The price of Bitcoin increased by 300% a year ago from the last halving; Will the process be different in 2023?

Rekt Capital, a popular trader and analyst, predicted in a tweet that the price of Bitcoin could grow significantly this year. According to his analysis, Bitcoin will bottom out in 2023, but could be accompanied by growth that will surprise the market.

The chart shows the upside potential of Bitcoin’s growth

To the report Investigating the price of Bitcoin in four-year mining reward halving cycles at the halving event, CoinMarketCap, Racket Capital noted that 2023 is when the next bottom candle closes (annually).

According to this analyst, in the next 12 months, we will witness the formation of a price that will be accompanied by an upward trend as the time of the next halving event approaches in 2024.

Thus, the year 2023 is the candle and the year 2024 is the fourth candle in the current (halving) cycle of Bitcoin. Rect Capital said:

The third candle is the price floor candle in the four-year cycle of Bitcoin, which can be accompanied by significant price growth.

The scope of Bitcoin’s volatility, which can surprise traders, is clearly visible in the four-year chart of the cycle. He continued:

The third candle of the cycle in 2015 saw a 234% growth and in 2019 it saw a 316% increase.

The third candle of the cycle in 2023 may be more powerful than many think.

Some other such analyzes have led market participants to similar optimistic conclusions.

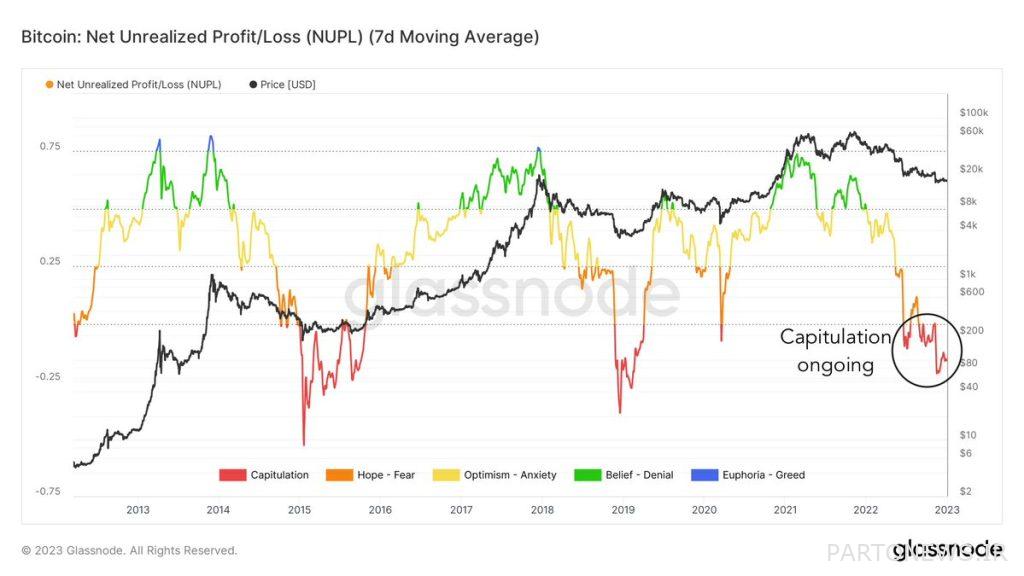

Among these analyses, the unrealized profit-to-loss ratio of Bitcoin investors continues to move in the surrender phase, according to a proprietary indicator that examines the current state of the market.

The anonymous analyst and trader with the nickname Game of Trades wrote on his Twitter on January 11 (21st):

Now is the most profitable time to accumulate bitcoins. Net unrealized profit and loss is still in the extreme surrender range.

The macroeconomic conditions in 2023 are similar to the previous global financial crisis

Given the current macroeconomic conditions, especially considering the decline in the price of digital currencies, a reversal of the market trend will require a large amount of luck.

As the US Federal Reserve continues to raise interest rates despite falling inflation, market participants’ concerns are now focused on the long-term implications of this policy.

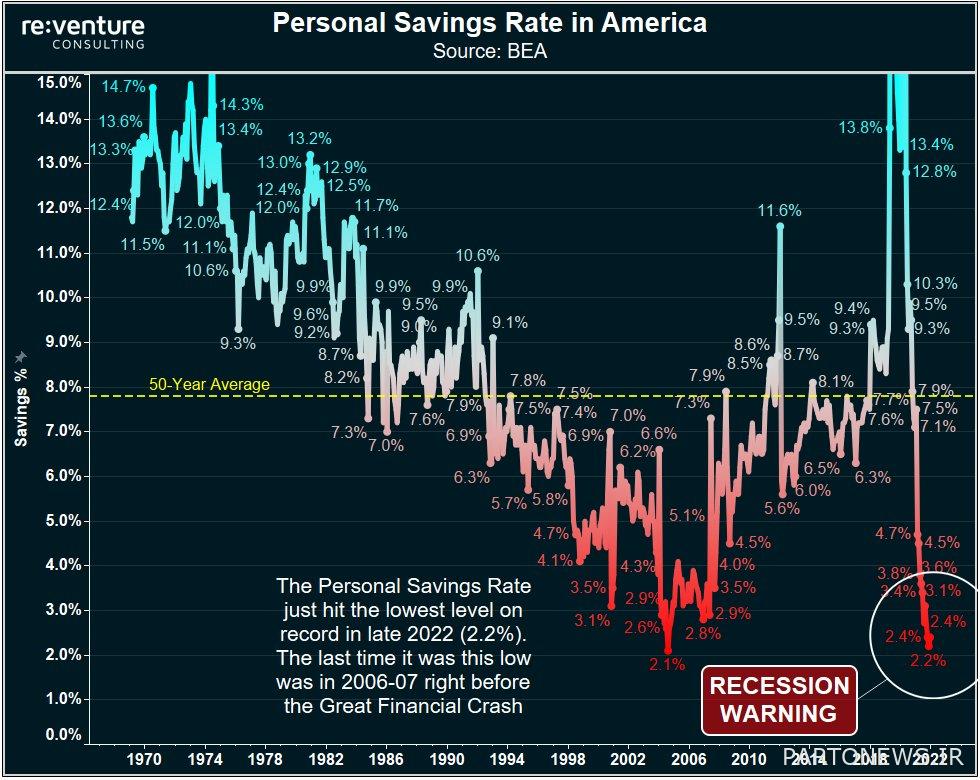

Analysts, including Nick Gerli, founder and CEO of Reventure Consulting, say that what could affect market sentiment next is not inflation, but deflation.

On January 10, Gurley, citing a chart of the US savings trend, warned that conditions were ripe for a repeat of the global financial crisis in 2008 from the perspective of a recession. He noted:

The savings rate (from income) in the United States fell to its lowest level ever, at 2.2 percent.

That means Americans are running out of money. The savings rate index last reached this level in 2006-2007 (2006-2007). Just before the global financial crisis; Great Depression Warning. As a result, consumer spending is expected to decline sharply in 2023.

On January 12th (22nd), we will see the publication of the first figures of the consumer price index (inflation rate) in 2023, and its predictions have already affected the price of Bitcoin.