The slight decline in digital currencies coincided with the collapse of the global stock market

Following the collapse of the global stock market yesterday, many digital currencies also fell in price. Some experts expect that the stock market pressure will continue to ease and there will be an opportunity to recover prices; An event that could benefit digital currencies in the short term.

To Report Bitcoin Desk, the Bitcoin market has been very volatile over the past week and the volume of price fluctuations has increased significantly. This situation may reflect a sense of distrust among digital currency investors.

Bitcoin has lost 3% of its value in the last 24 hours, while the result of price changes for the last seven days is almost zero; This means that Bitcoin is currently traded at the same price seven days ago, despite cross-sectional fluctuations. Yesterday, many altcoins performed worse than bitcoins. Solana, for example, has lost about 5 percent of its value during this period, and Olench has seen a 4 percent decline.

Yesterday, the S & P500 index, one of the most important instruments for measuring the overall state of the US stock market, experienced a significant decline and reached a level almost 20% below its historical peak in January (December 1400). The volume of fluctuations in the stock market and digital currencies is still high, and meanwhile, the global gold price rose yesterday.

Some experts expect further easing of selling pressure in the global stock market; An event that will benefit digital currencies in the short term. Meanwhile, the correlation between the price performance of Bitcoin and the S & P500 index has increased day by day over the past year.

“MRB Partners,” said MRB Partners.

As long as central banks and the bond market do not restrict the world’s monetary conditions, it is too early to worry about a recession. While we do not expect this to happen in 2022.

The investment firm has said it will provide an opportunity for the stock market to return, assuming that concerns about rising US interest rates continue to fall, bond yields decline and economic growth shows resilience.

Poor performance of Diffie tokens in recent days

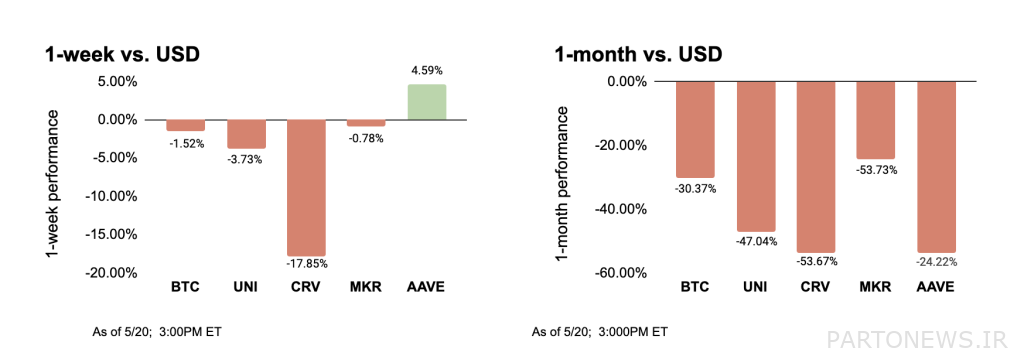

Decentralized Financial Protocol (DeFi) tokens have performed worse over the past month than bitcoin. The low performance of Defy tokens and other market coins in downtrends is usually due to the fact that these digital currencies have a higher investment risk than bitcoins.

The Defy Index (DFX) of the Quin Desk website, which measures the price performance of top Defy tokens, has fallen 33 percent over the past month, while Bitcoin has lost 23 percent of its value over the same period.

Over the past week, however, the Diffie index has been consistent and has not fluctuated much. Part of the improvement is due to the rise in the price of Aave in recent days, and on the other hand, the 17% fall in the price of Curve in the last seven days is out of the general direction of this index and other tokens in the Defai area.