The story of the circulars that doubled the power of sanctions/ Are the blows of internal decisions heavier or the sanctions of foreigners?

Online Economy – Amirreza Mohammadi: According to studies, the sanctions have caused the GDP in Iran to be lower than the world average since 2010. In fact, sanctions are one of the main reasons why Iran’s economy lags behind the world economy. However, the role of internal restrictions should not be ignored due to inefficient and sometimes contradictory laws and regulations.

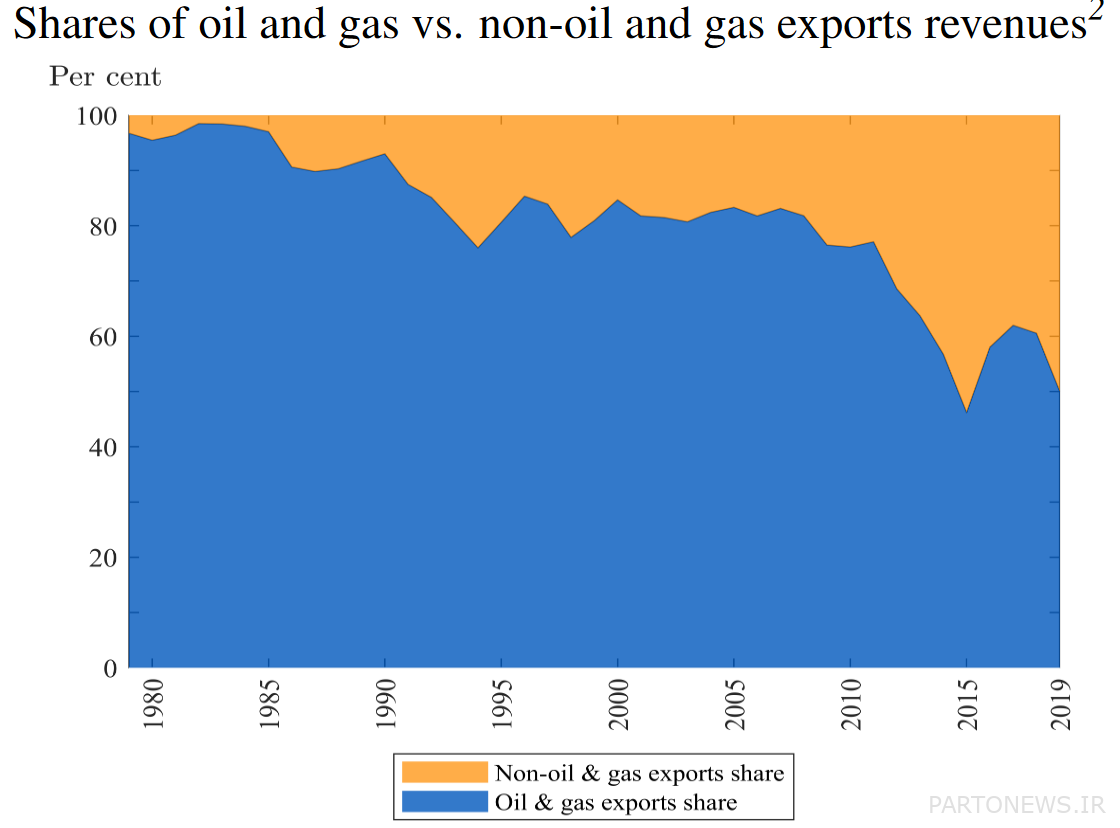

At the same time, the data shows the effect of sanctions on currency jumps in 2010, 2017 and 2019; In such a way, the inflation rate has also recorded higher numbers in the periods when the severity of the sanctions was higher. Also, the share of oil and gas in revenues has increased from more than 90% in 1980 to about 50% in 2019.

In the meantime, statistics indicate that the severity of sanctions against Iran, respectively, in 2010, 2012 and 2018, which coincided with Trump’s order to withdraw the United States from the JCPOA; has been at its highest level.

For nearly half a century, Iran’s economy has been struggling with sanctions. In some years, the severity of these sanctions and its impact on Iran’s economy has been less, and in some years, these effects have been greater. Many experts believe that sanctions are one of the main reasons for the current conditions of Iran’s economy; However, on the other hand, some others believe that although sanctions have had a significant impact on the country’s economy, the government’s economic policies are the main cause of high inflation and unstable economic conditions.

This group believes that the government could have managed the situation as much as possible with the right economic policies even in the critical conditions of sanctions; As Russia has also experienced such an atmosphere and with the set of correct economic policies implemented by the central bank of this country, it has continued its growth path well and has provided the conditions to support its domestic production.

What do the analysis of sanctions and peak charts say?

The first embargoes in the post-revolutionary era were initiated by the United States of America in November 1979, by embargoing Iran’s oil trade and blocking 12 billion dollars of the country’s assets. These sanctions ended in January 1981, but the US efforts to limit Iran’s economic and political efforts increased. Perhaps the most important periods of sanctions against Iran can be considered the sanctions imposed during the government of Mahmoud Ahmadinejad and Hassan Rouhani.

To examine the impact of sanctions in Iran, we must examine the changes in important economic indicators in this period of time. Some of these indicators are inflation rate, unemployment rate, economic growth, oil and gas export, government budget deficit and trade balance. Hashem Pesran, a renowned economist who has raised serious points in this field by examining the impact of sanctions on Iran’s economy.

In order to examine the effect of sanctions on Iran’s economy, the sanctions intensity index has been used. This index shows the severity of the sanctions in the given time frame, considering the coverage of the world’s most authoritative media, the application and occasional cancellation of sanctions.

The severity of sanctions against Iran

As can be seen, the intensity of sanctions has been different in different time frames. The intensity of sanctions against Iran was at its highest level in 2012, the withdrawal of the United States from the JCPOA in 2018, and the sanctions in 2010, respectively.

How much was the oil and gas sector damaged?

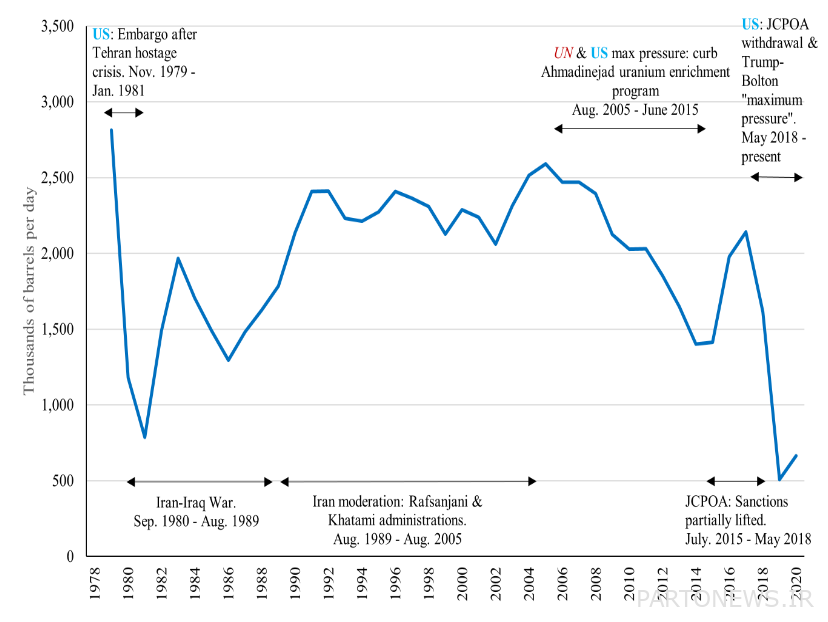

Perhaps the most important impact of sanctions can be evaluated in the country’s oil sector. At the beginning of the revolution, Iran’s oil exports, which reached 6 million barrels per day at its peak, had halved. The first sanctions of the United States had a significant impact on oil exports and reduced Iran’s daily oil exports to 700,000 barrels.

Although the lifting of sanctions in 1981 helped to improve Iran’s oil exports, due to the coincidence of the imposed war, Iran’s oil exports could not return to the pre-sanctions days and remained below 2 million barrels per day. Until the end of the imposed war, Iran’s oil exports reached less than 1.5 million barrels per day; However, with the end of the imposed war, and in the years 1989 to 2005, at the same time as the country’s relations with the world improved, oil exports increased and fluctuated between 2 and 2.5 million barrels per day.

After the imposition of US and UN sanctions in 2007 and 2006, Iran’s exports began a downward trend again. The increase in the severity of sanctions caused Iran’s oil exports to reach less than 1.5 million barrels per day until 2014 and before the JCPOA agreement. At the same time, the JCPOA agreement made the obstacles to oil exports less. Until 2017, Iran’s oil exports reached more than 2 million barrels per day, and finally, Trump’s withdrawal from the JCPOA in 2018 caused Iran’s exports to experience a serious and historic decline to the level of 500,000 barrels per day.

In total, the sanctions imposed by the United States of America in 1979, in the government of Mahmoud Ahmadinejad, and in the government of Hassan Rouhani in 2018, have hit Iran’s oil exports the most.

Iran’s oil exports in the period from 1978 to 2020

The sanctions imposed against Iran also greatly affected the government’s revenue structure. The chart below shows the share of oil and gas revenues and non-oil and gas revenues. As can be seen, the share of revenues from oil and gas exports has reached over 90% of total revenues in 1980. As can be seen in the picture, the share of these revenues in 2014 was below 50%, and in 2019 it reached 50%.

Iran’s economy is lagging behind the world economy

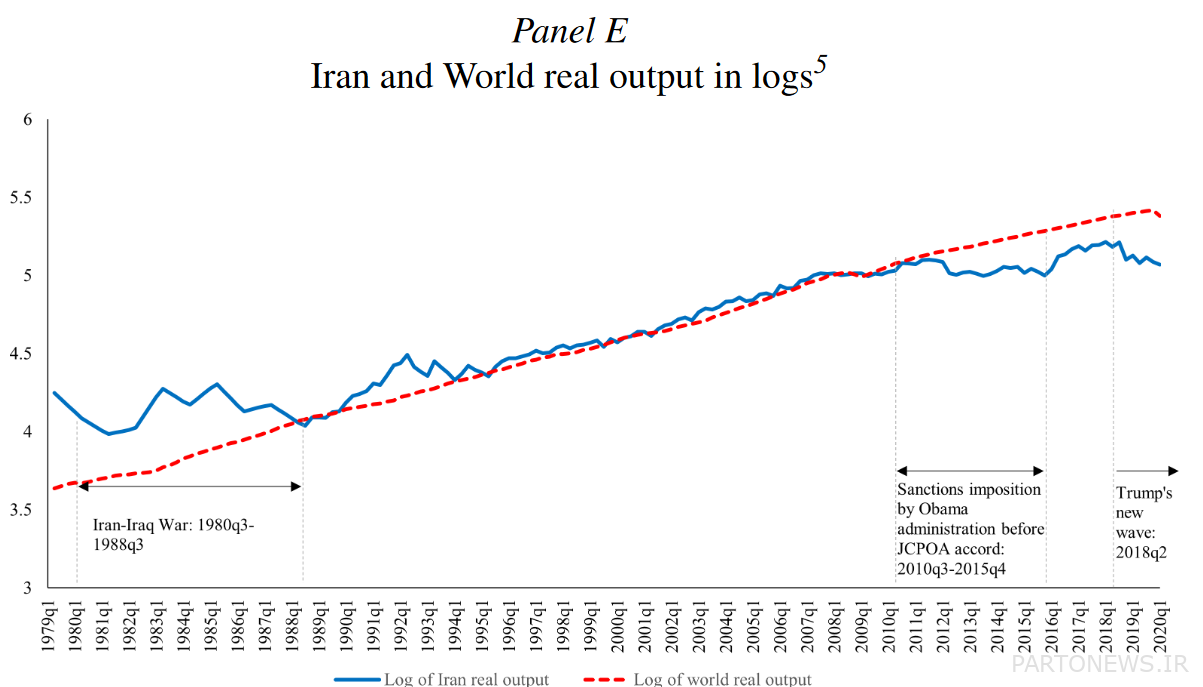

Sanctions have had a significant impact on the growth of GDP in the country. The following chart shows the gross domestic product in Iran and the world. For better comparison, the data is displayed in logarithmic form. In fact, the global data is the weighted average of the natural logarithm of real production for the 33 largest economies in the world.

Before the imposed war, Iran’s GDP was higher than the world average. The occurrence of the imposed war and the imposition of the first sanctions hit the growth of Iran’s economy so that until the end of the imposed war, Iran’s economy could not experience significant growth. At the same time, the global average GDP continued to grow and reached the level of Iran’s economy.

The reduction in the severity of sanctions made Iran’s economy able to grow in line with the world economy until 2010. As can be seen, from the end of the war to 2010, in most of the years, the GDP in Iran’s economy was higher than the world average and grew at the same time.

With the intensification of sanctions in 2010, Iran’s economy stopped growing once again so that it could not grow at the same time as the world economy and fell behind the global average GDP. In fact, before 2016, it can be said that Iran’s economy has stagnated.

The easing of sanctions in 2016 allowed Iran’s economy to experience growth until 2018, but the withdrawal of the United States from the JCPOA in 2018 and the re-intensification of sanctions made Iran’s economy stop growing again. It should also be noted that the decrease in production and the tightening of production conditions due to sanctions can have a negative effect on the employment of the country and cause the growth of unemployment.

The following table shows the real growth of production in Iran in different periods.

Production growth | Period |

-1.6 | Iran-Iraq revolution and war 1979 third season – 1989 second season |

5,16 | Rafsanjani’s presidential term, 1989, the third season – 1997, the second season |

4.72 | Khatami’s presidential term, 1997, the third season – 2005, the second season |

1,68 | Ahmadinejad’s presidential term, 2005, the third season – 2013, the second season |

0.83 | Rouhani’s presidential term 2013 third season – 2021 second season |

2.01 | The complete sample after the revolution of 1979, the third season – 2021, the first season |

3.13 | Complete example of post war 1989 season 1 – 2021 season 1 |

How did the embargo lead to inflation?

Inflation is one of the fundamental challenges of Iran’s economy. The occurrence of sanctions, from various channels such as reducing the government’s oil revenues, has caused an increase in the budget deficit, and as a result, inflation. The graph below shows the inflation rate from 1979 to 2021. As can be seen in the graph, in the years when the sanctions have intensified, the inflation rate has also increased.

For example, the imposition of sanctions between 2006 and 2008 has led to an increase in inflation from 10% to 25%. Also, the intensification of sanctions in 2010-2012 has led to the growth of the inflation rate from 10% in 2010 to 36% in 2013.

It can also be seen that in years like 2014 when the sanctions against Iran were less, inflation experienced lower rates. In 2018 and at the same time as the United States withdrew from the JCPOA, the inflation rate reached about 40% in 2019. In fact, the inflation and the resulting uncertainty that has been imposed on the country’s economy during the time period of the intensification of sanctions is one of the main reasons for the decrease in production in the country.

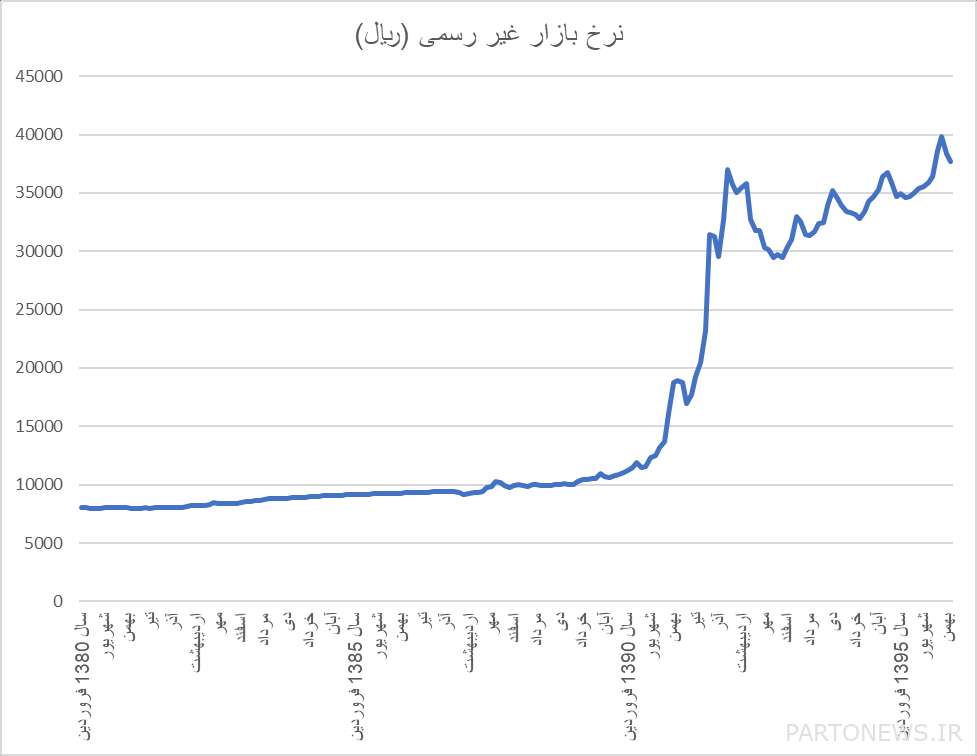

Increase in exchange rate due to sanctions

Exchange rate is one of the most important variables in the economy. Changes in this rate have a great impact on the decisions of people and investors. Such an increase in uncertainty about the exchange rate strongly affects the production sector of the country. Various sanctions have reduced the access of the country’s government and banks to currency. This problem has led to a decrease in the supply of currency inside the country, and the growth of the exchange rate. Also, the decrease in access to foreign exchange has faced many production sectors of the country with various problems, such as the decrease in access to raw materials.

Also, in different years, the imposition of sanctions has led to currency jumps. For example, the withdrawal of the United States from the JCPOA is an important reason for the currency jump in 2017.

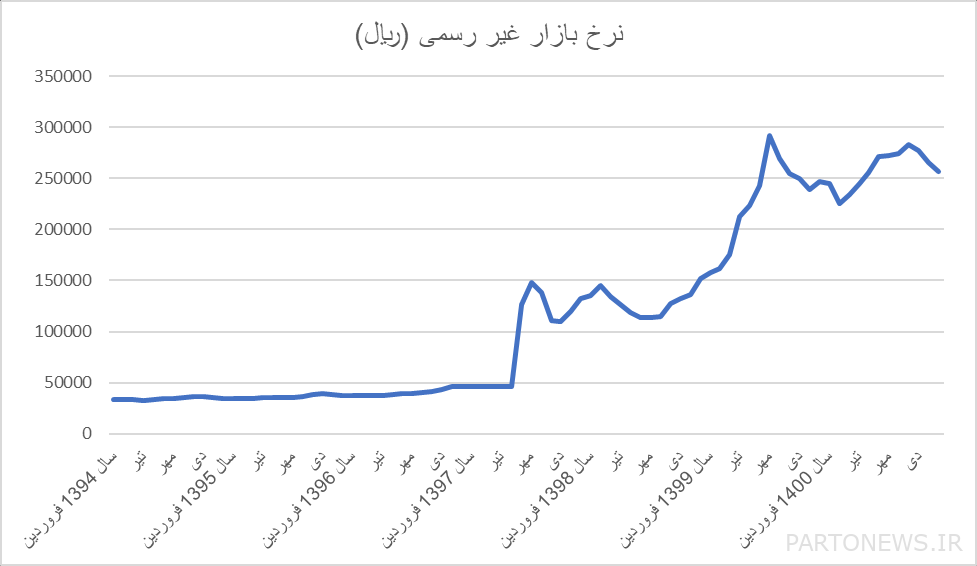

The chart below shows the exchange rate in the informal market.

Note: The source of the data is the central bank and the exchange rate mentioned is not necessarily the exchange rate in the market.

The intensification of sanctions since 2010 and its effect on the exchange rate can be clearly seen in the graph above. The exchange rate has reached 3466 Tomans in March 2013 with a growth of 209% from 1118 Tomans in Farudin 2013.

Also, the jump in the exchange rate can be seen in the graph above, simultaneously with the increase in the severity of sanctions in 2017 and 2019. Simultaneously with the withdrawal of the United States from the JCPOA, the exchange rate in 2017 has reached 14,815 tomans from 4,643 tomans. Also, the intensification of sanctions in 2019 and its coincidence with the Corona epidemic has brought an increase in the dollar rate to 29,243 Tomans.

Are sanctions alone to blame?

Sanctions should be considered as an external shock to the country’s economy. The severity of the effects of sanctions on the country’s economy is a result of the economy’s structure. Iran’s high dependence on oil revenues is one of the main reasons for the high impact of sanctions on Iran’s economy. Usually, in the years before the embargo, the increase in foreign currency income from oil exports and its injection into the economy caused the exchange rate not to grow in line with liquidity and inflation. This issue has compressed the currency spring, the force of which was released at the time of the sanctions and has led to currency jumps.

Also, the government’s budgeting structure, expansionary policies at the same time as high inflation, and the government’s dependence on the banking system are one of the main reasons for inflation in Iran. Applying sanctions has caused inflation by putting pressure on the government budget. But it should be noted that until the government’s budget structure is reformed, lifting sanctions is only a temporary solution.

Also, the structure of the banking system and the laws related to it are considered as one of the important roots of inflation in Iran’s economy. Negative real interest rate, laws related to default, government dependence on the banking system, lack of independence of the central bank are some of the things that have fueled the imbalance of the banking system in Iran, and as a result, the growth of liquidity and the inflation rate.