The fall of Bitcoin dominance to the lowest level of the last 4 years; What should we expect?

The rate of dominance of Bitcoin on the digital currency market has reached its lowest level since 2018, and tensions between Russia and Europe over the issue of energy supply in this continent are intensifying. These conditions have made investors show little desire to enter the market.

To Report Cointelegraph, since yesterday and at the same time with the agreement of the members of the Group of Seven (G7) to impose restrictions on the use of Russian energy, the price of commercial goods in the international markets decreased, while Bitcoin was at a lower price during this period. It was traded from $20,000.

As can be seen from the chart above, Bitcoin has not performed well for several days and is currently hovering around $19,800. Now that we are on the verge of closing the weekly price candle, the weakness of Bitcoin in crossing the $20,000 resistance is quite evident, and there is no enthusiasm among the market participants to raise the price.

Cheds, one of the digital currency market analysts on Twitter, referring to the 8-day exponential moving average (EMA 8 – green line in the picture), has depicted the continued resistance of this indicator on the chart.

The American stock market has passed a difficult week, and the S&P500 and Nasdaq indices each experienced a decrease of 2.7% and 3.25% respectively during this period.

After the Group of Seven agreed to impose a price ceiling on Russian oil in its meeting, the price of oil in Europe fell, while concerns about Russia’s retaliatory action increased.

Following this decision, Russia stopped the supply of gas to Europe, which was supposed to resume on September 3 (12 Shahrivar), and stated the reason for it was technical problems.

Javier Blas, the energy and commodity writer at Bloomberg, said about the announcement of the suspension of gas supplies to Europe by Russia’s Gazprom:

It seems that Gazprom has presented its reason for stopping the supply of gas to Europe in the way that the only active turbine of the Nord Stream 1 pipeline must be repaired right now in one of the specialized workshops of the Siemens Energy group located outside of Russia. and until this happens, the pipeline will not be restarted (in other words, the problem will persist forever).

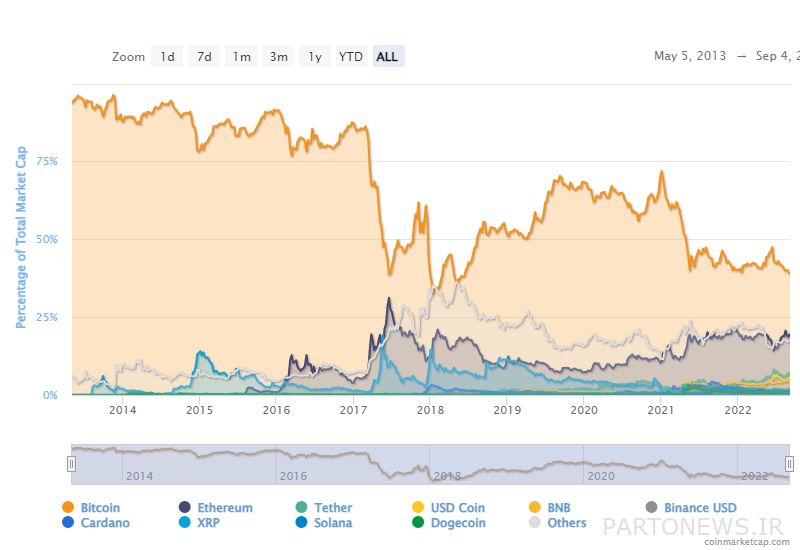

Bitcoin is losing its dominance

The void of buyers in the Bitcoin market is clearly felt. The dominance rate of Bitcoin on the digital currency market reached its lowest level in the last 4 years yesterday. According to Coin Market Cap website, Bitcoin’s dominance rate is now 38.82%, which is the lowest level since 2018.

Also read: What is Bitcoin Dominance? Everything about Bitcoin Dominance

The chart of the total value of the digital currency market, however, has maintained its position above the 200-week moving average (MA 200 – $1.007 trillion); A move that is considered an achievement in the current bearish market. However, it cannot be said that Bitcoin has retained its key supports like the cryptocurrency market value index.