The growth of the non-cash supply of Bitcoin; Are long-term investors bullish?

Large investors moving bitcoins from exchanges to cold wallets is a way to reduce liquidity in the market. In such a situation, an increase in demand in the market can lead to a supply crisis and a possible price increase.

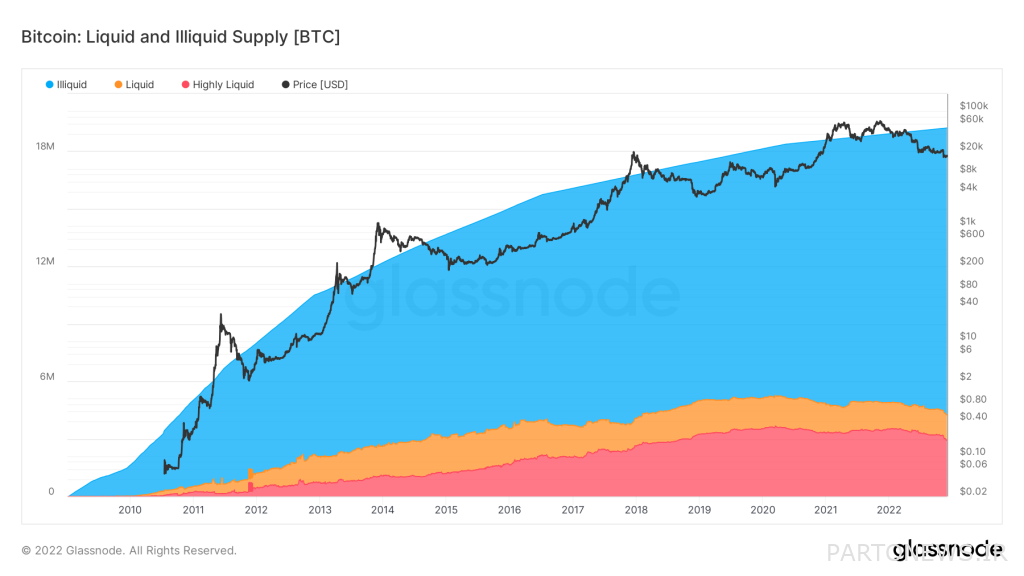

To Report CryptoSlate, data from its analysis platform Glassnode shows that the non-cash supply accounts for nearly 78% of the total circulating supply of Bitcoin. In other words, less than 22% of all mined bitcoins are circulating in the market.

This indicator shows that investors are withdrawing their cryptocurrencies from exchanges and storing them in non-custodial (non-custodial) wallets to avoid selling their assets.

In its report, CryptoSlate examined Bitcoin supply indicators to assess the long-term prospects of this digital currency after weeks of market turmoil and uncertain macroeconomic conditions.

Non-cash supply is a key indicator; Because it shows that traders and small investors can only own a quarter of the total supply of Bitcoin and by selling it, exert downward pressure on the market.

On the other hand, this means that large-scale buyers intend to acquire more Bitcoins from whales, organizations and powerful traders.

The chart below shows the movement of Bitcoin towards non-cash supply since 2010; The non-cash supply of Bitcoin makes up roughly three-quarters of the total circulating supply.

Consider a cashless supply as a situation where bitcoins are transferred to a wallet without a history of spending; While cash supply is a situation where bitcoins are transferred to wallets that have a history of spending such as transfers to exchanges.

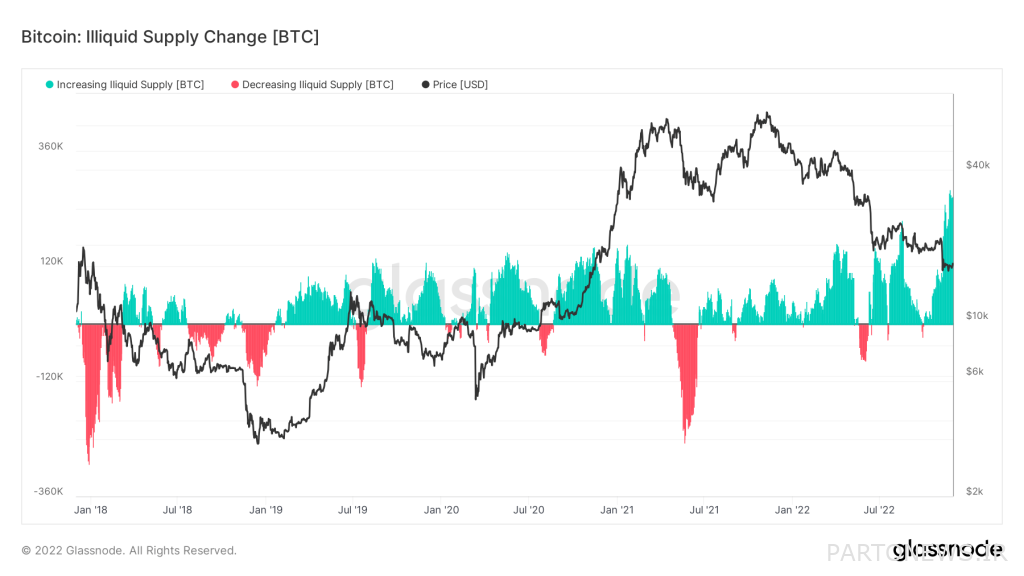

This data has recorded the fastest rate of change in Bitcoin to long-term investors, also known as non-cash supply change, over the past 5 years. As a result, these long-term investors are not spending their bitcoins and are in the accumulation phase.

Out of the total mined bitcoins, 15 million tokens are currently not sellable and only 4.3 million bitcoins are continuously circulating and are classified as liquid and very liquid. A large portion of these coins are held by short-term investors or traders. Therefore, a supply shock when the price of Bitcoin was $53,000 means that the coins have moved from short-term investors to long-term investors.

In fact, the growth rate of Bitcoin’s cash supply has slowed in recent months; A situation that can be attributed to a bullish long-term outlook and increasing concerns about the security of funds in exchanges and online wallets.

The chart above shows the supply of highly liquid and liquid bitcoins, showing that the supply of each is 3 million and 1.3 million, respectively. It is clear that amid the market turmoil, both liquid supply and highly liquid supply have been trending down.