchwork and economic calluses continue and can the markets turn the page in the new year?

More reports on p Market Read Tejarat News.