The efficiency of the markets in the third week of February 1401 / the efficiency of the financial markets was negative

According to Tejarat News, the financial and capital markets in the third week of February, in addition to the international news, were also affected by the news against the entry of the car into the commodity exchange. This is despite the fact that during this week, the price of dollars and coins in the open market was relatively stable. Although the price of dollar, coin and gold closed on Thursday with an increasing trend, but the returns of the markets were negative this week.

The total stock market index did not rise significantly during the trading of the third week of Bahman and ended its work at a height of 1.556 thousand units. However, this week, the total equal weight index could not avoid the withdrawal of real money and decreased by 0.42%.

Dollar price

The National Exchange announced the price of the dollar at 43,616 Tomans on Thursday, 13th of February. Meanwhile, the price of this American banknote was announced yesterday as 42 thousand 985 tomans. This American bill has decreased by 631 Tomans. The efficiency of this market has decreased by 1.45%.

controlled process Dollar price In the third week of February, there was a fluctuation of 40 thousand tomans in the fourth step of the channel. In some days, it went down to the second step in the mentioned channel. In some cases, he climbed to the 8th and 9th steps. Traders were looking forward to international news in the past weeks; But the market maker strongly prevented Sharpy from changing the price.

This week, the currency and gold exchange system was supposed to be launched; But there was no news about the start of this system under the title “Nakhoda”.

Also, this week, the effort of the country’s monetary institution was to bring different dollar rates closer to each other in the trading market; An action that could blind the enthusiasm of the buyers of the agreed currency. The queue of agreed dollars has disappeared and the buyers of this type of currency tend to buy from the free market in order to avoid the cutoff of subsidies and taxes and the disciplinary measures of the market.

gold price

This week, gold had the biggest negative return among the financial markets, with a decrease of more than 3%.

Price gold On Thursday, 13th of Bahman 1401, it was 2 million and 178 thousand Tomans. This is despite the fact that each gram of gold was traded at the price of 2 million and 111 thousand Tomans last day. Gold became more expensive by 61 thousand tomans in the second week of February compared to the previous week and became cheaper by 66 thousand 300 tomans in the third week.

Market participants believe that as long as the price of the dollar has limited fluctuations; Do not expect growth The price of gold and coins had the On the other hand, some traders say that the dollar is kept in the current price range not by itself but by order; But the price in the yellow metal market does not follow the order.

Prices for coins

The yield of the coin market increased by 4.5% in the second week of February, and this week left a negative yield of 0.82%.

Last week, Imami coin was traded at the price of 24 million and 849 thousand tomans. Yesterday, this piece of coin reached the price of 24 million and 644 thousand tomans with a decrease of 205 thousand tomans.

Some market participants say that the increase in the global gold rate will strengthen the power of domestic coin collectors. At the same time, the movements of the gold market have shown that the yellow metal tends to increase in any market.

On the other hand, it is said that China has increased the demand for storing and buying its gold. This decision may cause the growth of global gold and its movement towards the border of two thousand dollars.

Exchange

The transactions of the third week of Bahman this year took place while the market was affected by the contradictory news of the entry of the car into the commodity exchange. For this reason, shareholders witnessed the continuous withdrawal of real money from the capital market. It should be noted that about 1,700 billion tomans of money has been withdrawn from the capital market this week.

The total index also did not rise significantly during the trading of the third week of Bahman and ended its work at a height of 1.556 thousand units.

However, this week, the total equal weight index could not avoid the withdrawal of real money and decreased by 0.42%.

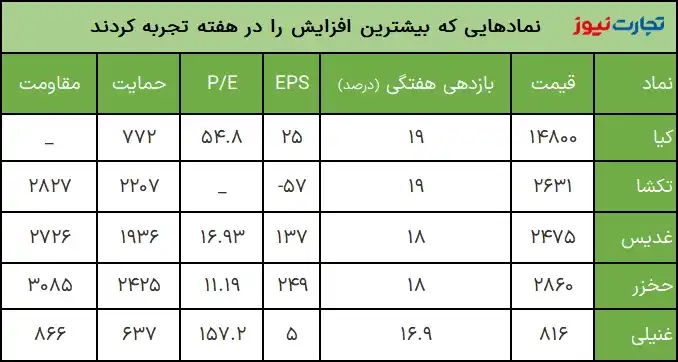

The highest weekly yield

A review of this week’s market transactions shows that the Kia symbol was able to gain the highest return of the week with an increase of 19%.

Taksha and Ghadis were also the most profitable symbols of the third week of Bahman with an increase of 19 and 18 percent respectively. It should be noted that the levels of 2827 and 2726 Tomans are the most important resistance levels for these two stocks.

Lowest weekly return

During this week’s trading, Femarad capital market had the worst performance of the week with a 14% drop.

The important support and resistance of this share are 1877 and 2538 Tomans, respectively.

Fanava and Bimah were also symbols that disappointed their shareholders with a decrease of 14 and 12 percent each this week.

It should be mentioned that if these two symbols move forward with the same command, the important supports in front of them are 512 and 136 Tomans.

Read more reports on the currency and gold news page.