The results of not borrowing from the central bank

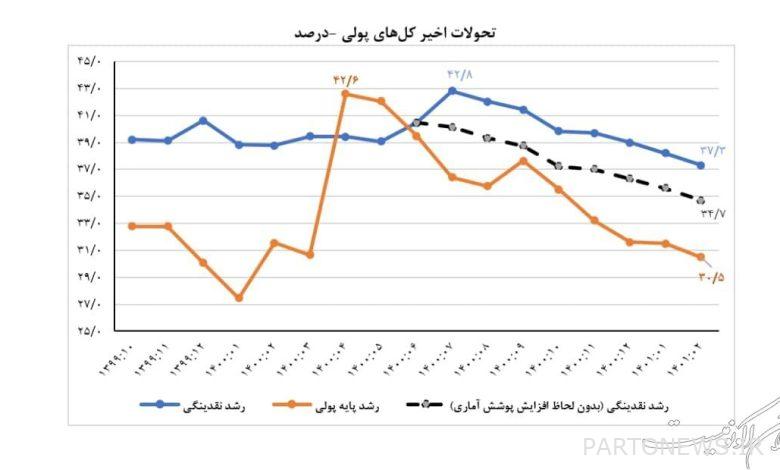

According to the report of Iran Economist, the publication of new statistics of monetary indicators depicted the latest situation of the forces affecting inflation until the end of May of this year. According to the report provided by the Central Bank of the monetary components affecting inflation, the behavior of these components has changed significantly since the beginning of the 13th government. The chart below summarizes the report that the Central Bank has presented on the growth trend of the country’s monetary base and liquidity over the last year and a half. The 13th government’s suspension of borrowing from the central bank is the main factor in reducing the growth rate of liquidity and monetary base.

According to the statistics published by the Central Bank, the growth rate of the monetary base has decreased from around 42% at the end of August last year to around 30% at the end of May this year. The obvious change in the behavior of the monetary base since the beginning of the thirteenth government can be mainly attributed to the strictness of the government officials in monetizing the budget deficit and even settling the previous government’s salary. At the beginning of its work, the 13th government was faced with a heavy budget deficit due to the non-fulfillment of the resources foreseen in the budget law of 1400. In addition, the settlement of 55 thousand billion tomans, which the government had previously received from the Central Bank for its expenses, was postponed to the 13th government. In this situation, the work of the 13th government became more difficult to prevent the growth of the monetary base from getting worse.

Cost control and revenue recovery; The key to slowing down the growth rate of the monetary base

However, the government took two major measures to solve the deep gap between its resources and expenditures and finally to prevent the monetization of the budget deficit. On the one hand, the 13th government made every effort to control costs and only considered the basic priorities of the country in allocating the budget. In addition to controlling expenses, the 13th government succeeded in increasing its resources significantly in the remaining months of 1400 by pursuing policies to prevent the growth of the monetary base from the budget deficit. The successful marketing and growth of oil exports, the identification of 2.2 million new taxpayers through the connection of payment gateways (POZ) to tax files, etc., were among the government’s measures to immediately restore resources and prevent the inflation of the budget deficit last year. With these actions, the government was able to settle the previous government’s debt, prevent the growth of the monetary base through the budget deficit channel and not create a new force to increase inflation.

strict supervision of the central bank on banks; The factor of reducing the speed of liquidity growth

In addition to the monetary base, the growth rate of liquidity has also been decreasing since the beginning of the 13th government. According to the new report of the central bank, the growth rate of liquidity has reached from about 40% at the end of September last year to less than 35% at the end of May this year. According to a report recently published by the Ministry of Economy, in the first two months of this year, the growth of deposits was 2.7% and the growth of the balance of granted facilities was 1.07%. While in the first two months of last year, the growth of deposits was 8.6% and the growth of the balance of granted facilities was 11.1%. These statistics clearly indicate the active management of the central bank on the country’s banking network. The result of these actions is the decrease in the growth rate of liquidity until May of this year, and this trend is expected to continue until the end of the year.

Global inflation is a disturbing factor in reducing inflation

Considering the improving trend of the internal components related to inflation such as monetary base, liquidity, budget deficit, etc., the continuation of the decreasing trend of inflation is the most likely scenario. However, the factor that directly affects this trend is the occurrence of global inflation following the war in Ukraine. These conditions have caused inflation to be imposed on the country through imported goods, and this issue has become a factor in slowing down the decline of inflation in recent months. However, the continuation of the trend of reducing the growth rate of monetary indicators and disconnecting the budget from the monetary base has made the reduction of inflation inevitable in the coming months.