The efficiency of the markets in the last week of February 1401 / the efficiency of the coin market was double digits!

According to Tejarat News, financial and capital markets were affected by international news in the last week of February; During this week, the price of dollars and coins increased significantly in the open market, but the stock market fell. The highest weekly returns were related to the coin, gold and dollar markets, respectively, and the stock market recorded a negative return.

In the fourth week of February, transactions took place in the stock market while the market was affected by the fear of real people. For this reason, shareholders witnessed the continuous withdrawal of real money from the capital market.

Dollar price

The National Exchange announced the price of the dollar at 42,985 tomans on Thursday, 20th of February. Meanwhile, the price of this American banknote was announced yesterday on 27 February 44,637 Tomans.

This American banknote has increased in price by 1,652 Tomans. The efficiency of this market, unlike the decrease of 1.45% in the third week of February, this week had a positive efficiency of 3.84%.

The dollar price became more expensive in the last week of February. This American banknote reached the seventh level of the channel of 40 thousand tomans in the last cash transaction yesterday.

In the last month, that is, from the last week of January to February 27 Dollar price It has grown by 31.11 percent. This amount of price growth is equivalent to an increase of 4,820 tomans in the price of the dollar in the month of Bahman.

Market analysts believe that the country’s monetary institution, during the 40 days that Farzin has taken the helm of the central bank, has tried hard to keep the price at the bottom of the channel of 40 thousand tomans. They say, but the price of the dollar has gone its own way regardless of speech therapy and does not follow force and orders.

gold price

Price gold On Thursday, February 20, 1401, it was two million and 111 thousand Tomans. This is despite the fact that each gram of gold was traded at the price of two million and 201 thousand tomans last day. Gold had a negative return in the third week of February.

Prices for coins

The yield of the coin market was negative in the third week of February. This market had a negative return of 0.82% last week, but this week’s coin had the highest return among financial and capital markets.

Last week, Imami coin was traded at the price of 24 million and 644 thousand tomans. This piece of coin increased by two million and 952 thousand tomans in the last week of February and reached the price of 27 million and 596 thousand tomans.

The price of gold and coins continued to grow in the last week of February. Even the supply of a quarter of a coin in the commodity exchange could not control the price of the yellow metal.

Just a month ago, the pre-sale of the quarter coin offering started but failed; However, the government still insisted on selling other pieces of coins in the same way as quarter coins. From the 24th of December, the Central Bank under the pretext of control Prices for coins He offered a quarter of a coin in the commodity exchange. This action not only failed to control the price of yellow metal in the market, but also caused price jumps of more than one million tomans in some days.

However, these offerings were not well received and so far only less than half of all the coins considered have been sold. It seems that this policy of the central bank was to auction the country’s gold reserves rather than managing the market.

In the last month, the price of Imami coins increased by 45.25%. This amount of growth is equivalent to an increase of five million and 598 thousand tomans in the price of this coin during the month of Bahman.

Exchange

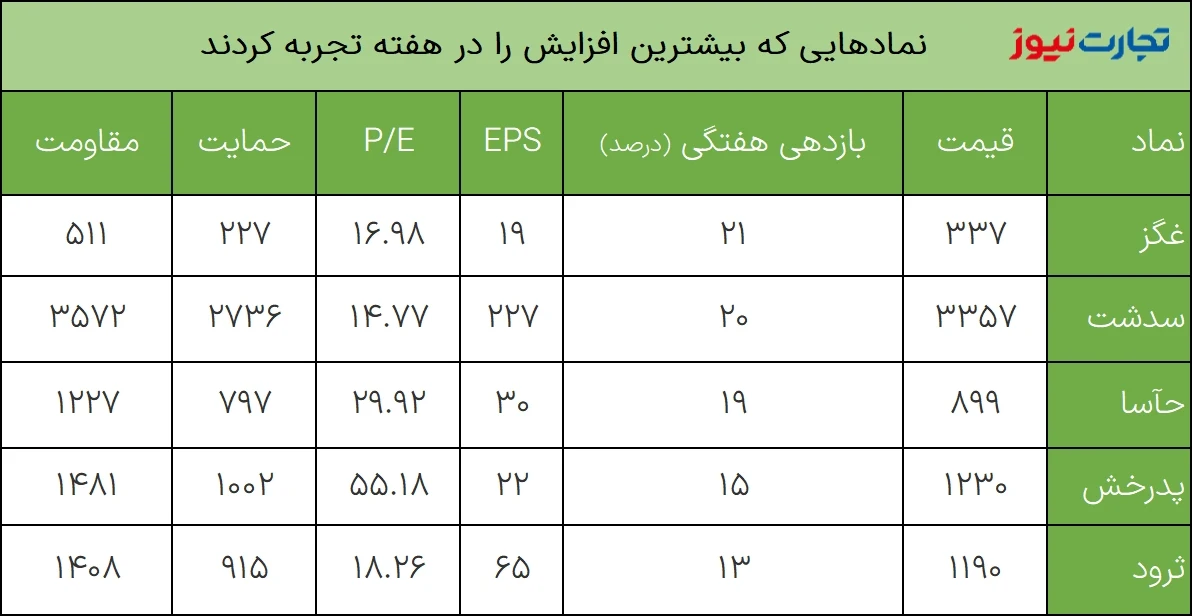

The review of this week’s market transactions shows that the total index of the Tehran Stock Exchange stood at 1.524 thousand units at the end of the fourth week of February and experienced a 2.14% drop.