The safe margin of bank debtors was removed in the 13th government

According to Iran EconomistMost of the banks’ resources are obtained from people’s deposits, so it is necessary for the depositors to be informed about where the banks’ resources are spent. The fact that about 10% of the banks’ resources are taken by some people in the form of loans and not returned is not only to the detriment of the banks, but also to the detriment of the depositors and the general public.

Transparency in the functioning of banks and the recognition of members of the society to introduce bank debtors is an issue that has always been raised, and the 13th government insisted on doing this from the very first months, and the president clearly announced in a meeting with the CEOs of the banks that the banks should They should be tough on bad accounts and publish the names of bank debtors.

On November 23, 1400, Seyed Ehsan Khandozi, the Minister of Economic Affairs and Finance, requested the central bank to publish the list of bank debtors every three months.

He obliged the banks and credit institutions to announce to the public the details of the recipient’s facility, the bank’s justification for allocating resources, the amount of the facility, the payment amount, the debt balance, the interest rate, and the type of collateral.

The seriousness of the government in introducing bank debtors is important because more than 80% of the financing of projects and enterprises is done by banks, so monitoring the financing process of the banking system is necessary and the creation of money should be prevented and its inflationary effects should be eliminated. .

According to the definition of the Ministry of Economy, a bank superdebtor refers to people who have received 10% of the bank’s savings in the form of facilities and 18 months have passed since their delay in paying installments.

After the order of the President and the request of the Minister of Economy from the Central Bank to introduce bank debtors, some banks published their legal debtors in 2019, but there was no news about the facilities of the real receivers, and many banks not only did not take any action in publishing the relevant list, but this They forgot the order. But in the last two weeks of last year, banks gradually published the list of their big debtors.

According to this report, the micro-facilities and major commitments of 22 banks and related parties of 25 banks were published in the first three months of 1401. Also, according to the latest report of the central bank (February 1401), the list of information on current and non-current facilities and major obligations and related parties of 14 banks and one credit institution, which had been examined until the end of December this year, was updated and published separately for each bank.

32% increase in the balance of facilities in February 1401 compared to the previous year

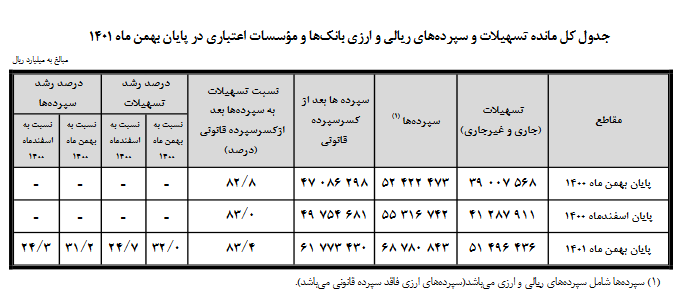

According to the Central Bank report, by the end of February 1401, the total balance of deposits has exceeded 68,780.8 thousand billion Rials, which is 16,358.4 thousand billion Rials (31.2%) compared to the same period of the previous year, and compared to the end of 1400, equal to 13,464 It shows an increase of 1 thousand billion Rials (24.3%).

The highest amount of deposits is related to Tehran province with a balance of 36334.3 thousand billion rials and the lowest amount is related to Kohgiluyeh and Boyar Ahmad provinces equal to 197.5 thousand billion rials.

The total balance of facilities until the end of February 1401 is more than 51496.4 thousand billion Rials, which compared to the same period of the previous year is 12488.9 thousand billion Rials (32%) and compared to the end of the previous year 10208.5 thousand billion Rials (24 7 percent) has increased. The largest amount of facilities related to Tehran province with a balance of 29911.6 thousand billion rials and the lowest amount related to Kohgiluyeh and Boyer Ahmad provinces is equal to 203.3 thousand billion rials.

It should be noted that the ratio of facilities to deposits after deducting the legal deposit is 83.4%, which at the end of February 1401 has increased by 0.6 percentage points compared to the same period of the previous year and by 0.4 percentage points compared to the end of the previous year. The mentioned ratio is 90.6% in Tehran province and 116% in Kohgiluyeh and Boyer Ahmad provinces.